The restaurant industry's woes may have more to do with a lack of innovation than supply chain disruption...

The restaurant industry's woes may have more to do with a lack of innovation than supply chain disruption...

Many companies needed to take a more modern approach to staffing with updated workforce models even before the global pandemic.

Last month, I attended a session on "How a Global CEO Reinvents the Workforce" at the Harvard Club in Boston, led by my friend Miles Everson.

Everson is an expert on labor force optimization, thanks to his work at PricewaterhouseCoopers and his current firm, MBO Partners. He spoke at great length on how labor markets are going through a period of massive disruption.

It was a thought-provoking session, and it left me with a lot to think about in terms of the labor market.

Everson said that while some industries have innovated impressively to deal with the pandemic's disruption to labor supply, there's one that hasn't... restaurants. And that really stuck with me...

He argues that many in the industry are having issues sourcing talent because it fails to adapt to change – and that's it's not just based on the market environment's scarcity.

Think about the industry: In most restaurants around the country, you still have a waiter or waitress who takes your order, brings out your food, and then the check.

The only innovation most restaurants have adopted en masse during the pandemic is QR codes, mostly to display menus digitally and avoid patrons' hands on hard copies.

But these codes only serve a single purpose. Most restaurants haven't implemented QR codes for ordering or payment to reduce labor time for waitstaff significantly.

It was a great observation on Miles' part and led me to dig into QR codes, which it turns out have not been as widely adopted in the U.S. over the past decade compared with other places.

Stumbling upon an interesting New York Times piece, I realized just how important the innovation of QR codes could be – offering insights into what customers are buying, how they're buying, and where they're buying.

In other words, businesses that use them correctly generate a ton of data about their clients, raising concerns about tracking and data privacy...

One of the biggest instigators of QR codes, and the tracking they enable, is a company that claims to care about protecting privacy and data...

One of the biggest instigators of QR codes, and the tracking they enable, is a company that claims to care about protecting privacy and data...

It wasn't until 2017 when Apple (AAPL) integrated a QR code capability into its iPhone cameras – allowing recognition without a separate app. From that point, QR codes started to appear more in the U.S.

While the tech giant may claim to value your privacy above all else, it's enabling businesses to track your purchase history and other personal data much easier.

Implementing QR codes into the Apple ecosystem adds functionality for users by simply opening the photo app. This example of ease of use within an ecosystem of supported devices is what makes Apple so successful today.

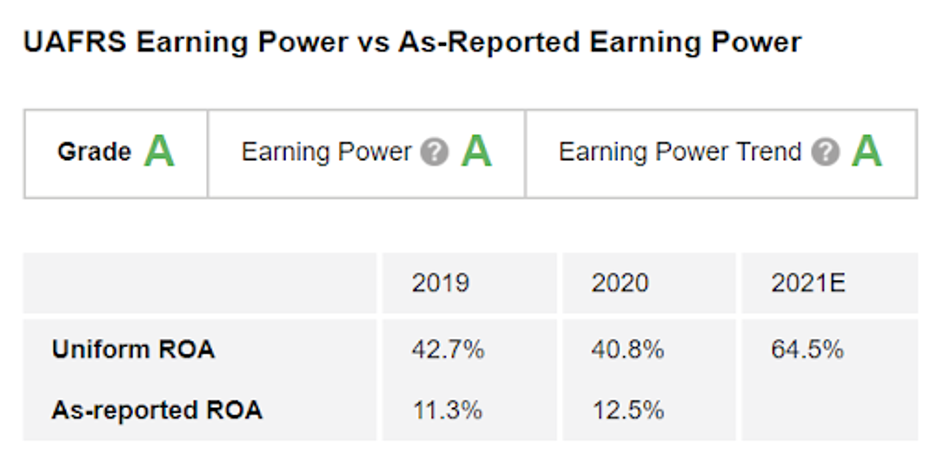

But looking at as-reported financials, Apple does not appear to be that profitable of a business, showing a return on assets ("ROA") of just 13% in 2020, about in line with corporate averages.

However, we see a much different story for this company if we utilize Uniform Accounting instead, adjusting for distortions inherent in the as-reported numbers.

A glance at The Altimeter – which shows users easily digestible grades to rank stocks based on their real financials – reveals Apple's Uniform ROA was nearly 41% in 2020 and is forecasted to rise to almost 65% this year, driving "A" grades across the board for performance.

Thanks to The Altimeter, we can see the iPhone maker's true dominance in leveraging its ecosystem to drive consumer value through ease of use.

Does this mean Apple is a buy?

Does this mean Apple is a buy?

Remember, not all great companies are great stocks.

In other words, you don't just buy a company just because of its high quality. You need to know its valuation, too.

Altimeter subscribers can click here to see how Apple is valued based on Uniform Accounting.

If you want to hear more about similar stories and aren't an Altimetry subscriber, you can click here to find out how to gain immediate access to the full grading for more than 4,400 other publicly traded companies, including Apple.

Regards,

Joel Litman

August 26, 2021

The restaurant industry's woes may have more to do with a lack of innovation than supply chain disruption...

The restaurant industry's woes may have more to do with a lack of innovation than supply chain disruption...