Bausch Health (BHC) is looking for a lifeline...

Bausch Health (BHC) is looking for a lifeline...

The pharmaceutical giant has a staggering amount of debt coming due. Its problems began when it tried to force growth from 2013 to 2015... buying up competitors and raising the prices of their drugs.

Bausch was still known as Valeant Pharmaceuticals back then. And Valeant's shopping spree impressed investors... at first.

The stock jumped from $47 per share to start 2012... to more than $250 per share before folks noticed how much debt the company had tacked on. And it's still carrying that debt to this day.

Total long-term debt stood at more than $30 billion in 2015. While Bausch has paid back some of its debt in the intervening years, it still sits at $21.9 billion.

With even more debt coming due soon, Bausch has been racing to fix the problem... and investors should be paying close attention.

Bausch is running out of time to get its house in order...

Bausch is running out of time to get its house in order...

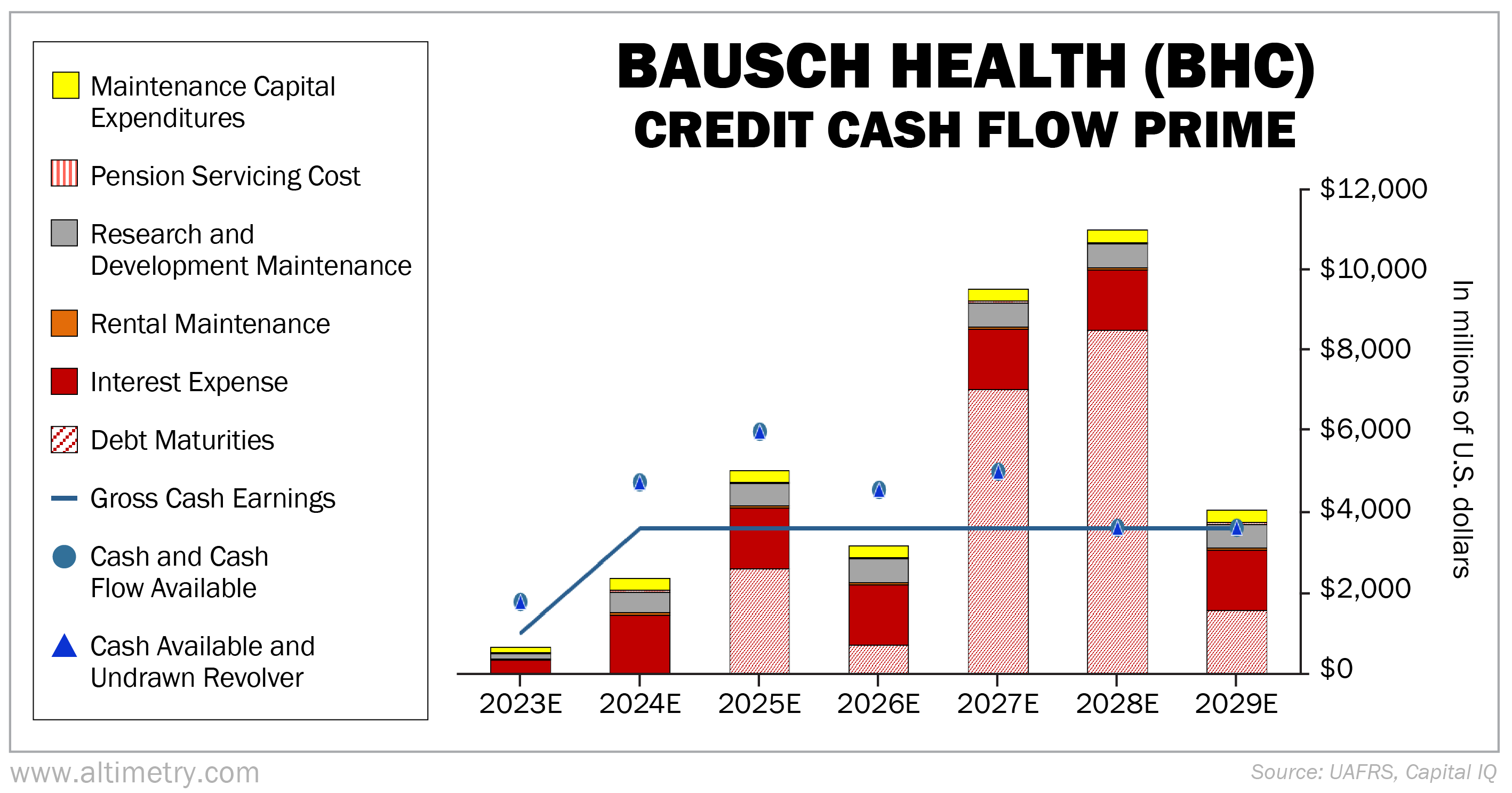

We can see this through our Credit Cash Flow Prime ("CCFP") analysis.

The CCFP gives us a more accurate sense of a company's overall health. It compares financial obligations against cash position and expected cash earnings.

In the following chart, the stacked bars represent Bausch's obligations through 2029. This is what it needs to pay in order to keep the lights on... to prevent the company from collapsing.

We compare these obligations with cash flow (the blue line) and cash on hand at the beginning of each period (the blue dots).

As you can see, starting next year, Bausch won't have enough cash flow to cover all its obligations...

Bausch is facing a "Wall of Debt" in the coming years. And according to credit-ratings agency Moody's, over 90% of rated health care providers are in the same boat. More than half don't even have enough cash on hand.

These companies are now scrambling to raise enough cash to stave off bankruptcy. Bausch started with a failed spinoff of its medical-aesthetics business, Solta Medical.

The company announced the spinoff in 2021... but it never materialized. Starting in 2022, recessionary concerns caused a lot of initial public offerings ("IPOs") to raise less than expected.

Bausch worried Solta would end the same way. So instead, it turned to its Bausch + Lomb (BLCO) eye-care business.

Bausch + Lomb was the company's crown jewel...

Bausch + Lomb was the company's crown jewel...

It's one of the biggest names in eye care... and eye care itself is a stable, predictable business. Bausch + Lomb was a huge cash cow for Bausch Health, bringing in nearly $4 billion in revenue each of the past six years.

Bausch was loathe to part with it... But it had no choice. The eye-care business struck out on its own back in May 2022.

And now that Bausch + Lomb is an independent company, any competitor can scoop it up for cheap.

We'll be seeing a lot more setups like Bausch in the coming months and years... and not only in the health care industry. Faced with a mountain of debt and nowhere near enough cash, companies will be forced to sell their top assets.

Smart strategic acquirers will snap up these deals as fast as they can.

And keep an eye on Bausch + Lomb. One pharma giant's painful loss might turn into a big gain for investors.

Regards,

Joel Litman

February 20, 2024

Editor's note: Despite recent market highs, Joel warns that a "Wall of Debt" is coming for 1 in 3 U.S. stocks. When it hits, they'll be forced to shed top assets... and a select group of savvy competitors will get the bargain of a lifetime.

Joel and Stansberry Research's Dr. David Eifrig recently uncovered a treasure trove of opportunities – some of which could have as much as 500% upside potential. They say Wall Street sharks are already circling the same opportunity. But if you act fast, there's still time to take advantage. Get the details here.

Bausch Health (BHC) is looking for a lifeline...

Bausch Health (BHC) is looking for a lifeline...