Macy's (M) doesn't want your $5.8 billion...

Macy's (M) doesn't want your $5.8 billion...

The legacy department store made waves last week when it turned down a lucrative takeover offer from Arkhouse Management and Brigade Capital. The buyout would have taken Macy's private at a 20% premium to market prices.

Many folks thought it was crazy for saying no... particularly because the holiday season was so bad for department stores.

Even though Black Friday sales rose to a record $9.8 billion, almost all of the new sales were from online shopping. And since it's easier to buy products directly from the companies that make them, department stores had trouble keeping up foot traffic.

Consumer spending growth is projected to slow down in the first quarter of 2024... before declining over the next two quarters, partly due to fears of a mild recession. That will hurt discretionary spending, which is more bad news for department stores.

In this environment, you might expect a public department store to gladly accept a takeover bid as a lifeboat against bankruptcy.

Yet as you'll see, Macy's had good reason to refuse the offer... and bet on its own recovery instead.

Macy's tends to do a far better job than its peers of surviving tough times...

Macy's tends to do a far better job than its peers of surviving tough times...

Consider well-known department stores Neiman Marcus, JCPenney, and Lord & Taylor... all of which went bankrupt in 2020. Macy's, on the other hand, managed to pull through.

Its Uniform return on assets ("ROA") flipped negative for fiscal year 2021. Even so, it was able to avoid bankruptcy because it generated decent cash in the prior few years.

As recently as 2019, the company's Uniform ROA was 8%. While those aren't amazing returns, they're above the cost of capital... which is around 5%.

That gave Macy's enough wiggle room to survive the worst of the pandemic. And as of last year, Uniform ROA has recovered to 10%.

As for why it would turn down a $5.8 billion bid... the simple answer is the company thinks it's going to survive both the pandemic and the upcoming recession. The takeover would cut short its chance to recover.

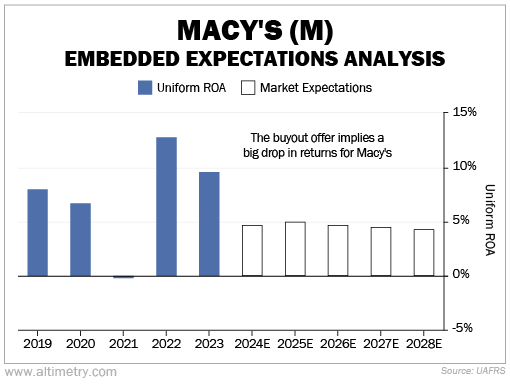

We can see why through our Embedded Expectations Analysis ("EEA").

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today... or in this case, a prospective bidder.

At a $5.8 billion purchase price, Arkhouse and Brigade expect Uniform ROA for Macy's to fall below its cost of capital. Take a look...

Macy's has performed better than this expectation in four of the past five years. So while the acquisition bid is a lifeboat... it's one Macy's doesn't think it needs.

This proposed selling price might have been appealing for department-store competitors that did go bankrupt...

This proposed selling price might have been appealing for department-store competitors that did go bankrupt...

But given its strong performance history, including the past two years, Macy's is holding out for a better deal.

It's also important to note who the buyers are. Arkhouse Management is an investing firm that focuses on real estate. It's not all that interested in Macy's for its business... It wants its real estate, which is valued anywhere between $6 billion and $8 billion.

Premium to share price or not, the current bid is below the real estate value alone. Macy's thinks it can create more value on its own.

And while it might not be a quick journey... if Macy's can keep generating returns like it has for the past few years, investors may finally reward the stock.

Regards,

Joel Litman

February 1, 2024

Macy's (M) doesn't want your $5.8 billion...

Macy's (M) doesn't want your $5.8 billion...