I'm currently decamped in Miami to enjoy the sun this winter...

I'm currently decamped in Miami to enjoy the sun this winter...

While here, I've been surprised to see how many familiar faces have taken up partial or full residency in Florida.

One of the people I've caught up with who recently moved to Florida is my friend Jeff. He manages small-cap funds at IronBridge, an asset-management firm that focuses on cleaned-up accounting analytics (similar to what we do here at Altimetry).

Jeff also knows that GAAP accounting cannot be trusted. He's written previously about the importance of certain items on the balance sheet like research and development (R&D), and how these can lead to distortions if improperly accounted for.

Sixty years ago, if investors correctly predicted earnings announcements and bet on the results, they were fantastic stock pickers.

However, if asset managers were to correctly forecast earnings today, their funds' performances would be no better than if someone randomly threw darts to decide which stocks to buy.

As Jeff put it, it's because we're now seeing "capitalism without capital." After years of bloat and distortions, balance sheets don't show the actual investments in such important items as R&D. With this incomplete picture, investors can't begin to see a company's real performance.

Due to this distortion, few investors understand the consequences of R&D to earnings power...

Due to this distortion, few investors understand the consequences of R&D to earnings power...

Fifty-three of the 70 companies listed in the U.S. with a market capitalization greater than $100 billion are located in R&D-intensive industries. Interactive media, health care equipment, pharma, semiconductors, and aerospace and defense are just a few corners of the market where R&D is essential.

Approximately 75% of the biggest companies listed in the U.S. thrive thanks to their R&D... so it's critical to properly account for this line item.

Under Uniform Accounting, R&D should be capitalized rather than expensed. To expense an investment puts it on the income statement, where it's treated as a short-term cost against revenue. Meanwhile, capitalizing puts R&D on the balance sheet as an asset that a company invests in for long-term cash-flow generation. Expenses should be recognized in the period when the respective revenue is incurred, so that means R&D should be capitalized... not expensed.

Without capitalizing R&D, a company's earnings are significantly understated... Just look at Cisco (CSCO).

Without capitalizing R&D, a company's earnings are significantly understated... Just look at Cisco (CSCO).

The tech giant is a great example of a company whose real returns have been distorted because accounting hasn't kept up with the shift toward capitalism without physically invested capital.

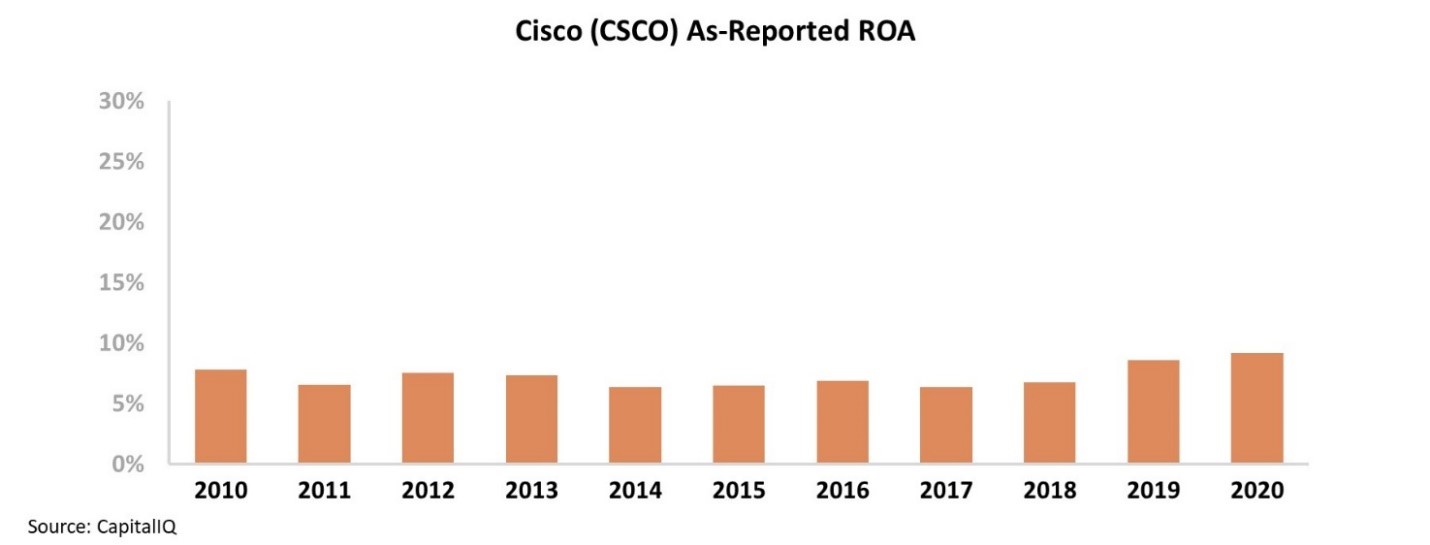

Based on GAAP accounting, Cisco doesn't look that impressive. Even though the company's return on assets ("ROA") has been rising over the previous three years, this metric hasn't been above 10% in roughly a decade.

On an as-reported basis, investors may conclude that Cisco's returns aren't far off from corporate averages.

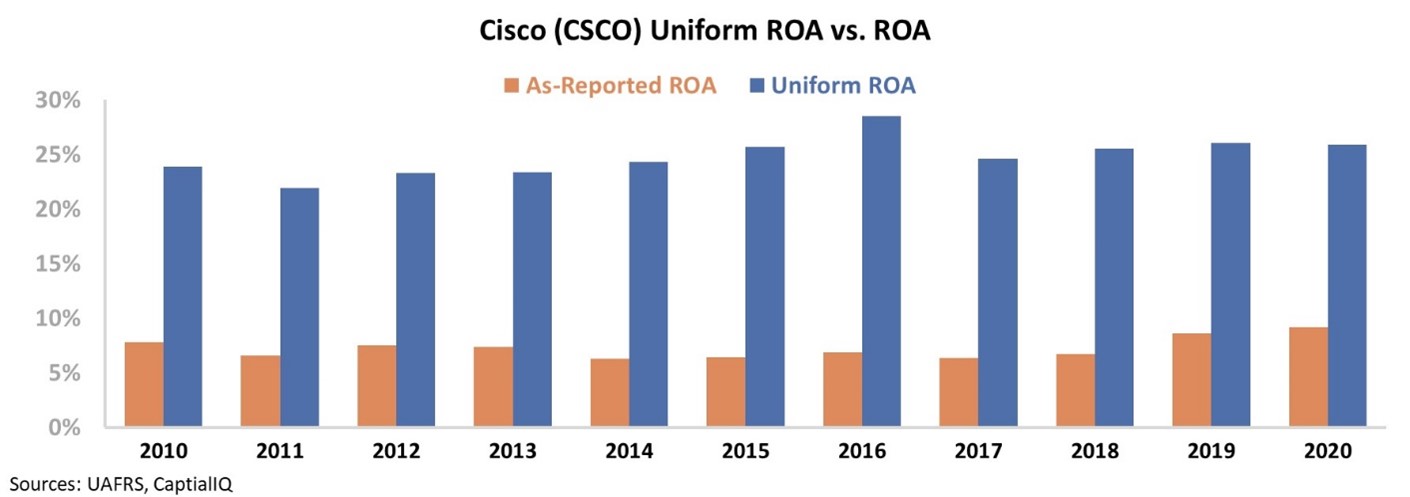

In reality, this below-average ROA is just "noise" from bad accounting. Once we adjust for distortions – including around R&D expense – we can get a better picture of what's really going on with Cisco's returns.

Through the power of Uniform Accounting, we can see that Cisco's real profitability has been consistently greater than 20% for the past 10 years – more than double its as-reported ROA. Take a look at the chart below...

Cisco invests in R&D and intangible capital investments to dominate its end markets and generate strong returns... but the company is being punished for it under GAAP metrics.

By being a leader in markets like networking and cloud hardware, security hardware, and other core computing parts of what keeps our modern economy humming, Cisco generates impressive returns. This has helped power the company to a nearly $200 billion market cap.

Only by using Uniform Accounting can investors see the power of Cisco. By focusing on only the GAAP metrics, they would completely miss the company's above-average performance.

Without understanding real profitability trends, investors are forced to guess at the outcome of a company's strategy... instead of using the data to power analysis. They miss the power of these companies that are committed to capitalism without capital.

Regards,

Joel Litman

February 3, 2021

I'm currently decamped in Miami to enjoy the sun this winter...

I'm currently decamped in Miami to enjoy the sun this winter...