Novo Nordisk (NVO) is feeling the pressure from GLP-1s...

Novo Nordisk (NVO) is feeling the pressure from GLP-1s...

These revolutionary weight-loss drugs are the biggest health care megatrend today. With demand for GLP-1s expected to rise 12% per year through 2031, the market has high expectations – and plenty of room for disappointment.

And Novo Nordisk learned this lesson the hard way recently.

The pharmaceutical giant created Ozempic and Wegovy... two of the most popular GLP-1s available today. Its latest offering, CagriSema, is supposed to be the next GLP-1 blockbuster.

But in a Phase III trial, CagriSema achieved overall weight loss of just 22.7%... lower than the expected 25%. The results were roughly in line with Eli Lilly's (LLY) Zepbound.

Considering CagriSema was developed to compete with Zepbound, investors were far from impressed. Shares fell 18% on the news, wiping out as much as $125 billion of Novo Nordisk's market value in one day. They're down another 7% since then.

In short, investors are worried Novo Nordisk isn't taking off as they had anticipated. But it's still in a much stronger position than these folks realize...

Much of the trouble stems from something called international financial reporting standards ('IFRS')...

Much of the trouble stems from something called international financial reporting standards ('IFRS')...

IFRS is a set of accounting rules that govern how businesses report their results. It applies to all publicly traded companies in the European Union. That includes the Denmark-based Novo Nordisk.

Frankly, IFRS about as valuable as its U.S. counterpart, generally accepted accounting principles ("GAAP") – which is to say, not very valuable at all.

We took a deep dive into the problems with GAAP last week, using Warren Buffett's holding company as an example. GAAP was created for accountants, not investors. It often results in misleading financials that mask a business's true performance.

IFRS can similarly overstate or understate a business's actual financial health, creating a misleading picture for investors.

To get a clearer picture of company results, my team and I developed Uniform Accounting – which applies more than 130 adjustments to strip away the distortions of as-reported metrics. We do this for both GAAP and IFRS reporting.

And when we run Novo Nordisk through the Uniform Accounting lens, we start to understand the market's panic...

Given the success of Ozempic and Wegovy, you'd expect Novo Nordisk to be minting cash...

Given the success of Ozempic and Wegovy, you'd expect Novo Nordisk to be minting cash...

The two drugs contributed about $25 billion of the company's $41 billion in total revenue for 2024.

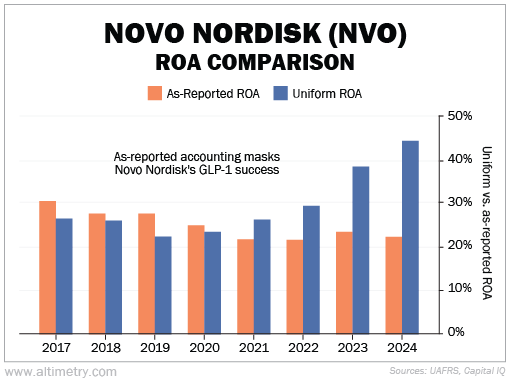

But Novo Nordisk's as-reported return on assets ("ROA") has actually fallen in the past five years... from 25% in 2020 to 22% last year.

No wonder investors are pinning their hopes on CagriSema.

Using Uniform Accounting, we can see where these folks are going wrong. Novo Nordisk's Uniform ROA has nearly doubled since 2020, from 24% to 45% last year.

Now that's what we'd expect from a GLP-1 pioneer...

GLP-1s have boosted Novo Nordisk's profitability in a big way. Even if CagriSema doesn't pan out, the company's reign is far from over.

We don't expect Novo Nordisk's stock to stay down for long...

Despite the recent drop, shares are up more than 170% since the start of 2020. Investors will come back around soon enough.

But with the right data, they could have avoided this panic in the first place.

Regards,

Joel Litman

February 18, 2025

P.S. President Donald Trump's promise to "remove every burdensome regulation" will stretch to all corners of the government...

And make no mistake – the market will feel the impact.

Specifically, we expect Trump's deregulation agenda to change the requirements surrounding GAAP reporting.

This is an exciting time to be in-the-know about Uniform Accounting. Investors could soon be hit with a wave of much-improved financial data. The insights they uncover could send select stocks up triple digits – starting with five in particular.

Get the full story (and a free recommendation) here.

Novo Nordisk (NVO) is feeling the pressure from GLP-1s...

Novo Nordisk (NVO) is feeling the pressure from GLP-1s...