For years, corporations could borrow without worry...

For years, corporations could borrow without worry...

After the Great Recession, the Federal Reserve lowered interest rates to almost nothing. Its goal was to boost consumption and production growth.

This meant lots of companies had access to incredibly cheap capital. They weren't concerned with how they were going to pay that money back.

As a result, merger and acquisition (M&A) activity was high for years. Companies had access to cheap debt. They used it to buy other companies. The number of M&A deals rose steadily from the Great Recession until 2021.

We're no longer in the same position today. Inflation is high, and interest rates are still on the rise. Thanks to more expensive financing costs, M&A volume fell 36% last year.

But some companies are still desperate to get deals done – including in the real estate sector.

Today, we'll take a look at a surprising real estate deal that just popped up. One company is determined to grow, in spite of tough times for the industry... And its target is holding out for more money.

We think that could spell trouble down the line for investors.

It seems like a smart move – at an odd time...

It seems like a smart move – at an odd time...

Earlier this month, Public Storage (PSA) announced it was looking to buy competitor Life Storage (LSI) for $11 billion.

It wasn't the first time Public Storage made that bid. As one of the biggest self-storage companies in the world, the company wants to consolidate the industry and secure its market position.

Public Storage privately made the same offer back in January. Life Storage turned it down. So Public Storage took the offer public to add pressure... but was rejected yet again last Thursday.

Life Storage thinks the deal undervalues the company. We're not so sure...

This offer comes right when financing costs are as high as they've been in decades. Self-storage is one of the rare corners of the real estate sector that looks good today. That's because people need to store all the stuff they bought during the COVID-19 pandemic.

Overall, this seems like a defensive play. Public Storage needs to improve its pricing power. Buying Life Storage is its best bet.

But Public Storage shouldn't raise its bid – no matter what Life Storage claims...

But Public Storage shouldn't raise its bid – no matter what Life Storage claims...

The deal Life Storage rejected values it at about $129 per share. That's a 17% premium over the closing price before Public Storage announced its bid.

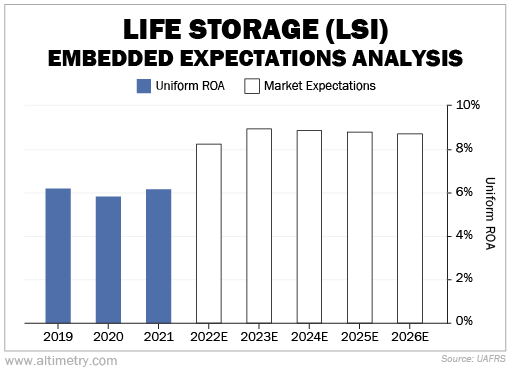

But in order to justify an $11 billion valuation, Life Storage has no room for error. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that to our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At $129 per share, Public Storage expects Life Storage's Uniform return on assets ("ROA") to remain near 9%. That's close to its all-time highs.

Take a look...

Public Storage thinks this booming post-pandemic demand isn't going anywhere. It believes Life Storage's business will be even more profitable in the future.

In other words, to justify these valuations, Life Storage needs to perform as well as it ever has... forever.

Life Storage might have rejected the best deal it's going to get...

Life Storage might have rejected the best deal it's going to get...

Our EEA shows us that Public Storage's offer was already high. It would be crazy to raise that bid. An $11 billion valuation doesn't leave any margin of safety if things go wrong.

Demand for self-storage has surged as the world reopens from COVID-19. That may not last. And financing costs are on the rise.

Life Storage's returns could look much worse in the coming years.

Don't expect a new buyer to offer Life Storage a sweeter deal. As far as we're concerned, the company waved goodbye to a bid that was too high to begin with.

Life Storage's stock is unlikely to soar anytime soon.

Regards,

Rob Spivey

February 21, 2023

For years, corporations could borrow without worry...

For years, corporations could borrow without worry...