Zara has fashion production down to a science...

Zara has fashion production down to a science...

If you're not familiar with the brand, you probably haven't spent much time on social media app TikTok lately. Zara is a Spanish retailer that makes everything from pants and dresses to coats, suits, and handbags. It's extremely popular with the younger demographic due to its trendy styles and low prices.

The brand's founder, Amancio Ortega, understood the importance of speed all the way back in 1975. He knew that as communication and technology improved, fashion trends would move faster and faster... and pushed Zara to reduce lead times and react quicker to the latest trends.

Today, it takes an average fashion company six months to develop a new product and get it out to stores. It takes Zara just one week.

To support these breakneck speeds, Ortega is taking part in the supply-chain supercycle – the massive shift that's taking place as U.S. businesses and the government pour money into the supply chain.

According to a recent Bloomberg report, Ortega has invested more than $700 million in new U.S. facilities in the past few weeks. He bought warehouses in Tennessee, South Carolina, Virginia, Pennsylvania, and Texas... all with the goal of getting Zara's products to consumers faster.

To most investors, it looks like Ortega is simply throwing good money after bad...

To most investors, it looks like Ortega is simply throwing good money after bad...

Clearly, Zara believes that further investment is a boon for the business. But if you're only looking at as-reported numbers for its holding company, Industria de Diseño Textil (ITX.MC), you'd likely disagree.

Global companies report numbers using international financial reporting standards ("IFRS") – the international equivalent to generally accepted accounting principles ("GAAP"). And based on the as-reported IFRS numbers, Zara's holding company appears to be struggling.

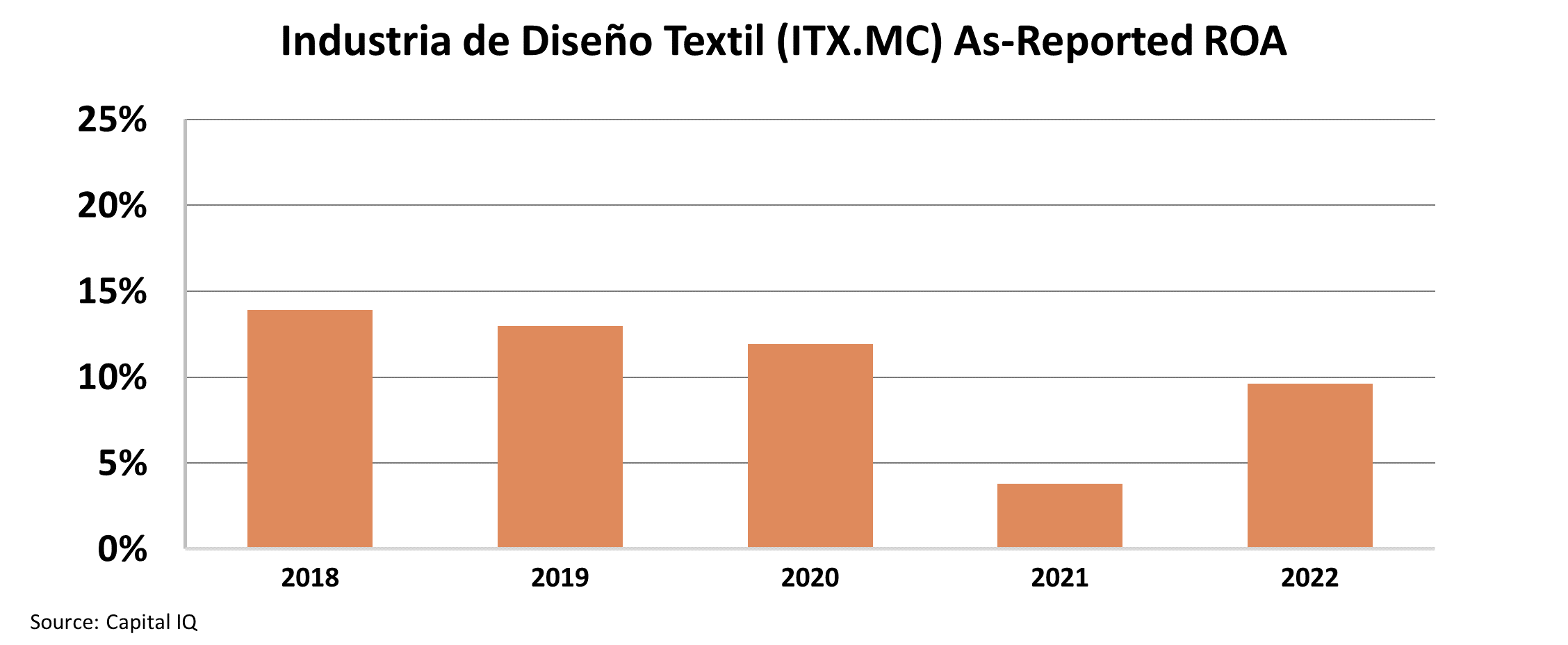

Over the past five years, as-reported return on assets ("ROA") has slid from 14% to less than 10%, below the 12% corporate average. Take a look...

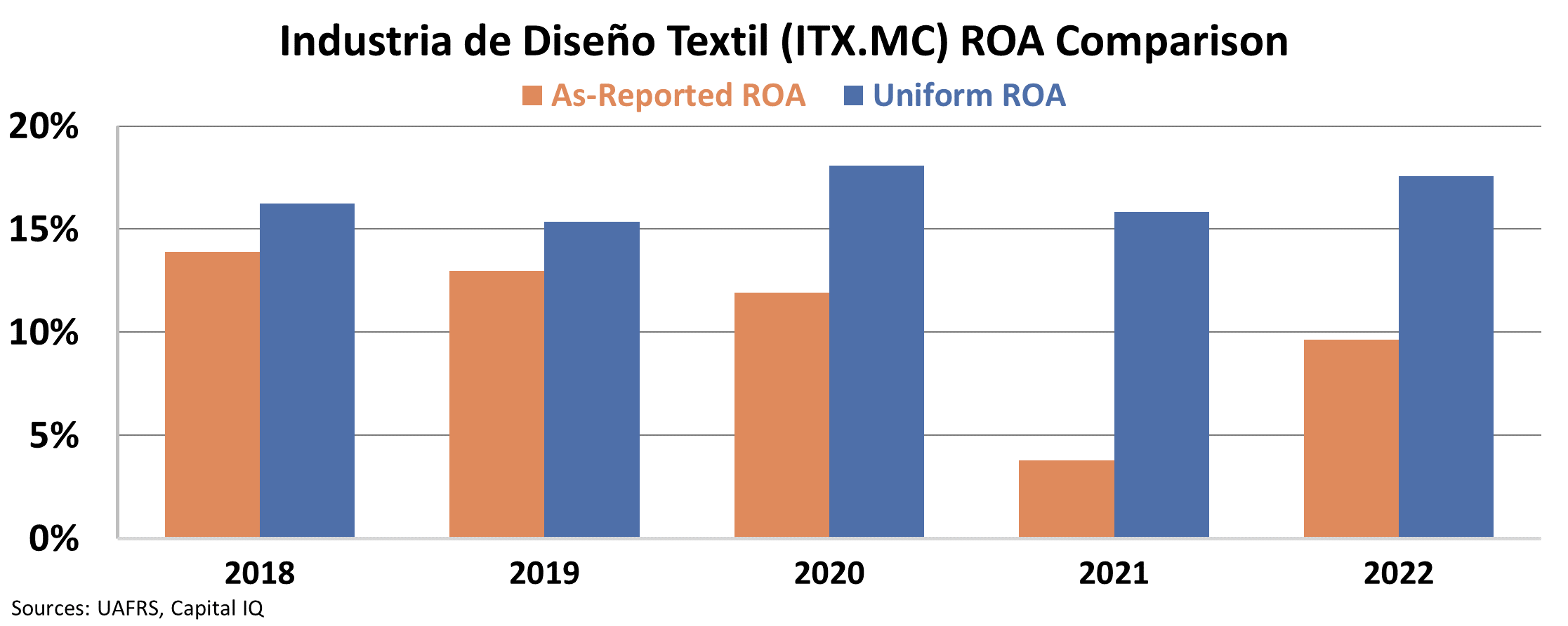

But like GAAP, distortions in the IFRS standards frequently lead investors astray. Once we make 130-plus adjustments under Uniform Accounting, we can see the true profitability of the business.

Uniform Accounting shows us that Ortega's investments are paying off. Returns haven't been falling. In fact, as you can see in the following chart, they've risen from 16% in 2018 to 18% in 2022.

Using Uniform Accounting, we can see that Ortega is making all the right moves to keep Zara's business growing. Investors who are looking for a promising retail investment should consider this supply-chain supercycle beneficiary.

Regards,

Rob Spivey

September 29, 2022

Editor's note: Altimetry founder Joel Litman has an urgent warning for investors. In short, he believes the coming weeks will trigger massive gains and losses for your portfolio by the end of the year. But it's not too late to position yourself on the right side of history...

Last week, Joel revealed what he sees coming (and how to prepare) in a brand-new "Financial Lifeline" broadcast – including the dramatic shift that could devastate millions of Americans... and the single best way to play it.

It's a strategy that could help you profit in an up market, a down market, or even a sideways market. But the window to prepare is closing fast. Click here for the full story.

Zara has fashion production down to a science...

Zara has fashion production down to a science...