Editor's note: The markets and our offices are closed on Friday, April 7, for Good Friday. Because of this, we won't be publishing Altimetry Daily Authority. Please look for your next edition on Monday, April 10.

It was a horrible winter to be a skier...

It was a horrible winter to be a skier...

The trouble started right around the holidays, when most of the U.S. was struck by Winter Storm Elliott. The historic storm brought coastal flooding, freezing temperatures, and buckets of snow.

There was so much snow and ice that it made traveling hard. You might recall the Southwest Airlines (LUV) breakdown that left thousands of passengers stranded for days.

For much of the East Coast, that was the extent of the cold snap. Unseasonably warm weather meant little to no snow for the rest of the winter.

And for U.S. ski resorts, it seemed like they couldn't win...

Resorts on the East Coast struggled as they got almost no snow all season. Even mountains in Vermont, like Killington, Jay Peak, and Stowe, grappled with below-average snowfall this winter.

Meanwhile, resorts on the West Coast faced the opposite problem... There was too much snow.

Resorts in California reported more than 56 feet of snow this season. That shattered previous snowfall records. And as unlikely as it might seem, it actually made for a difficult ski season.

The extreme weather took a toll on the ski industry... including one of the biggest ski resort operators. And as we'll explain today, the pain might not be over yet.

The more snow there is, the more expensive it gets...

The more snow there is, the more expensive it gets...

Vail Resorts' (MTN) first half of the ski season wasn't pretty.

The company operates 41 mountain resorts and ski areas spread across the U.S., Canada, and Australia. Most of its locations are in the U.S... which meant the unpredictable weather took a big toll on operations.

More than 25% of Vail's planned operating days for the winter season ended up with partial or full resort closures. In the second quarter, it was able to squeeze out 22% more revenue year over year... but don't get too excited.

The 2021 to 2022 ski season was still heavily burdened by the pandemic. Vail hiked prices considerably to keep up with inflation. And even then, it wasn't able to fully offset inflation. Expenses were up 35% in the same quarter.

The record snowfall meant even more costs for the business. Some California resorts were forced to dig out snow-covered chairlifts so they could run. And the snowstorms deterred some folks from making the trip out in the first place.

There's a good chance this won't be a one-time issue...

There's a good chance this won't be a one-time issue...

Climate change is contributing to warmer, shorter winters. At the same time, it's a factor behind some of the intense winter storms we've been seeing. So this pattern isn't going away anytime soon.

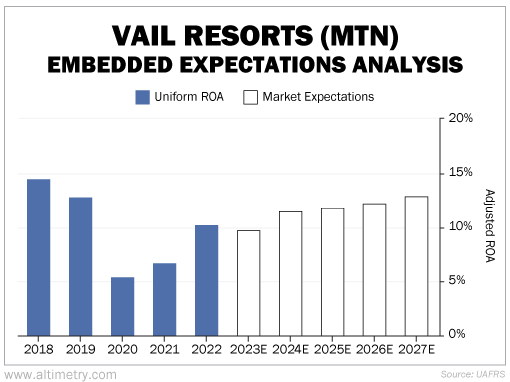

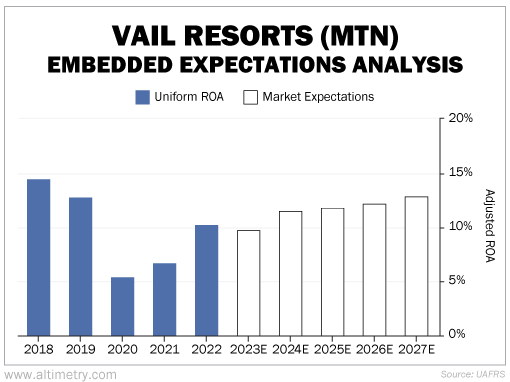

Vail will likely have plenty more battles with unpredictable weather to come. However, the market is only focusing on the good news. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Vail's Uniform return on assets ("ROA") hit an all-time high of nearly 15% in 2018... before plunging to 5% in 2020. At its current price, the market expects returns to get back to 13% by 2027.

Take a look...

It's true that Uniform ROA recovered to 10% in 2022. Even so, it's way too early to celebrate.

Vail's fiscal year ends in July... meaning fiscal year 2023 will include this winter season. Because of the higher expenses from above-average snowfall, returns could suffer.

Investors don't seem to understand that too much snow on the West Coast is an issue for Vail. They'll be shocked when management announces how the rest of the winter season turned out. And the stock could fall as a result.

All that snow out west came with serious consequences for Vail. We'd keep away.

Regards,

Rob Spivey

April 6, 2023

It was a horrible winter to be a skier...

It was a horrible winter to be a skier...