Last week, I presented at Northeastern University...

Last week, I presented at Northeastern University...

I always find these events refreshing. As regular Altimetry Daily Authority readers know, many interns have come through our doors thanks to Northeastern's co-op program, and we've gone on to hire plenty of these young folks full-time.

Altimetry Director of Research Rob Spivey – a Northeastern alum – has told me if I mentioned the school in today's essay, I should also mention that anyone who has a child, grandchild, or family friend looking to go to college and gain real-world experience at the same time should look into the co-op program.

We were lucky to have more than 1,000 people register for my presentation last week. In it, I explained that the societal shifts of the "At-Home Revolution" have caused some stocks to take off from market lows... while others have stagnated due to poor exposure to these market trends. (You can listen to the full presentation right here.)

However, I opened the presentation with an anecdote that doesn't address what's happening right now. Instead, I started by talking about prior market crashes and how the trends we're seeing now are just extensions of trends we've seen many times before.

When studying where the market is going in the future, it's essential to have a good grasp of the market's history. Historical trends will continue into the future. As the saying goes, there's nothing new on Wall Street.

By knowing more about the history of the market, you can become a smarter investor.

Many folks think about investing as buying or selling stocks... But these aren't the terms hedge funds or professional analysts often use.

Many folks think about investing as buying or selling stocks... But these aren't the terms hedge funds or professional analysts often use.

Instead, investors going "long" on a stock means they're buying a share in the company and hoping it will go up in the long term.

Meanwhile, investors "shorting" a stock are preemptively selling the stock, and now owe the stock to someone else. They hope it will go down later, so they can buy it back for a better value.

We hear these terms all the time. But most investors have little understanding of where the terms actually came from... and why we still use them today.

To solve this riddle, we need to turn the clocks back all the way to the late Stone Age...

To solve this riddle, we need to turn the clocks back all the way to the late Stone Age...

Today's anthropologists and historians can see how cooperation and relationship-building took on a new role in primitive societies as early humans were first developing the tools needed to build the foundations of civilizations.

Specifically, relics from this period show us how early humans thought about their world.

One of these tools is the key to our story: the tally stick.

As early as 20,000 to 40,000 years ago, humans were making markings in pieces of wood, bone, and stone.

While it's impossible to know for sure, experts believe these early relics were used to track the phases of the moon or important rituals.

These early tally sticks continued to evolve in complexity. During the time of the Achaemenid Empire, centered in modern-day Iran, tally sticks were used to convey messages and track food or other administrative resources.

In the Middle Ages, the tally sticks further evolved into the split tally sticks, where one tally stick was divided in half. This allowed two different parties to have the same set of information.

By splitting a stick down the middle, each half would only match up with the other part of the original stick.

This meant these split tally sticks served as early receipts. If one participant promised to pay the other with five cows, it was impossible to forge the transaction to change the number of cows after the fact.

This meant the split tally was adopted in early legal disputes due to its ability to protect against fraud.

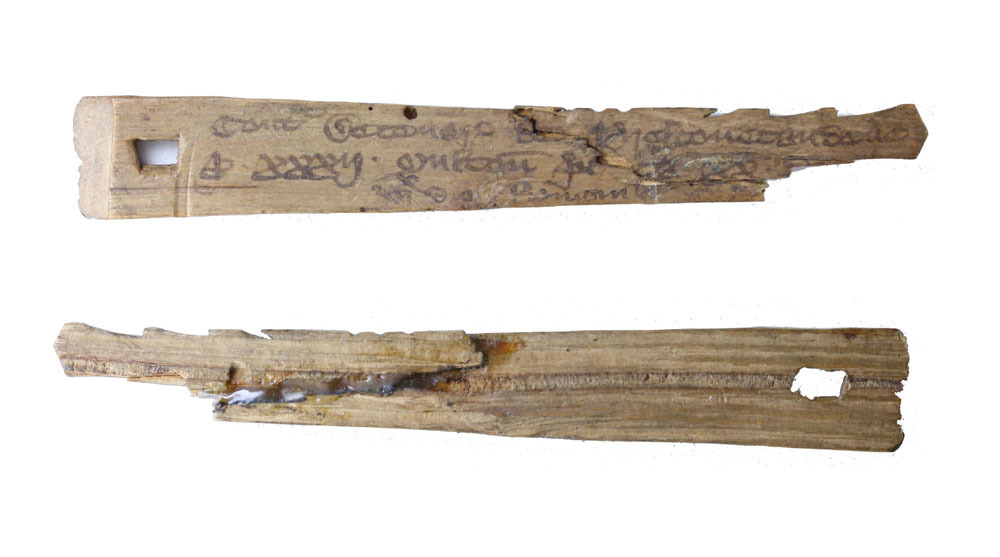

Here's a medieval split tally stick used for transactions...

As you can see, the two pieces of the tally stick weren't split evenly...

As you can see, the two pieces of the tally stick weren't split evenly...

The larger piece would be entrusted to the lender, or the person who was owed something at the end of the transaction. The shorter piece was given to the borrower, who would owe something at the end of the transaction.

This became a widely accepted convention with split tally sticks, until buyers would just say they were "long" and the person who owed the item would say they were "short."

Both pieces of the split tally had another name. The short end of the stick was known as the "foil," and the longer piece was known as the "stock."

This is why investors in shares of a company are "long stock" today.

It can be confusing as to why Wall Street folks use lingo that seems so far divorced from what they're actually doing. However, these terms and phrases can usually be traced through history. Knowing their origin can help investors understand what's going on in the markets every day... and cut through the jargon.

Regards,

Joel Litman

March 22, 2021

Last week, I presented at Northeastern University...

Last week, I presented at Northeastern University...