Home prices still don't make sense...

Home prices still don't make sense...

People started moving out of cities and buying homes at record pace in late 2020. Roughly 18 months later, the housing market still hasn't settled down.

Despite a huge increase in construction, homebuilders still can't keep up with demand. Prices are rocketing higher. And here's another crazy stat from the current boom...

Many houses are selling for more than $1 million above their asking prices.

For example, a home in Tucson, Arizona, was listed for $1.9 million back in March. Within 24 hours, the sellers received more than 15 offers. They were all above the asking price. The winning buyer offered $3 million – all cash.

And last month, a two-floor, 2,500-square-foot home in Berkeley, California, was listed for $1.795 million. It received 28 offers and sold for more than $4 million. And again, the buyer paid all cash.

The market craze is creating significant concerns for folks who are desperate to find new homes.

But of course, high prices and volumes are great news for online marketplaces like Zillow (Z)...

But of course, high prices and volumes are great news for online marketplaces like Zillow (Z)...

Since 2006, Zillow has revolutionized the home-search market. It has become one of the most influential companies in real estate services.

Brokers and potential buyers flock to the site, which modernizes the valuation and homebuying process on the web.

As home demand surges, Zillow will continue to be the go-to platform for homebuyers, sellers, and realtors. But a bad business decision drove away investors a few years ago...

Back in 2018, the company pivoted from its core web-aggregator business to become a housing "market maker." It started to acquire and sell homes under an initiative called "Zillow Offers."

Investors heavily scrutinized the pivot, as the new business was asset-intensive with razor-thin margins.

As many expected, the initiative flopped... CEO Rich Barton announced the company would shut down all Zillow Offers operations in the third quarter of 2021. The company recorded a steep $420 million loss in the process.

These days, Zillow is divesting to return to its roots...

These days, Zillow is divesting to return to its roots...

The company has abandoned its efforts to buy and sell homes, focusing again on being a platform for homebuyers, sellers, and realtors. It's now well-positioned to take advantage of strong real estate trends.

Today, Zillow's popularity is translating into more revenue...

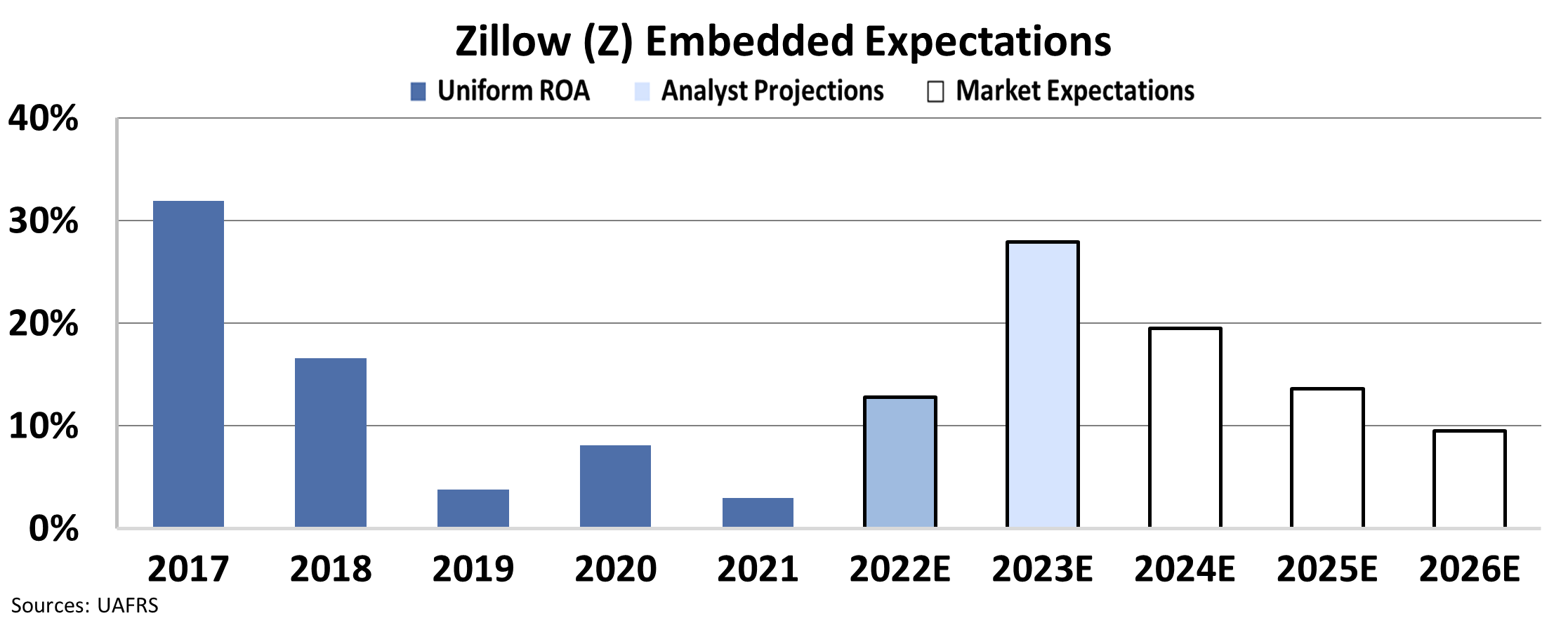

By utilizing our Embedded Expectations Analysis ("EEA") framework, we can see what investors expect companies to do at their current stock prices.

Wall Street analysts typically determine stock valuations using a discounted cash flow model, which makes assumptions about the future to produce the "intrinsic value" of the stock.

Here at Altimetry, we know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our EEA to determine what returns the market expects.

We can see that Zillow's returns cratered from the move to Zillow Offers. Uniform ROA fell from 32% in 2017 to just 17% in 2018... and cratered to sub-10% levels before CEO Barton shut down the division.

Now, as I said, Zillow is getting back to its roots and focusing on its online platform. And with home sales through the roof, analysts are pricing in peak profitability.

The market, on the other hand, still predicts struggles ahead for Zillow... with expectations for returns to fall back below 10%.

You can see the huge difference between analyst forecasts and market expectations. That's a great first step toward identifying where the market might be wrong.

Today – like we saw back in 2017 – Zillow is focused on its platform business during a booming housing market. And Uniform metrics show that these factors are setting the company up for success.

Regards,

Rob Spivey

May 24, 2022

Home prices still don't make sense...

Home prices still don't make sense...