Here at Altimetry, we understand the power of knowledge-sharing...

Here at Altimetry, we understand the power of knowledge-sharing...

Friday's Altimetry Daily Authority articles start with coaching comments from either Rob Spivey, our director of research, or me, Joel Litman. Each week, we give you our personnel insights.

When we launched Valens Research – the firm that powers Altimetry – more than 10 years ago, we didn't need an "all hands" call. We started as a small boutique firm, and everyone knew what everyone else was doing.

We had plenty of development-related calls or client calls that involved most of us.

Now our global workforce approaches 150 people. We have grown with many different initiatives, now including agile teams that span the organization and international borders.

It would be easy for our people to go weeks or months without knowing what someone else in our firm is working on. That could mean missed opportunities to learn from each other... or partake in the many other benefits of water-cooler talk if we were all (physically) in the same office.

Knowledge-sharing is vital for any organization. Too often, at larger organizations, two or three different departments could be building or developing the same code or model without realizing they're working on the same thing.

Without knowledge-sharing, companies end up with silos of information, and growth slows...

Without knowledge-sharing, companies end up with silos of information, and growth slows...

This can be a waste of time and resources.

Knowledge and knowledge-sharing is a genuine asset, and that asset must be built, cultivated, and given the highest priority.

For that reason, knowledge management software has evolved to improve efficiencies for contact centers, IT service desks, workflow, and more.

In 2020, the knowledge market raked in around $99 billion in the U.S. alone. And it's expected to grow even further... The global market for this industry is forecasted to exceed $1 trillion by 2027.

With knowledge-sharing becoming a more valuable service every year, companies that provide the backend for help desks are creating a massive value...

With knowledge-sharing becoming a more valuable service every year, companies that provide the backend for help desks are creating a massive value...

Zendesk (ZEN) is one of the larger companies in the knowledge management space. The Software-as-a-Service ("SaaS") company provides a customer service platform to help businesses provide better and more efficient support.

And based on current market valuations for this $17 billion firm, the market recognizes that more companies are focusing on knowledge management.

This makes sense when we take a deeper look at the market expectations for Zendesk...

To better understand what the market is pricing in, we can use our Embedded Expectations Framework.

To better understand what the market is pricing in, we can use our Embedded Expectations Framework.

Here's how it breaks down...

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which makes assumptions about the future and produces the "intrinsic value" of the stock.

But here at Altimetry, we know models with garbage-in assumptions only come out as garbage. Therefore, we've turned the DCF model on its head with our Embedded Expectations Framework. We use the current stock price to determine what returns the market expects.

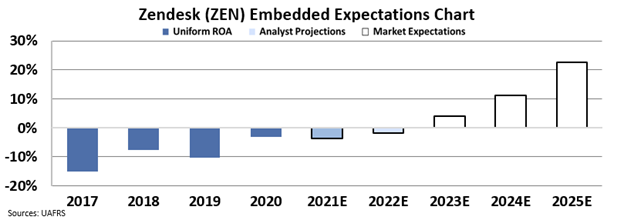

In the chart below, the dark blue bars represent Zendesk's historical corporate performance levels in terms of return on assets ("ROA"). The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how the company's ROA will shift over the next five years.

Even though Zendesk has never been profitable, our Embedded Expectations analysis shows that the company's ROA levels would need to reach historical highs – levels of 23% – to be valued at its current price.

With an understanding of what the market is pricing in, we can also look at analyst expectations.

Wall Street analysts hold more bearish expectations. They're pricing Zendesk's Uniform ROA to remain negative, only reaching negative 2% by 2022.

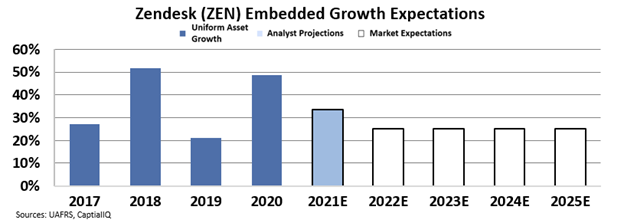

These expectations are aggressive, especially given that the market is also pricing steady growth for Zendesk. When we do the same Embedded Expectations breakdown for asset growth, we can see that the company is priced for continued 25% asset growth per year.

Typically, when a company grows rapidly, its ROA levels tend to fade. And Zendesk's profitability is still in negative territory.

So, while Zendesk is providing an essential service, Uniform Accounting shows that the market may already have priced in any possible upside from the company's strong position.

Regards,

Joel Litman

June 25, 2021

P.S. Right now, we're leveraging the power of Uniform Accounting to find big mispricings – and big investing opportunities – in an under-covered corner of the market: the world of microcaps.

Some of the most compelling setups we've seen over the past decade have been in the microcap space. This sector of the market is largely off-limits for big institutional investors... and that's great news for you.

Right now, you can get access to all of our microcap research with a special, limited-time offer that includes one FREE year of Microcap Confidential.

To find out how to gain instant access to Microcap Confidential – and the full portfolio of 17 high-upside microcap recommendations – click here.

Here at Altimetry, we understand the power of knowledge-sharing...

Here at Altimetry, we understand the power of knowledge-sharing...