You don't just work your way up to leading one of the world's largest tech companies for fun...

You don't just work your way up to leading one of the world's largest tech companies for fun...

That's why investors were surprised when, at the end of November, Salesforce (CRM) announced that CEO Bret Taylor is stepping down.

Thankfully, the company has another leader handy... co-founder and co-CEO Marc Benioff. But this is the second time in the past three years that Benioff has lost a fellow CEO.

Analysts think this might be a failure of the company's co-CEO "partnership" model. But we can't ignore that Taylor's exit coincides with hard times for Salesforce.

Big Tech is struggling after losing one of its biggest customers – venture capitalists. We have reason to think tech revenue could lag in the coming quarters.

Taylor is a serial entrepreneur. In his public statement of resignation, he said he was stepping away to pursue a new startup.

It's possible... But the timing seems a bit fishy. He was on the fast track to becoming the sole CEO of Salesforce. Folks are speculating that Benioff is trying to step into an executive chairman role.

We think Taylor's reason for leaving might not just be that he was tired of Benioff's perpetual positivity. It's more likely that he has concerns about the business's outlook and doesn't want to be a part of it.

Regardless, investors don't seem too concerned about Salesforce's future...

Regardless, investors don't seem too concerned about Salesforce's future...

It's true that Salesforce stock is down nearly 20% since Taylor announced his departure on November 30.

But it's not just about what the stock is doing today... It's about what the market thinks will happen in the future.

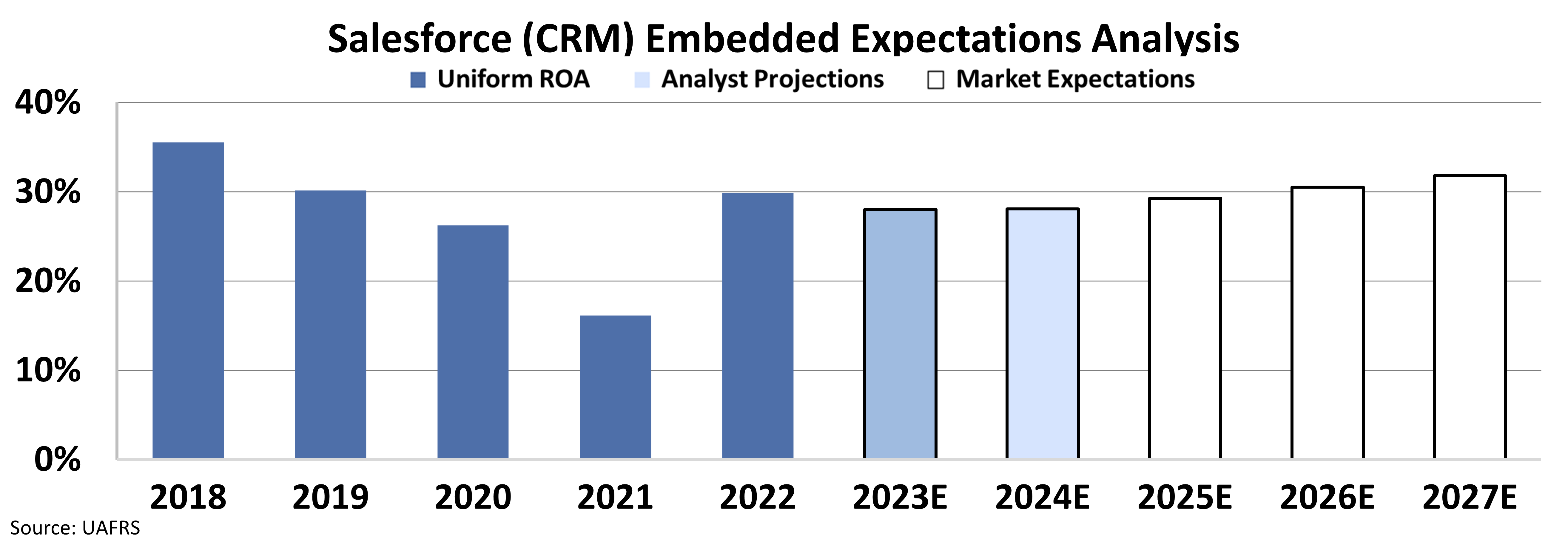

We can see this through our Embedded Expectations Analysis ("EEA") framework. It tells us how investors expect the company to perform in the future, based on the current stock price.

Stock valuations are typically determined using something called a discounted cash flow model. It makes assumptions about the future and produces the "intrinsic value" of the stock.

But we know that models based on distorted as-reported metrics only come out as garbage. So the EEA uses the current stock price to determine what the market expects.

Even after the recent drop, investors still believe Salesforce's performance will hold up. In fact, they think the company will be able to improve its profitability in the next five years.

Salesforce's Uniform return on assets ("ROA") was 30% in fiscal year 2022, which ended in January. That's well above the 12% corporate average.

As you can see in the following table, the market expects that number to improve to 32% by 2027. Wall Street analysts disagree... They think it's going to decrease a bit to 28%.

Take a look...

Now, it probably all depends on timing...

Now, it probably all depends on timing...

Salesforce is a wildly profitable business. Its Uniform ROA has been at least 30% in three of the past five years.

Our EEA framework tells us that the market doesn't expect that to change. Investors think Salesforce's returns will stay where they've always been.

And even though the stock has dropped in recent weeks, it's not trading at a discount. We can see this through Salesforce's Uniform price-to-earnings (P/E) ratio.

The P/E ratio compares a company's share price with the earnings it generates. Today, Salesforce's P/E ratio sits at about 29 times. Again, that's above the 20 times market average... So the stock isn't cheap.

Salesforce could face some rocky quarters ahead. Losing out on Bret Taylor is too bad.

It's unlikely this change will tank the company... although it seems like an odd time for him to leave, unless he's worried about something.

Salesforce is likely to keep being Salesforce. That means a strong business model and continued market dominance. But keep in mind that this is what the market already expects.

If the next few earnings calls don't go the company's way, it could be challenging for investors.

Regards,

Rob Spivey

December 20, 2022

You don't just work your way up to leading one of the world's largest tech companies for fun...

You don't just work your way up to leading one of the world's largest tech companies for fun...