To get the most out of work and life, focus on the vagus...

To get the most out of work and life, focus on the vagus...

That's not a typo. My coaching comment this week for our global team was focused on the importance of the vagus nerve.

The vagus nerve is essential to achieving peak performance for anything in life. Whether it's preparing stock analyses for clients, speaking at a conference, or practicing mixed martial arts, the vagus nerve can propel us to our absolute best.

The vagus nerve regulates a wide range of human functions, from the steady beating of the heart to speech patterns. When people say, "I've got a feeling about this, I feel it in my gut," they may actually be experiencing the vagus nerve in action.

While it may sound counterintuitive, stimulating the vagus nerve calms the body and mind.

Stimulation of the vagus nerve helps to override arguing with a loved one or experiencing road rage. It activates the prefrontal lobe of the brain for more rational and thoughtful behavior.

One way of stimulating the vagus nerve for all the benefits it can provide to you for achieving peak performance is, you guessed it, exercise.

When people think about calming activities, they may not think of exercise bikes...

When people think about calming activities, they may not think of exercise bikes...

Generally, spin bikes are intense cardio machines. And right now, one of the most popular producers of these bikes is Peloton (PTON). The company sells stationary bikes and monthly subscriptions to remote exercise classes.

Peloton's thumping music and demanding coaches might not conjure calming images. This is why Altimetry Director of Research Rob Spivey opts for the scenic rides on his Peloton bike... These are calmer than fast-paced classes, and they still let him work out and push himself as hard as he wants, on his own time.

Peloton is primarily associated with its famous bikes... but the company has increased its offerings in recent years.

Peloton recently began selling treadmills, and it may add a rowing machine in the future. The company also offers a wide array of classes beyond biking.

These include meditation, stretching, and yoga. These offerings focus on the wellness category and calming the vagus nerve. This has become particularly important as people seek to relieve stress caused by the coronavirus pandemic.

The quarantine has accelerated many positive trends for Peloton. When gyms shut down, people flocked to purchase Peloton products for their homes. In fact, in Peloton's fourth quarter, sales were up more than 172% from the same period last year.

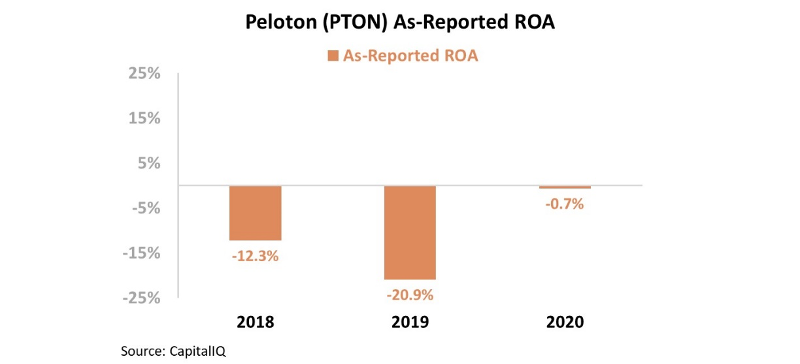

As the dominant player in a booming industry, investors would expect Peloton to have seen above-average profitability. However, looking at Peloton's as-reported metrics, it appears that the company hasn't been able to convert these gains into profits.

As you can see in the chart below, Peloton's as-reported return on assets ("ROA") has grown from negative 12% in 2018 to negative 1% in 2020, after a dip in 2019. This is an improvement, but returns are still negative for a company with a sizeable chunk of the exercise-product market...

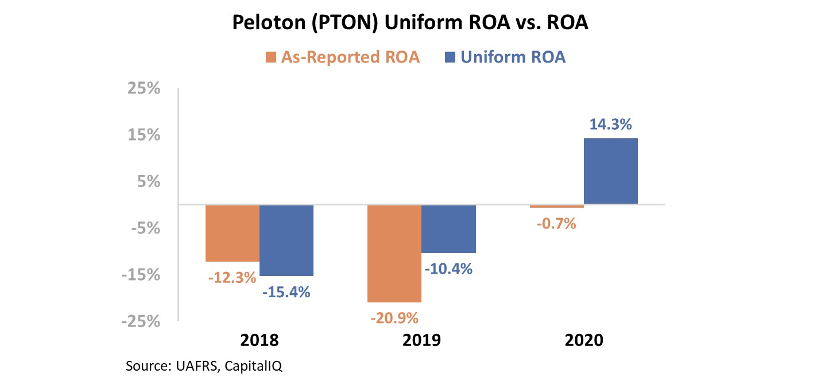

But due to distortions in GAAP accounting, this picture of Peloton's performance isn't accurate. As-reported accounting misrepresents excess cash and stock option expense, among other metrics. This means that Wall Street doesn't see the real story of Peloton's profitability.

Peloton's Uniform ROA inflected positively this year as the company saw huge sales growth. As you can see in the next chart, Peloton's Uniform ROA was 14% in 2020, compared with the as-reported negative 1% figure.

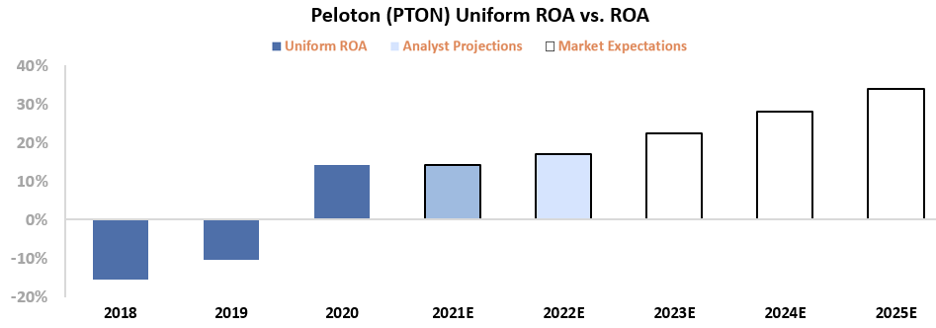

Peloton used its industry-leading market position to generate above-average returns. However, understanding the company's past profitability doesn't tell us if PTON shares are a "buy" today. In this case, we need to look at what investors are expecting the company to do in the future...

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which shows what the company is worth based on what investors think its cash flows will be in the future.

However, here at Altimetry, we know these models are garbage... so we've turned the DCF model on its head. Instead, we use the current stock price to determine what returns the market expects a company to make.

In the chart below, the dark blue bars represent Peloton's historical corporate performance levels, in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars are the market's expectations for how Peloton's ROA will shift over the next five years.

Right now, Wall Street is projecting the company's returns to improve to 17% in 2022. Meanwhile, the market is pricing in returns to rise further to 34% by 2025. Take a look...

In short, Uniform Accounting tells us that Peloton will need to continue improving its offerings to reach these expectations. It has begun to transition from a startup to a company with strong profitability this past year... and it will need to continue this trend and maintain its customer base to grow returns even more.

Expectations are high... but if Peloton can continue to innovate and monetize its offerings, they may be reasonable.

Regards,

Joel Litman

October 30, 2020

P.S. Exercising at home has re-emerged as a big trend during the pandemic. What other at-home trends have you seen that are creating winners and losers in the market? Send us an e-mail at [email protected] and we might take a closer look in a future Altimetry Daily Authority issue.

To get the most out of work and life, focus on the vagus...

To get the most out of work and life, focus on the vagus...