COVID-19 upended nearly every aspect of our lives...

COVID-19 upended nearly every aspect of our lives...

From virtual work and school to telemedicine and almost everything in between, our habits have shifted drastically since the onset of the pandemic.

And even as the world adapts to these changes, new challenges keep cropping up.

Consider supply-chain delays, which have put pressure on goods and services in industries around the world. Suddenly, critical items like semiconductors, building materials, and even baby formula have become scarce.

One solution to supply-chain constraints is a shift in consumer spending...

One solution to supply-chain constraints is a shift in consumer spending...

The past two years have also altered a major long-term spending trend. Before the pandemic, spending was steadily shifting from tangible goods to experiences. As people were cooped up, it made sense that they spent more on physical things than they used to.

But as the world opens back up and demand for goods skyrockets, many folks are wondering if this trend will revert. And that could benefit the economy...

A shift back to experiences could soften the massive demand for physical goods that's putting so much strain on the world's supply chain – and contributing to inflationary pressures as well.

Now, a big 'travel tech' company may be signaling that this shift is underway...

Now, a big 'travel tech' company may be signaling that this shift is underway...

Airbnb (ABNB) disrupted the hotel industry back in 2008 by letting anyone open up their homes for short-term rentals.

The company has since accumulated more than 7 million property listings around the world, ranging from city lofts and suburban homes to unique treehouses. It offers more immersive options than many hotels can... Plus, its listings are often cheaper and more private, which draws travelers to the platform.

In recent years, Airbnb has also expanded to let users to host experiences, which can include anything from walking tours to cooking classes and even sailing trips.

Earlier this month, the company announced banner first-quarter earnings. Revenue was up 70% year over year. Bookings rose 59%, climbing above pre-pandemic levels.

These stellar results indicate that consumers may be shifting their spending back toward travel and experiences.

Plus, pent-up travel demand and flexible work policies mean some people can visit new places for weeks and even months at a time.

All-time highs in travel demand spell all-time profits...

All-time highs in travel demand spell all-time profits...

But even as Airbnb records its best performance yet, as-reported metrics make it appear barely profitable.

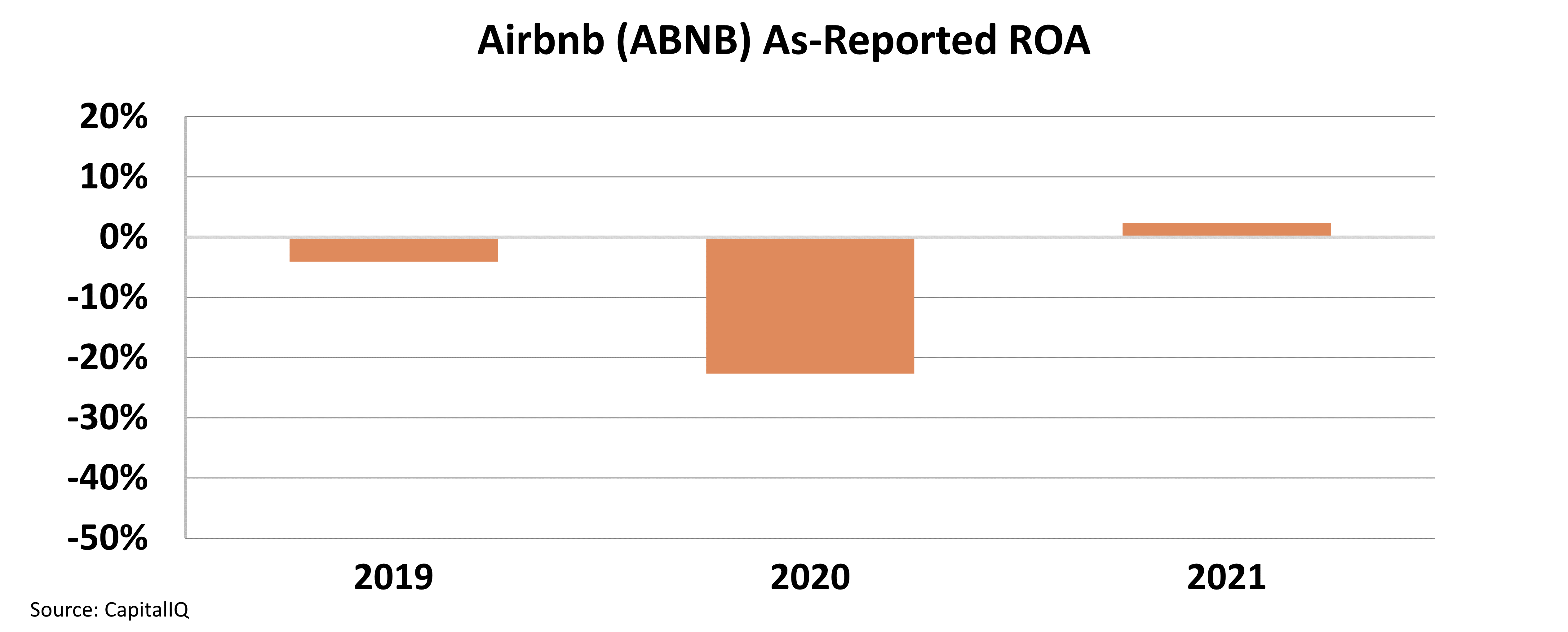

People stopped traveling when the pandemic hit... and the company's as-reported return on assets ("ROA") fell from negative 4% in 2019 to negative 23% in 2020. Since then, as travel has recovered, its ROA only seems to have become slightly positive – reaching 2% in 2021.

It appears all-time high returns still don't cover the company's cost of capital, wasting investors' money...

So even though Airbnb looks good from a macro perspective, you can't blame investors for staying far away if they're only looking at as-reported data.

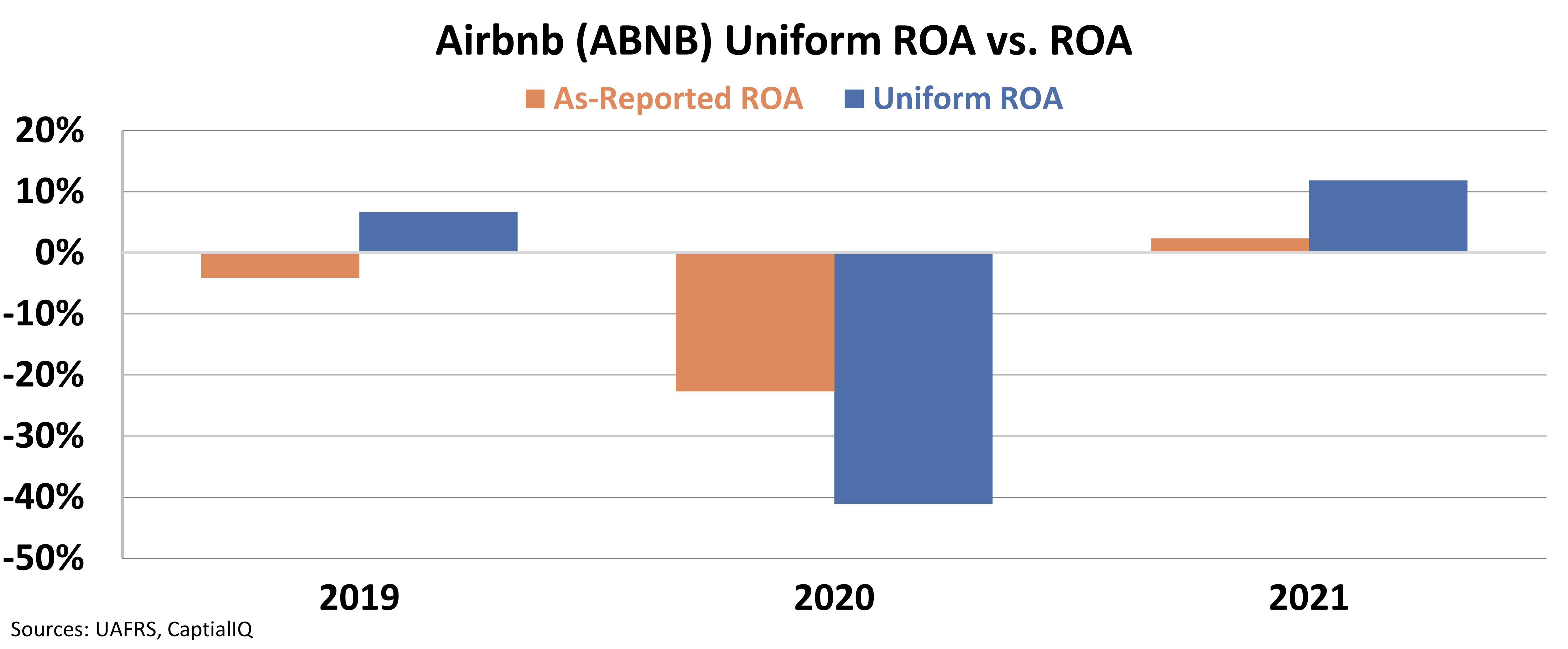

Uniform metrics, on the other hand, tell a completely different story. And it's one that should make any investor reconsider...

Airbnb was already profitable in 2019, with a 7% Uniform ROA. That number took a hit as travel halted during the pandemic, dipping to negative 41% in 2020. But the company is far more profitable in 2021 than as-reported metrics make it seem... Its Uniform ROA was 12%, above the corporate average of around 10%.

Uniform metrics show us that Airbnb bounced back from the pandemic stronger than ever, highlighting fundamental demand for the platform.

And its returns are set to further accelerate in 2022 and 2023. Analysts expect Uniform returns of 43% and 48%, respectively.

In short, Airbnb is only expected to get stronger from here. As more and more people return to traveling, demand for its properties and services will continue to rise.

Thanks to Uniform Accounting, we see that Airbnb is now an above-average performer. If you don't use the right data, you could miss out on a strong pandemic recovery story.

Regards,

Joel Litman

May 31, 2022