Don't be put off by high expectations...

Don't be put off by high expectations...

Yesterday, I discussed how the rough environment for tech stocks has hurt major software company Salesforce (CRM).

The company just announced a new round of layoffs and a hiring freeze. Its stock has fallen more than 30% since the start of the year.

But even though shares are down, the market still expects a lot from the company. And while you might be worried about the consequences if Salesforce falls flat, I believe the company has plenty of runway ahead.

Today, I'll explain what investors see in Salesforce... and why it might do even better than they think.

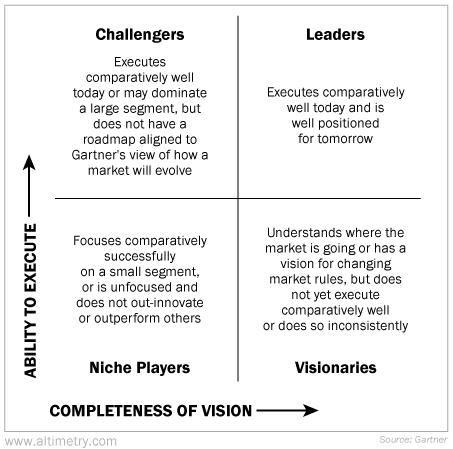

Every year, research and consulting company Gartner (IT) releases the rankings for what it calls its "Magic Quadrant" analysis.

In short, it scores tech companies on two scales... completeness of vision and ability to execute.

As its name suggests, the Magic Quadrant report puts companies into one of four quadrants. They're designated a leader (high vision and execution), a visionary (high vision, low execution), a challenger (low vision, high execution), or a niche player (low vision and execution).

Here's how it looks...

Gartner's analysis is a big deal in the tech world. Being a "leader" is one of the most prized ratings a tech company can get.

Earlier this year, Gartner ranked Salesforce as a leader in the multichannel marketing hub industry. Even earning this title once is no easy feat. But Salesforce has been a leader for five years in a row.

For context, software behemoth Microsoft (MSFT) has been designated a leader in analytics and business intelligence for 15 years running. This ranking puts Salesforce in the company of elite industry players.

Gartner's analysis highlights Salesforce's business strength, which we touched on yesterday. This company has solidified its position at the front of the pack.

That's why, despite Salesforce's recent struggles, the market remains confident in this company. Its position as a true market leader should help it maintain strong revenue amid economic downturns.

Salesforce is a best-in-class company. It's widely recognized as having some of the top products in the industry... and the market knows it.

But making great products is only half the battle...

But making great products is only half the battle...

The other half is actually selling those products.

To maintain strong revenue amid economic downturns, Salesforce's management team has to make smart choices for the business.

In the second-quarter earnings call, the team expressed confidence that it will continue to deliver strong results.

It highlighted the ability to drive multicloud adoption... meaning customers can use cloud storage from multiple vendors, which helps improve performance and reduce costs. That leads to higher revenue per customer.

The team is also confident in messaging app Slack, which Salesforce bought last July. The company is using Slack as a gateway that leads to bigger software contracts.

Investors have noticed management's enthusiasm...

Investors have noticed management's enthusiasm...

While the stock is down this year, folks' lofty expectations for Salesforce tell us that they haven't given up on this software leader. They understand management's confidence and are ready to buy in.

Management is being practical about controlling costs. Even if revenue doesn't take off like we expect, the company should still be able to meet market expectations.

But so far, Salesforce has been surpassing its revenue goals. So lowering costs can position the company to do even better.

Investors already seem to "get" Salesforce's performance potential. But if it keeps beating expectations, valuations – and therefore, its stock price – could rise even higher.

Regards,

Joel Litman

November 2, 2022

P.S. Gauging a management team's confidence is critical to making investment decisions.

Lots of CEOs talk a good game – that's how you get the gig. But in order to know what's really going on at a company, you have to read between the lines.

That's why my team leveraged advanced audio technology to develop our "Earnings Call Forensics" ("ECF") tool. It compares management's spoken words against the numbers... and rates those statements as "questionable" or "confident."

You can see this strategy in action in our most recent issue of Altimetry's High Alpha. We were confident in the potential of our latest recommendation. And our ECF analysis confirmed that management was, too. Two days later, the stock had shot up more than 50%.

Of course, we can't promise double-digit gains in two days every time. But our ECF analysis is just one of the ways we ensure management is making the best choices... and will continue to do so for years to come. Subscribe right here to see for yourself.

Don't be put off by high expectations...

Don't be put off by high expectations...