A new rivalry is shaking up the professional-services world...

A new rivalry is shaking up the professional-services world...

Jonathan Orszag, co-founder of FTI Consulting's (FCN) economic consulting division, has launched a competing firm. And he has taken a small army of former colleagues with him.

FTI fired Orszag back in 2023, following a dispute over profit-sharing and control.

Now, his new venture – Econic Partners – is poaching staff and clients from FTI's Compass Lexecon business, which provides competition law consulting.

FTI expects a $35 million hit to operating profits this year as a result. Shares fell 14% on the news, between February 19 and 20.

With investor confidence shaken, management is scrambling to reassure markets and retain existing talent. But beneath the headlines, the long-term picture might be more stable than it appears.

Today, we'll explain why FTI's business model is more resilient than investors expect... and why the market may be overreacting.

This business is built on more than a few rainmakers...

This business is built on more than a few rainmakers...

Economic consulting is an elite, niche industry. It's driven by experience, credibility, and deep relationships that take years to build.

Orszag himself made the case for why clients follow individuals, not logos. In his words...

When clients hire an expert, they hire an individual, not a brand... That is different from banking or management consulting.

The staff that has joined Econic Partners are some of the industry's best. But Orszag may be underestimating the value of FTI's bench.

Compass Lexecon has been around for nearly two decades. And its talent pool goes far beyond a single executive. The company has also had high-profile assignments like performing financial analysis for Tesla (TSLA) in the case of Elon Musk's $56 billion pay package.

While departures can sting, large professional-services firms are built to survive them.

Brand reputation, deep client rosters, and the right infrastructure for managing litigation create strength that new ventures can't replicate overnight.

The market is pricing in more pain than the fundamentals suggest...

The market is pricing in more pain than the fundamentals suggest...

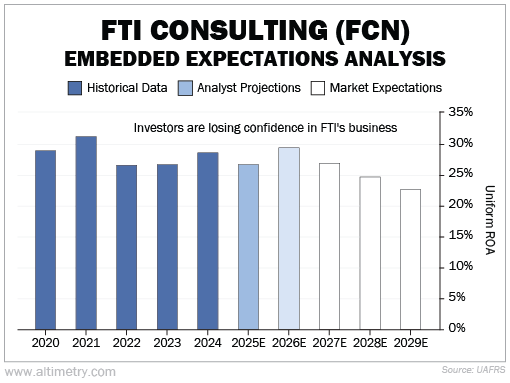

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet... We use FTI's current share price to calculate what investors expect from future performance and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Longtime Altimetry subscribers know we also pay attention to near-term Wall Street analyst estimates. These folks tend to have a good grasp of where a company is headed over the next two years or so.

FTI's Uniform return on assets ("ROA") has been very consistent – at least 25% for each of the past five years. Analysts expect returns to stay that high through at least 2026.

But investors don't share that confidence... They're worried profitability will fall a bit, to about 23%, in the next few years.

Take a look...

Investors fear FTI's competitive advantage will disappear alongside the recent talent exodus.

We think their concerns are likely overblown. FTI's long-term client relationships and institutional knowledge should make for a solid future... even up against Econic.

In the meantime, FTI's 'expectations reset' could mean opportunity...

In the meantime, FTI's 'expectations reset' could mean opportunity...

The market has already punished FTI for the perceived disruption to its business. But talent transitions are nothing new in the professional-services industry – and they rarely dismantle an entire business.

FTI's situation highlights a broader lesson... Employee departures make headlines, but institutional expertise is harder to disrupt than most investors think.

With expectations already low, FTI may have more stability than the market is giving it credit for. And investors willing to look beyond the drama may find a resilient business trading at a discount.

Regards,

Joel Litman

March 26, 2025

A new rivalry is shaking up the professional-services world...

A new rivalry is shaking up the professional-services world...