This chicken producer is getting out while the market is red hot...

This chicken producer is getting out while the market is red hot...

With a weekly production of around 90 million pounds of broilers – chickens raised specifically for their meat – Sanderson Farms (SAFM) is the third-largest poultry producer in the U.S.

But this Mississippi-based poultry producer falls behind the likes of industry giants for broiler production. Tyson Foods (TSN) produced 200 million pounds of chicken per week in 2020. And Pilgrim's Pride (PPC) handled 160 million pounds of weekly production in the same period.

Earlier this month, Sanderson Farms announced its plans to sell its business for $4.5 billion to Cargill and Continental Grain, two of the largest private agricultural companies in the U.S.

The move appears to be driven by a desire to strike while the iron is still hot, with prices for poultry skyrocketing amid a surge in consumer demand and a challenging labor market limiting supply.

If approved, the deal will combine Sanderson with Continental Grain's Wayne Farms, the market's sixth-largest producer that ended 2020 with the production of nearly 49 million pounds of broilers.

Based on the two companies' volumes, the merger will likely place new production closer to Pilgrim Pride's levels, truly separating it from other second-tier competitors like Perdue and Koch Foods.

While it appears Sanderson is timing the sale perfectly on the surface, it may still be a good deal for the other parties...

While it appears Sanderson is timing the sale perfectly on the surface, it may still be a good deal for the other parties...

The poultry business is quickly becoming one where size is essential. From producer and consumer prices, the poultry business can leverage economies of scale to streamline production in a market with booming demand and tight supply.

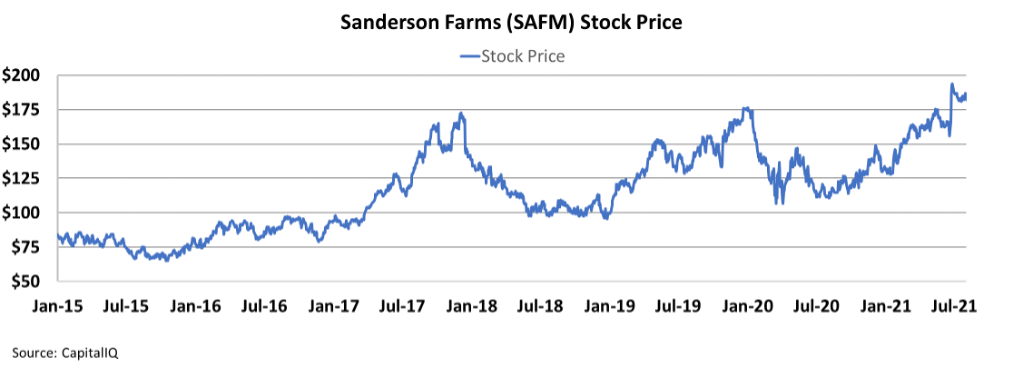

But the deal valuing Sanderson at $203 per share – a five-year high for the stock price – may have some investors thinking Cargill and Continental Grain are letting animal spirits get the best of them.

But just because the stock price is higher than it has been historically doesn't necessarily mean the two acquirers are overpaying.

To understand why we can compare the company's historical performance with market expectations for the future using our Embedded Expectation Analysis framework.

This is how it breaks down...

Stock valuations are typically determined using a discounted cash flow ("DCF") model. This makes assumptions about the future and produces the intrinsic value of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Framework to determine what returns the market expects.

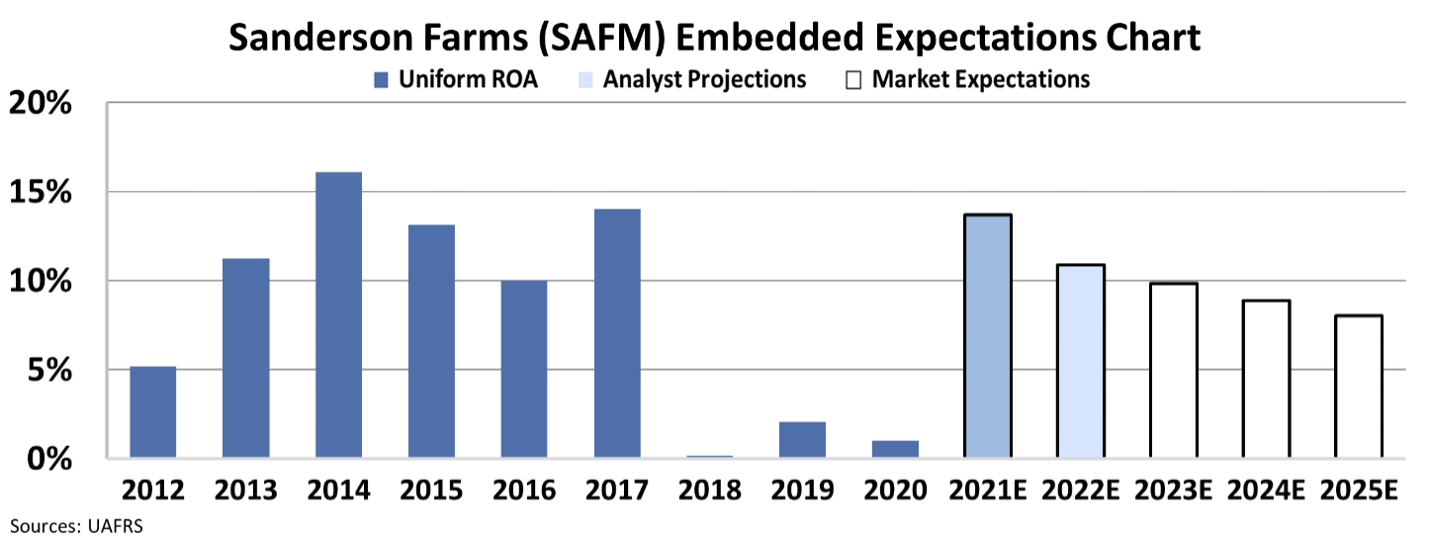

In the chart below, the dark blue bars represent Sanderson Farm's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's return on assets ("ROA") will shift over the next five years.

Looking back over the past 10 years, Sanderson's average Uniform ROA has been around 6%. At $203 per share, the market is pricing in the company to see Uniform ROA decline to 8% a year going forward, slightly less than what it has done most of the past decade.

Based on this analysis, it doesn't look like Cargill and Continental Grain are getting a great deal on Sanderson Farms.

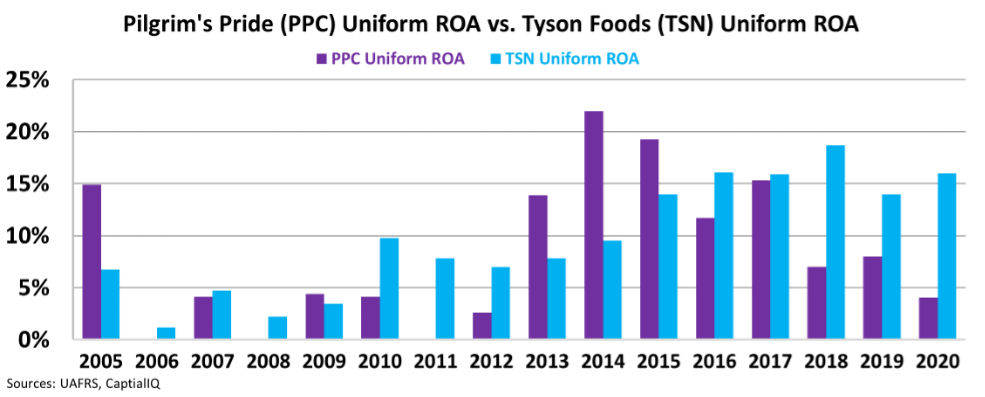

However, looking at the average returns of the two largest players in the space, Pilgrim's Pride and Tyson Foods, over the past decade, we can see that the two generated Uniform ROA of 9% and 12% on average, respectively.

If Sanderson Farms and Wayne Farms can find sufficient synergies post-acquisition to move toward these levels, it doesn't look like too bad of a deal after all.

Using Uniform Accounting, we can make apples-to-apples comparisons of companies to understand their true valuations better. Any investor trying to use GAAP metrics or stock price analysis is only shooting in the dark.

Expectations are what markets are all about... So, it's important to watch for when a company may be mispriced...

Expectations are what markets are all about... So, it's important to watch for when a company may be mispriced...

In the August issue of our Hidden Alpha newsletter, we identified a company that has been much more resilient during the pandemic than the market realizes.

Furthermore, the company is trading at a discount to its peers, despite growing faster than them... And we think it's a double in waiting.

Learn more about Hidden Alpha – and find out how to gain instant access to the August issue – by clicking here.

Regards,

Rob Spivey

August 24, 2021

This chicken producer is getting out while the market is red hot...

This chicken producer is getting out while the market is red hot...