I was recently catching up with my longtime friend Jeff Madden...

I was recently catching up with my longtime friend Jeff Madden...

Jeff runs a fund called the "U.S. Alpha Fund," and he does a great job of it. The fund's returns are ranked in the top 10% in terms of portfolio returns.

That ranking may even be too conservative. His fund is one of the best – if not No. 1 – in risk-adjusted returns.

When we were chatting, Jeff mentioned he had been reading excerpts of Roman Emperor Marcus Aurelius' Meditations.

It's a compilation of the emperor's personal notes to himself, written in a highly quotable, pithy format. Historians believe that Meditations was never actually meant to be published... But I'd argue that almost 2,000 years later, the world is a better place with the book's availability.

Marcus Aurelius was one of the greatest Roman emperors. Based on his thought processes and philosophy for daily living, he would have also likely been a great investor.

The lessons he wrote down for himself are incredibly consistent with the advice that the investing greats provide.

Much of what Marcus Aurelius wrote was meant to help himself make better decisions and avoid error-filled thought processes. When working through tough decisions, the emperor suggests that the first thing to do is not to work yourself up. Don't let your emotions get the better of you.

And according to another one of his notes...

If thou art pained by any external thing, it's not this that disturbs thee, but thy own judgement about it. And it's in thy power to wipe out this judgement now.

Marcus Aurelius spends a great deal of time discussing the importance of what we would call "mindfulness," including being silent and patient when reacting to any outside argument or action.

Meditation and mindfulness are skills and practices that many people today have found useful (including yours truly)...

Meditation and mindfulness are skills and practices that many people today have found useful (including yours truly)...

Many great investors have preached the importance of meditation and its positive effect on their lives and their portfolios.

Legends like Ray Dalio of Bridgewater Associates, Paul Tudor Jones of Tudor Investment, and Michael Novogratz of Fortress Investment have all publicly recommended meditation.

It has even been promoted by the CFA Institute, the global association of chartered financial analysts and investment professionals.

By pausing and being mindful, you can help prevent your emotions from getting the better of you.

And by stopping yourself from overreacting, you can make better decisions.

This was incredibly important to Marcus Aurelius when it came to running the Roman Empire. It's just as important when making investment decisions and managing investment funds.

As I mentioned, investing great Ray Dalio has been a big proponent of meditation...

As I mentioned, investing great Ray Dalio has been a big proponent of meditation...

Dalio has served as co-chief investment officer of the massive Bridgewater Associates hedge fund since 1985. He's also known for his book, Principles.

Perhaps the steady hand that meditation has given him – and many others at Bridgewater – has helped contribute to his success...

Dalio has generated one of the most impressive track records of long-term performance against the market. As of late last year, his fund's average return over the prior 28 years was 11.5% versus 7% for the market.

For context, given the compounding of those excess returns over such a long period of time, that's the difference between your money rising 550% versus more than 2,000% over nearly three decades.

And yet, if we examine the Bridgewater portfolio today through as-reported financial metrics, the current top stock holdings look weak. This perhaps indicates a lack of mindfulness.

Has the Bridgewater team has taken leave of its senses?

Or perhaps the team is looking beyond the as-reported income and cash flow metrics when building the portfolio. In other words, it might actually be mindful of the issues with bad accounting measures.

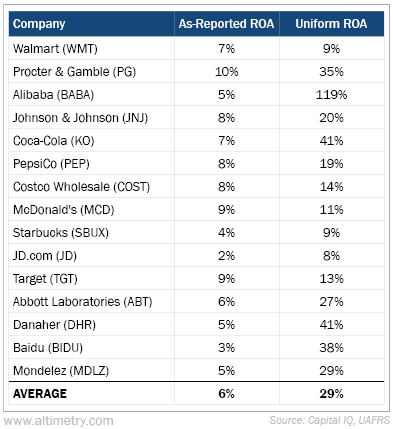

When using Uniform Accounting metrics to review the fund's equity investments, we see a very different picture. In reality, the fund's stocks are much higher-quality than the as-reported metrics imply. Take a look...

On an as-reported basis, many of these companies would appear to be poor performers with returns on assets ("ROAs") well below the U.S. corporate average of 12%. The average as-reported ROA of the companies in the fund is 6%.

However, once we make Uniform Accounting adjustments to accurately calculate earning power, we can see that the returns of the companies in Bridgewater's portfolio are much more robust.

The average company in the portfolio displays an impressive average Uniform ROA of 29% – well above corporate-average returns.

It pays to be mindful – both in your decision-making and in the data you use – for improving your life... and of course, your investments.

Regards,

Joel Litman

May 14, 2021

I was recently catching up with my longtime friend Jeff Madden...

I was recently catching up with my longtime friend Jeff Madden...