The Albanian army, led by Reed Hastings, took over the world... or at least the Emmys...

The Albanian army, led by Reed Hastings, took over the world... or at least the Emmys...

Hastings' business had amassed 20 million subscribers across its DVD-rental and streaming businesses by 2010. But despite its success, media executives simply weren't scared of Netflix (NFLX).

The company was split between two business models. Its original mail-order DVD-rental business was in decline. And its newer streaming service faced a lot of trouble as it grew popular.

Other media companies that gave Netflix permission to stream their content often only gave it older content. It began to gain a reputation of offering nothing but reruns.

Time Warner CEO Jeff Bewkes even joked that Netflix threatening the media industry was like "the Albanian army [taking] over the world."

Hastings took the criticism to heart. For the next year, he wore Albanian army dog tags around his neck... while he figured out his company's future.

Today, we'll delve into how Hastings turned this criticism into a driving force... and transformed Netflix into a media powerhouse.

Hastings took a risk that would redefine Netflix's future...

Hastings took a risk that would redefine Netflix's future...

In an effort to focus on streaming, he announced that Netflix would separate the DVD business. Customers would have to subscribe to each service individually.

At first, it was a complete disaster. Subscriber costs rose 60%.

Hastings said he didn't expect subscribers to leave... and was immediately proved wrong. Roughly 800,000 subscribers ditched Netflix in just one quarter. Cost of goods sold roughly doubled between 2010 and 2012.

Investors couldn't wrap their minds around Hastings' decisions. It looked like his company was spending hundreds of millions of dollars on effectively nothing... while bleeding customers.

Shares fell more than 80% from Netflix's all-time high in about a year.

Then, the Emmys rolled around...

Then, the Emmys rolled around...

You see, Hastings was building Netflix's content library from the inside out. He spent hundreds of millions of dollars developing original content between 2010 and 2013.

Investors didn't understand what was happening until 2013. That's when Netflix's first major release, House of Cards, won three Emmy Awards.

Netflix's costs were rising so it could supply its own content. It wouldn't be stuck airing other companies' reruns. And it no longer had to worry about licensing rights.

Within a month of the Emmys, Netflix's stock hit a new all-time high. And it's up more than 1,000% since then.

While Netflix is still a great business, investors have gotten overzealous...

While Netflix is still a great business, investors have gotten overzealous...

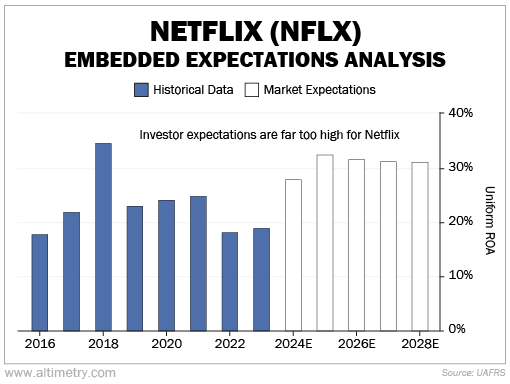

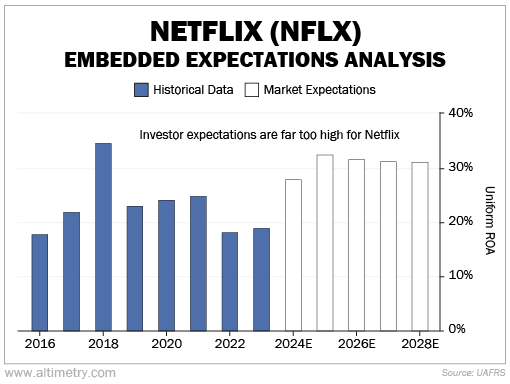

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Netflix's Uniform return on assets ("ROA") has settled around 20% in the past five years. The market believes returns will rise to 30% by 2028. They've only been that high once in the past decade.

Take a look...

Streaming competition has gotten fiercer. Netflix isn't the only product in town anymore. And it has to keep investing in new content to keep subscribers coming back.

If the past several years are any indication, Netflix's Uniform ROA should remain closer to 20% than to 30%...

If the past several years are any indication, Netflix's Uniform ROA should remain closer to 20% than to 30%...

So while it's still a great business... it's probably not as undervalued as it was 10 years ago.

It took a while for the market to realize what Netflix was up to. And it was several years before the benefits became clear.

While Netflix's stock has already soared, there are always companies looking to transform their businesses.

Don't be afraid to invest in companies that are betting on themselves... Even if it takes a few years, the massive upside can be worth the wait.

Regards,

Joel Litman

August 27, 2024

The Albanian army, led by Reed Hastings, took over the world... or at least the Emmys...

The Albanian army, led by Reed Hastings, took over the world... or at least the Emmys...