Tech stocks have outperformed the wider market in recent years...

Tech stocks have outperformed the wider market in recent years...

Technology has been the top-performing sector over the last few years, leading many investors to overweight investment in tech or decry that a tech bubble will burst.

These fears are fueled further by the sector's recent performance – the Technology Select Sector SPDR Fund (XLK) has been down almost 10% since the beginning of the year.

While many analysts are calling for a rotation out of tech and into industrial stocks, corners of the market are still looking to sniff out any value.

For example, private equity firm Thoma Bravo hasn't given up on tech. It has a portfolio of tech companies, specifically in the application, infrastructure, and cybersecurity software subsectors.

The firm is still looking to put money to work in tech, focusing on the ever-scalable Software as a Service ("SaaS") business model that has seen a rampant rise in popularity in recent years...

Thoma Bravo is looking to follow in Adobe (ADBE) and Autodesk's (ADSK) footsteps...

Thoma Bravo is looking to follow in Adobe (ADBE) and Autodesk's (ADSK) footsteps...

Thoma Bravo recently announced that it agreed to acquire cloud-based business planning software firm Anaplan (PLAN) for $10.7 billion. That's a roughly 25% premium over current stock prices. At any lower price, shareholders wouldn't have approved the deal, which means that even at this price, Thoma Bravo is betting there is still a lot of potential upside for the company.

If there was any doubt that people were still willing to pay big money for big tech, Thoma Bravo just put that conversation to rest.

Most of the time, SaaS companies are not profitable until they achieve a certain scale. For Adobe and Autodesk, the SaaS transformation meant taking a short-term profitability hit before returns accelerated.

Anaplan is still a young company, and it seems to have struggled with the same issue of reaching profitability without adequate scale.

The company has focused on growth before profitability, but that strategy has been costly. Anaplan experienced a net loss of $203 million in 2021 and $154 million in 2020.

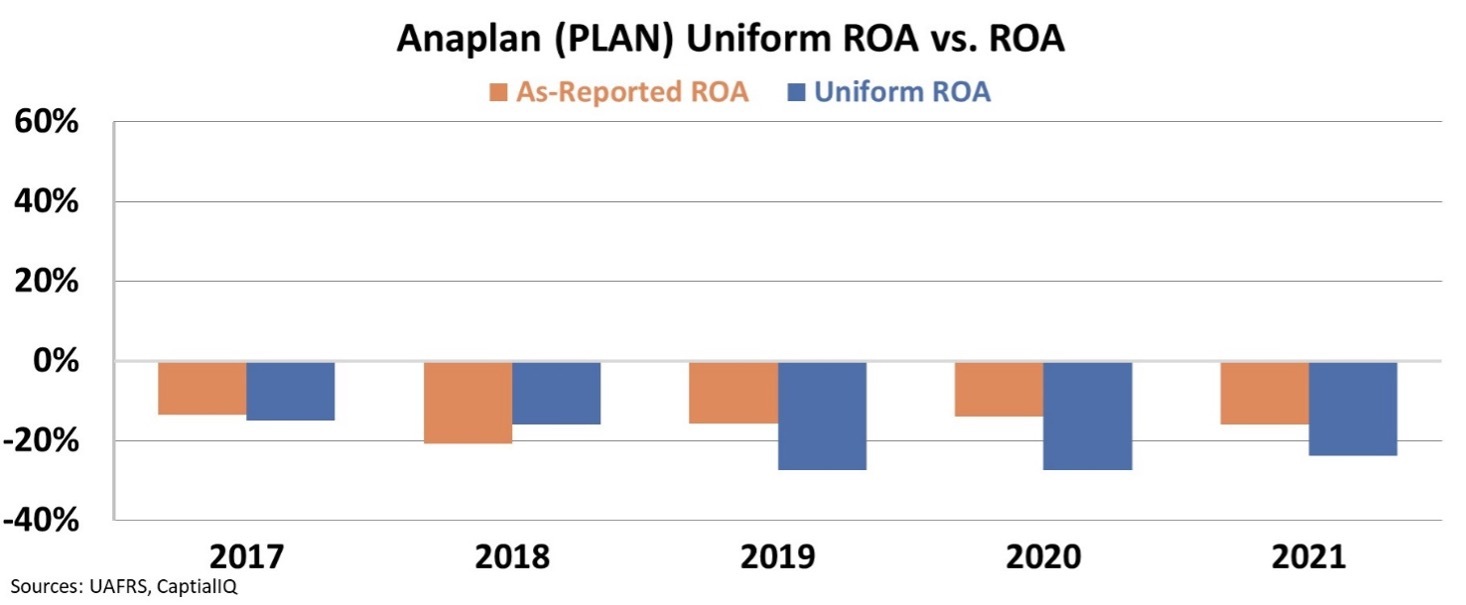

When we look at the figures using Uniform Accounting, we see that the Uniform return on assets ("ROA") of the company has been negative in each of the last five years, hovering at around negative 20%.

Thoma Bravo's acquisition price implies a major inflection...

Thoma Bravo's acquisition price implies a major inflection...

Even though the numbers don't look good, Thoma Bravo may be able to help Anaplan reach its goals faster by using its network and experience in the tech industry. With the potential for a SaaS transformation at play, only looking at historical performance would not be enough to evaluate the company.

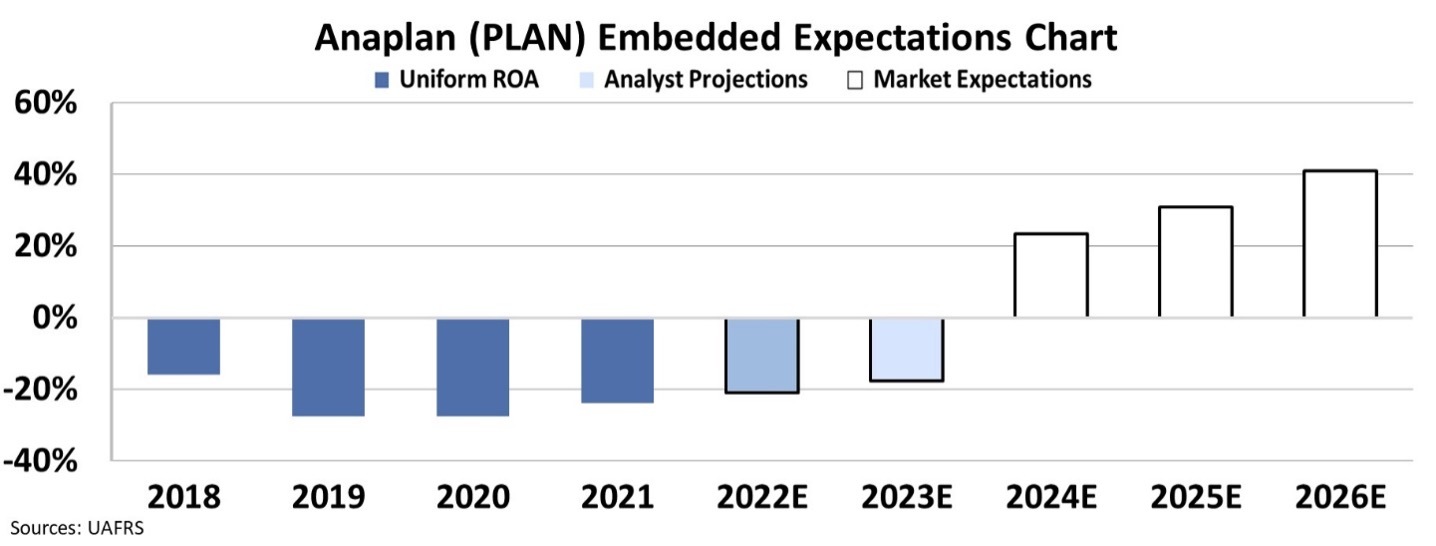

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

Looking at the company's embedded expectations, we can see that Thoma Bravo expects Anaplan to see its Uniform ROA inflect to 41% over the next several years.

This is achievable in the tech industry, especially for a SaaS firm. But it would not be right to say it will be easy, and only SaaS firms with enough scale ever get to those levels of profitability.

Thoma Bravo is likely facing an uphill battle to make back its investment.

Thanks to Uniform Accounting, we can easily see what expectations are for SaaS companies like Anaplan and whether Thoma Bravo got a good deal.

To see the Valuations grade for Anaplan, you can click here as an Altimeter subscriber.

While Anaplan might not be the strongest buy, other SaaS companies are raking in mountains of cash...

While Anaplan might not be the strongest buy, other SaaS companies are raking in mountains of cash...

In one of our backtests, we found that 96% of Internet-related stocks that transitioned to a SaaS model performed better... with an average gain of nearly 760%.

From our test, we also found a little-known SaaS company whose stock could easily rise 10x from today's levels... I put all the details that you need to know in my recent presentation.

Watch it right here.

Regards,

Joel Litman

April 5, 2022

Tech stocks have outperformed the wider market in recent years...

Tech stocks have outperformed the wider market in recent years...