Lithium-ion batteries have steadily taken over the world...

Lithium-ion batteries have steadily taken over the world...

They power all sorts of devices – from cellphones and hand-held video cameras to kitchen appliances and medical devices.

They've transformed how we use energy and how we get around... moving us from oil and gas to greener alternatives. They're now an essential part of home generators and electric vehicles ("EVs").

To put it plainly, lithium-ion batteries have become a crucial part of our everyday lives over the past few decades.

However, as with a lot of new technologies, lithium-ion batteries didn't take off right away. When they first entered the market in 1991, they were expensive... more so than other energy sources.

Since then, though, the price of lithium-ion batteries has fallen more than 97%. That's helped greener technologies – and EVs in particular – gain popularity.

And even though it's cheaper to make lithium-ion batteries today, the basic design hasn't changed much... until now.

In September, Toyota Motor (TM) announced a breakthrough in improving the lithium-ion battery for its vehicles. It's introducing a solid-state lithium-ion battery.

Today, we'll look at some of the advantages of Toyota's new technology... and explain why it presents a massive buying opportunity for investors.

Toyota's solid-state lithium-ion batteries are changing the game...

Toyota's solid-state lithium-ion batteries are changing the game...

They have a solid electrolyte – as opposed to the current liquid electrolyte – which ultimately makes them safer and more durable.

The new technology also has the potential to triple EV ranges and cut charging times by two-thirds.

Toyota expects that its farthest battery range could reach up to 932 miles by 2027. For comparison, the carmaker's only current EV has a range of 318 miles. And instead of taking about 30 minutes to charge, it would only take about 10.

Overall, these new batteries are much more efficient. They also create a massive opportunity for investors...

You see, solid-state batteries are way more lithium-intensive than current lithium-ion batteries.

Essentially, solid-state batteries can increase the amount of energy stored by packing more lithium into the battery. That will ultimately lead to increased demand for lithium, which means lithium miners stand to profit...

That's great news for companies like Livent (LTHM)...

That's great news for companies like Livent (LTHM)...

Livent is one of the largest lithium miners in the world – and it's the largest pure-play lithium miner in the U.S. It works with major EV makers like Tesla (TSLA) and General Motors (GM).

After a surge in EV interest in 2021 and 2022, lithium miners have been struggling this year.

With a recession right around the corner, consumers are buying fewer cars. And EVs are being hit especially hard, as they tend to be more expensive than traditional gas-powered vehicles.

As a result, lithium prices have fallen more than 70% since the beginning of 2023, which is weighing on Livent.

However, the long-term growth potential of EVs and the batteries that charge them hasn't changed. And with the introduction of solid-state batteries, the future of lithium producers like Livent is looking even more promising.

After all, higher demand for lithium should translate into stronger returns.

Yet, the market seems to be totally missing this opportunity...

Yet, the market seems to be totally missing this opportunity...

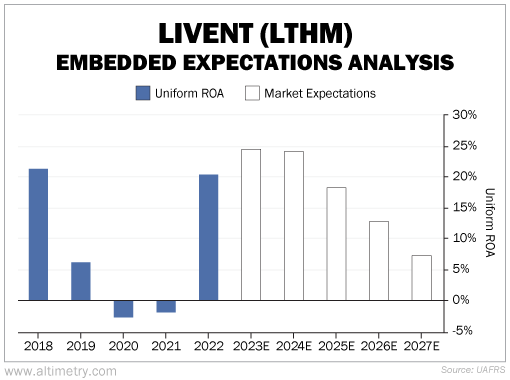

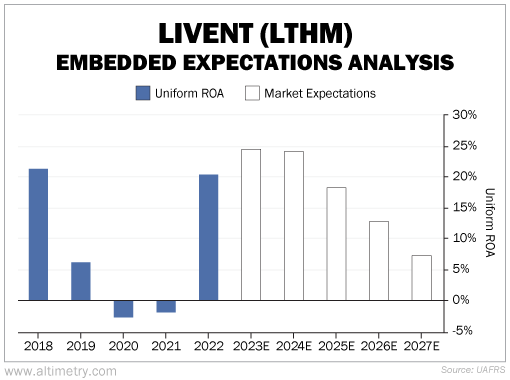

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects Livent's Uniform return on assets ("ROA") to fall below 10% by 2027.

Take a look...

Returns have dipped below 10% within the past few years... However, that only happened when lithium demand was low.

In 2018 and 2022, when lithium demand was high and pricing was good, Livent's Uniform ROA climbed above 20%.

Today, the market seems to be pricing Livent like it'll never see demand pick back up. It's too focused on the short-term problems instead of the long-term potential.

EVs are poised for significant growth, and solid-state batteries are on the brink of revolutionizing the market. Lithium demand should take off, and companies like Livent are in an excellent position to profit.

Investors who get in early can capitalize on this opportunity before the rest of the market catches on.

Regards,

Joel Litman

November 15, 2023

Lithium-ion batteries have steadily taken over the world...

Lithium-ion batteries have steadily taken over the world...