The U.S. economy had everything going for it in 2021...

The U.S. economy had everything going for it in 2021...

GDP growth was surging. Liquidity was abundant. Financial conditions were looser than they'd been in years.

It was the perfect environment for stocks to soar. And they did... with the S&P 500 climbing nearly 27% that year.

But then came 2022.

Inflation roared to a 40-year high, forcing the Federal Reserve into one of the most aggressive tightening cycles since the 1980s.

Liquidity dried up... credit markets seized... and the S&P 500 suffered its worst annual decline since the Great Recession.

Investors braced for an economic downturn. But instead of a full-blown recession, we got something different – a rapid tightening of financial conditions that crushed stock valuations without fully breaking the economy.

Now, nearly two years later, we're finally seeing the kind of backdrop that should have fueled a rally back in early 2022... if the wheels hadn't come off.

For the first time since the Fed started raising rates, financial conditions have eased back to pre-tightening levels...

For the first time since the Fed started raising rates, financial conditions have eased back to pre-tightening levels...

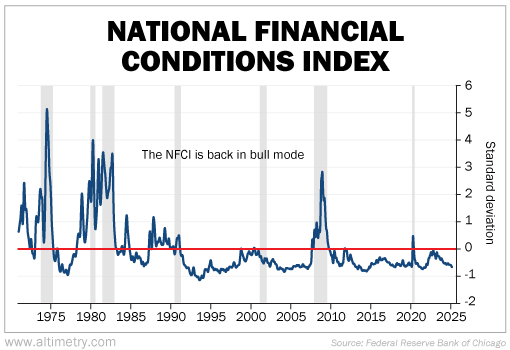

We can see this through the National Financial Conditions Index ("NFCI"), which tracks more than 100 financial metrics spanning risk, credit, and leverage.

The NFCI serves as a broad measure of financial stress in the system. When the index is above zero, conditions are tight – borrowing costs rise, lending slows, and liquidity dries up.

When it falls below zero, conditions are loose, making capital more available and markets more liquid.

As you can see in the following chart, the NFCI has been steadily loosening since March 2023. It's now well below zero... at levels last seen in late 2021, when markets were still in full bull mode.

Take a look...

Financial conditions have moved decisively into accommodative territory.

That kind of shift typically supports economic expansion, rather than contraction... reinforcing the case for a continued bull market.

This isn't the kind of easing we typically see in a downturn...

This isn't the kind of easing we typically see in a downturn...

And this isn't some kind of contrarian indicator that signals the good times are behind us.

Financial conditions like this signal a healthy economy. It's a good sign for the stock market.

Investor optimism is rising, which means near-term volatility could pick up. But that's not a signal to panic – it's a signal to stay the course.

Regards,

Rob Spivey

March 10, 2025

The U.S. economy had everything going for it in 2021...

The U.S. economy had everything going for it in 2021...