One of Musk's hotly anticipated products has nothing to do with Tesla...

One of Musk's hotly anticipated products has nothing to do with Tesla...

Rather than a new electric car or truck, many tech enthusiasts are looking to Musk's other company: SpaceX. This year, the private aerospace company is rolling out initial testing for Starlink, its satellite broadband product.

SpaceX is looking to launch between 4,000 and 30,000 satellites into orbit, providing broadband speeds to the Internet no matter where the customer is on the planet.

With the launch, Musk is betting that he can generate significant revenue with Starlink and fund his bigger goals of getting to Mars and setting up a self-sufficient colony there.

But a few obstacles are standing in his way. Currently, the Federal Aviation Administration ("FAA"), the Federal Communications Commission ("FCC"), and competitors like Amazon (AMZN) are pressuring SpaceX to settle on one deployment plan of either 4,000 or 30,000 satellites instead of holding extra in reserve.

While the price of Starlink terminals has dropped from $3,000 to $1,500, SpaceX is also making another gamble. Starlink needs to see substantial demand at its low $99 per month price point to turn a considerable profit. While the potential market size is enormous, the hurdle to cross it is high.

Only time will tell whether this large gamble pays off for Musk...

While Starlink is a huge step forward, satellite Internet isn't exactly new...

While Starlink is a huge step forward, satellite Internet isn't exactly new...

Musk is revolutionizing satellite Internet by promising to provide worldwide broadband speeds. These higher speeds are required for the type of video calling and remote work that many of us do amid the pandemic. But slower satellite Internet services have existed for years.

Historical satellite offerings aren't trying to compete with the typical Internet service providers on speed. Instead, they are a "good enough" solution for those without broadband access.

But other companies are looking to compete in this faster market. Companies like EchoStar (SATS) are challenging SpaceX in the race for satellite Internet customers.

One advantage of satellite broadband is it costs very little to bring new customers on board. Unlike traditional broadband, a company doesn't need to lay down new cable for each incremental customer.

The flipside is satellite maintenance costs a lot more than traditional cable after installation.

So, what does this means for profitability for an emerging satellite broadband company like EchoStar? For that, we turn to our Altimeter – which uses Uniform Accounting to see the true financial picture of a company.

Using Uniform Accounting, we can see whether the expensive startup's investments and high maintenance costs are a huge drain in profitability.

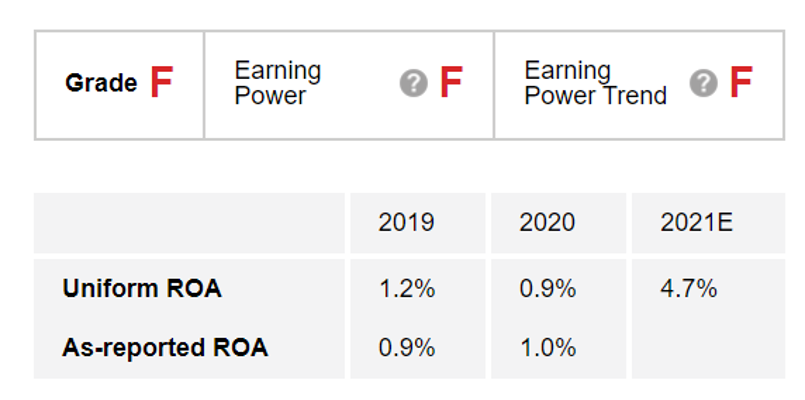

The Altimeter shows how EchoStar generated a weak Uniform return on assets ("ROA") of 1% in 2019 and 2020, earning the company an "F" for Earnings Power.

While returns are expected to climb slightly in 2021, it isn't enough to budge from an "F" for its Earnings Power Trend. This means the company gets an overall "F" grade for Performance.

Does this mean investors should avoid EchoStar at all costs?

Does this mean investors should avoid EchoStar at all costs?

Of course, we don't just buy companies based on strong historical performance and avoid those going through tough times. We also need to see if the market is already pricing them in. If the market is pricing EchoStar for collapse, it may be undervalued.

Altimeter subscribers can click here to see how EchoStar is valued based on Uniform Accounting... and if the stock is over- or underpriced.

Instead of gambling on speculations like EchoStar, you're far better off investing in high-quality companies over the long run...

Instead of gambling on speculations like EchoStar, you're far better off investing in high-quality companies over the long run...

Here at Altimetry, we use our proprietary Uniform Accounting as a tool to identify winners and losers among publicly traded companies.

In a recent backtest, we were surprised to find that a certain subset of tech stocks has a 96% win rate with average gains of nearly 760%, including the losers.

We just put together an urgent presentation detailing what we think could be the next 10-bagger out of this tiny and elite group of stocks.

You can watch it here.

Regards,

Joel Litman

with Edward Edwards

January 20, 2022

One of Musk's hotly anticipated products has nothing to do with Tesla...

One of Musk's hotly anticipated products has nothing to do with Tesla...