Housing demand is huge... but supply hasn't kept up.

Housing demand is huge... but supply hasn't kept up.

It's a problem we haven't see in decades. As the Wall Street Journal recently explained, at the end of July, 1.3 million single-family homes were for sale. This is the lowest amount in July since at least 1982.

This shortage has driven prices higher, with the median home price crossing above $300,000 for the first time ever in July... and it was an 8.5% increase from just a year earlier. These growing home prices are mitigating the increased purchasing power we've seen due to lower interest rates.

Here in Massachusetts, single-family home prices have risen by 14% this year. This shortage of existing homes has also been a boon for the home-building sector, as single-family housing starts grew by 4.1% in August.

Home construction cratered during the Great Recession and has yet to fully recover to 2007 levels. This slowing of supply has only made the spike in demand during the coronavirus pandemic worse.

Some prospective sellers have delayed plans to put their homes on the market, as they worry about finding new homes in a competitive market. And with the ongoing pandemic, many folks are concerned about letting strangers into their houses to view a potential home purchase.

While the supply of homes has fallen, the demand for purchasing them hasn't. People are rushing to get more living space as they anticipate working from home for an extended period of time, even after the pandemic recedes. Additionally, the lockdowns have left people craving more space and bigger yards.

In any tight market, the biggest winners aren't just the sellers, but the companies facilitating transactions...

In any tight market, the biggest winners aren't just the sellers, but the companies facilitating transactions...

Examples of market makers who have done just as well as those selling products include Visa (V) and Mastercard (MA). While these companies don't actually sell any goods or products, they profit from nearly every transaction made on a debit or credit card.

These firms provide the infrastructure for the entire payments industry and receive a small cut based on the volume of transactions. Market makers are able to charge premiums due to their role as the "middlemen" of transactions.

Another benefit to acting as facilitator in a market can be helping people reduce their concern about "information asymmetry" – when one party in a transaction has more information than another. In the real estate market in particular, sellers of houses have far more information than buyers. Real estate brokerages act as facilitators in verifying information and ensuring fair transactions.

In today's tight real estate market, these brokers have been big winners. With such high demand, brokers are nearly guaranteed to complete transactions due to the abundance of buyers. And one real estate broker taking advantage in this environment is RE/MAX (RMAX).

It's a franchising real estate brokerage business with more than 100,000 agents across the globe. Like other real estate brokers, RE/MAX makes money off the commissions from selling homes. This is obviously a cyclical business, with revenue driven largely by demand from the housing market.

RE/MAX is also a franchising business, which means it develops a network of affiliated real estate brokerage offices across its geographic locations. RE/MAX provides the brand name, training, and infrastructure, while the franchisees run the operations and make investments in the business. This leads to a highly "asset light" business model for RE/MAX.

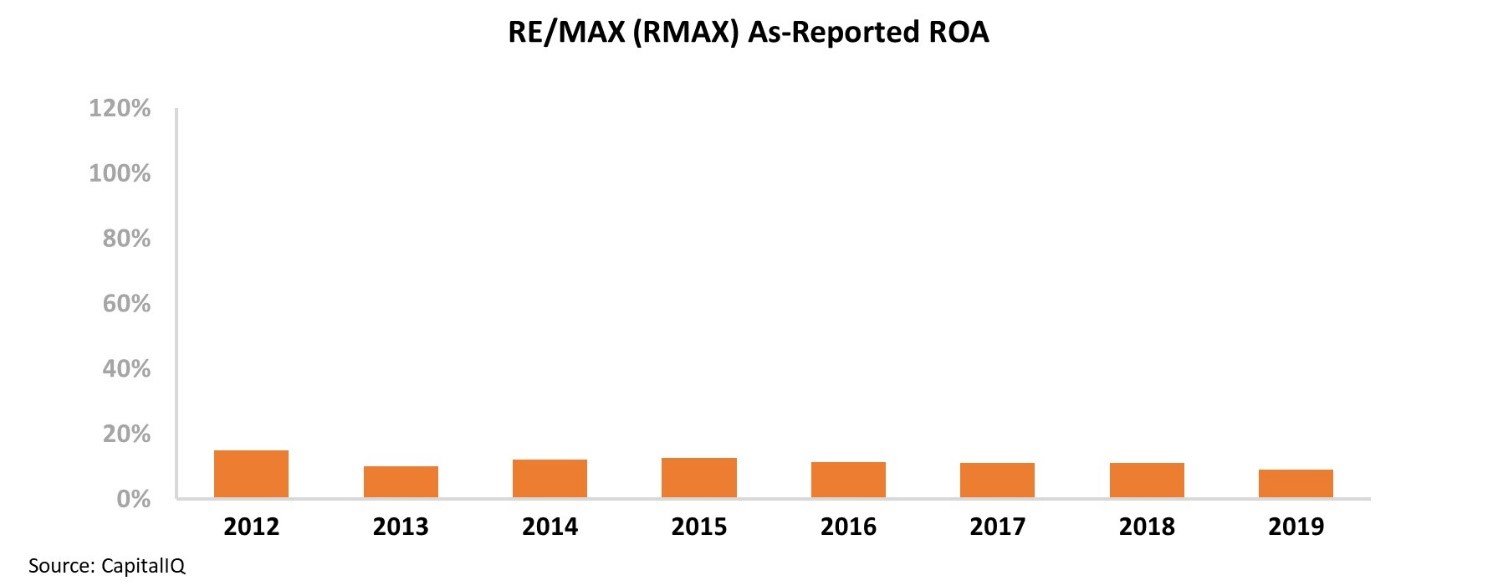

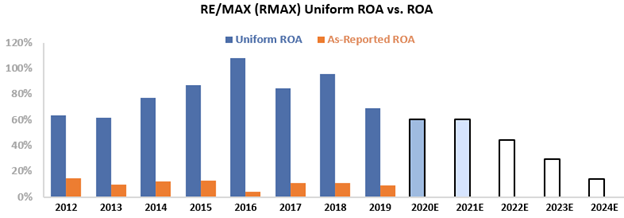

Investors would likely think that as a franchising brokerage, RE/MAX would be undergoing a boom as demand has recently outpaced supply. And yet, looking at the company's as-reported return on assets ("ROA"), RE/MAX appears to have declining returns.

The company's as-reported ROA has fallen from 15% in 2012 to 9% last year. It appears RE/MAX has been unable to capitalize on demand trends in the housing market and is thus seeing deteriorating returns...

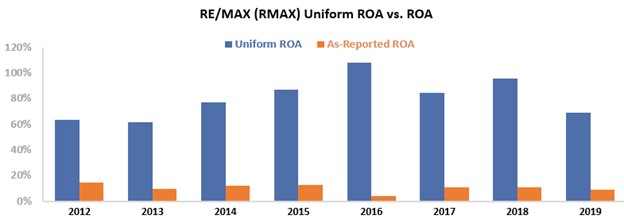

However, due to distortions in as-reported accounting – including the treatment of goodwill – this picture of RE/MAX's performance isn't accurate. That means the market has missed the mark about the strength of RE/MAX's returns.

The company's Uniform ROAs have been at least four times higher than as-reported metrics since 2012. Consider last year... RE/MAX'S Uniform ROA was 69%, compared with the 9% as-reported figure.

The company's franchising model has been hugely beneficial and has thus led to superior returns. RE/MAX allows its real estate agents to keep around 95% of commissions and instead requires monthly and annual fees. This makes the business model less cyclical. Additionally, RE/MAX has benefitted from expanding agent numbers worldwide.

However, understanding how strong the company's historical returns have been doesn't explain if the stock is undervalued or overvalued...

To see if RE/MAX can continue to create value for shareholders, we can use the Embedded Expectations Framework and easily determine market valuations.

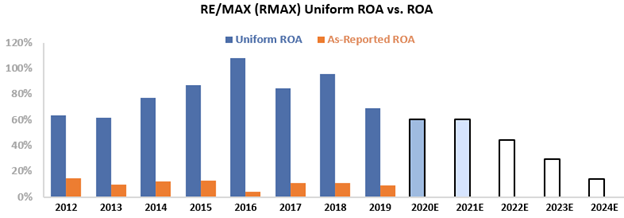

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, analysts forecast RE/MAX's returns to decline modestly from 69% to 60%. On the other hand, the market is pricing in returns to collapse all the way to 14%. This is well below RE/MAX's returns in any previous year.

If RE/MAX is able to continue expanding its reach through the use of franchising and take advantage of increased demand for homes, these expectations are likely to be too pessimistic. And again, RE/MAX is less cyclical than other brokerages due to the nature of its contracts with agents. This limits the downside risk, as the company maintains much of its fixed fees.

Without Uniform Accounting, investors would miss the company's strong ROA. They might see RE/MAX as a firm with average, declining returns... and not one with robust profitability that isn't likely to collapse as the market expects.

If RE/MAX can continue to execute on its franchising strategy and business model, RMAX shares could be primed for upside ahead.

Regards,

Joel Litman

October 6, 2020

Housing demand is huge... but supply hasn't kept up.

Housing demand is huge... but supply hasn't kept up.