Boaz Weinstein is at it again...

Boaz Weinstein is at it again...

Anyone familiar with Michael Lewis' book The Big Short and the Great Recession – or who has worked in the credit markets since the late 2000s – likely knows how financial-services firm Deutsche Bank (DB) was almost sunk in the crisis. While he wasn't mentioned in The Big Short, those in the know about that story were particularly familiar with the name Boaz Weinstein.

Weinstein almost brought down Deutsche Bank during his tenure there because of how prescient he was in foreseeing the risks of the mortgage crisis destroying mortgage-backed securities ("MBSs") and the whole economy.

You read that right... he was so smart he almost brought down his employer.

Weinstein sold short lower-quality MBSs and made massive gains. Unfortunately, to pay for the short position, he went long on a bunch of higher-quality MBSs. Since these paid a lower interest rate, Weinstein had to own a lot of those assets to make up for how much he was paying out to short the low-quality assets.

When things got worse than even he expected, the high-quality assets fell just as much as the low-quality ones... and Weinstein blew a giant hole in Deutsche Bank's reserves and liquidity.

It appears that this time around, Weinstein has learned from his mistake. Today, he runs hedge fund Saba Capital Management, which focuses on credit trading. As Bloomberg reported last week, Weinstein's fund is up 82% in the first quarter of this year. Considering the market rout, it's an impressive feat... especially for a credit fund.

This shows that there's money to be made in credit – when it's done right.

Initial public offerings ('IPOs') have been trending downward over the past 20 years...

Initial public offerings ('IPOs') have been trending downward over the past 20 years...

These peaked in 1999... and last year, only 159 new companies entered the market.

There are numerous reasons why IPOs have trended down over time, but one of them speaks to how the U.S. economy has changed over the past 30 years. It has become more digitized and complex with the advent of the Internet.

With this complexity comes consolidation in the corporate world. As products become more intricate, further industry knowledge and advanced processes need to be developed and housed under one roof. This translates to fewer and fewer companies in the tech sphere, which was one of the prior engines of IPOs.

As smaller companies become successful, it's more common for them to be bought out by larger competitors than to go public. Perhaps counterintuitively, this means there are large companies in the S&P 500 that most people don't think about, because they've gotten so big by purchasing smaller competitors.

In our Altimeter database, there are more than 250 companies with a market cap greater than $25 billion. Thirty years ago, only a select group of companies existed that were that large... but in today's world, many have slipped under the radar.

A perfect example of this type of company is Amphenol (APH). It makes fiber-optic and coaxial cables, which connect computers and networks. This seemingly mundane product is vital to today's economy, as these types of cables serve as the arteries of the Internet.

Amphenol reached its sizable $22 billion market cap through a steady series of acquisitions over the past 15 years. By incorporating competitors, Amphenol has become the world leader in these types of cables.

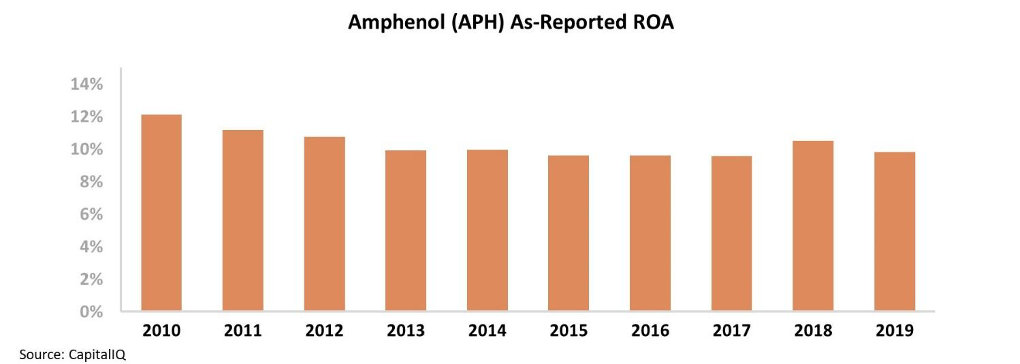

However, by looking at the as-reported returns, it appears that Amphenol has been unable to turn these acquisitions into profit. Instead of creating shareholder value, Wall Street instead thinks that Amphenol has stagnated over the past decade.

Based on GAAP financials, the company's return on assets ("ROA") has been trending steadily downward... struggling to stay just above cost-of-capital levels.

So it's no wonder that Amphenol has slipped under most investors' radar. Why should they care about a company that's unable to drive profits after a long streak of consolidation?

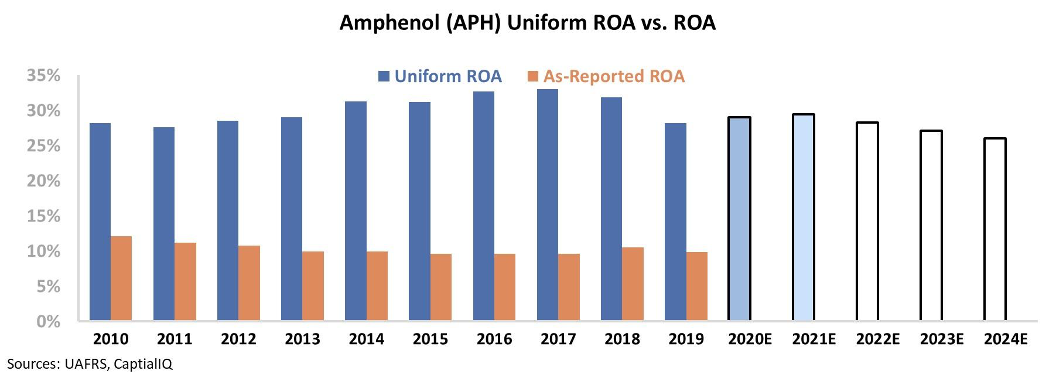

However, by looking at Uniform Accounting, we can identify a few reasons to pay attention to Amphenol. Once we make adjustments – including to goodwill and stock options – a completely different picture emerges...

Rather than a piddling return on assets, Amphenol has actually seen robust returns in excess of 27% in every year since 2010. Furthermore, returns have been trending upward over the past decade, rather than contracting. Take a look...

It turns out that Amphenol has been leveraging its purchases to improve its business. By integrating competitors, Amphenol has been able to corner the market on connectivity cables.

As companies demand faster Internet, Amphenol has developed the industry experience and advanced processes required to get ahead of the market. Thanks to its strong position, the company is able to charge prices sufficient to generate a premium return.

By using Uniform Accounting, investors can see the success story of Amphenol hiding right under their noses. If the company can continue to deliver on its strong returns through its acquisition strategy, the market will have to realize the power of consolidation.

Regards,

Joel Litman

March 31, 2020

Boaz Weinstein is at it again...

Boaz Weinstein is at it again...