Supply chains should be a source of strength...

Supply chains should be a source of strength...

But in recent years, many folks believe supply chains have been stretched too far. And now, they're under pressure due to disruptions from the coronavirus pandemic.

For almost three decades, supply chains have been run to maximize efficiency. Companies have been taking every step possible to maximize economies of scale and operate as lean as they can without tying cash up in working capital.

But with borders closed, fear of geopolitical risks, concerns over carbon emissions, and less knowledge about suppliers overseas, many people have been calling for supply chains to get shorter.

However, these interwoven supply chains have been essential in maximizing wealth creation in emerging countries across the globe. They've also helped maximize wealth in developed parts of the world and have been a key driver of low inflation rates.

The interdependence created by supply chains has also helped facilitate constant dialogue between countries.

Despite recent events such as the Suez Canal blockage, the ongoing trade tension between the U.S. and China, and the semiconductor shortage, supply chains should be a source of strength... not a source of weakness.

They're meant to bring companies and nations together.

These supply chains don't just grow on their own, though...

These supply chains don't just grow on their own, though...

Creating and maintaining them takes work.

Companies spend decades stitching together their supply chains and partnerships for sourcing. One of the biggest struggles is building trust and reliability between potential suppliers and customers. It's a process to reduce the lead time for folks to get comfortable with new suppliers.

This is as true – if not more so – for software and technology suppliers as it is for companies on one side of the world making chemicals or clothes for a different company on the other side of the world.

For example, TechTarget (TTGT) has invested in building a knowledge marketplace for IT suppliers and potential customers. The company helps match buyers and sellers of software, hardware, and consulting services.

TechTarget does this by helping vendors create interest through think-piece marketing. By giving potential buyers a place to read up on the technology options they need, TechTarget helps identify targets for vendors.

It essentially matches the people researching think pieces and white papers on key IT solutions with IT vendors that can actually solve those needs – creating "digital supply chains."

The company has provided a simple but powerful platform to help match those with IT solution needs with the right vendors.

TechTarget operates in a huge area of investment for most companies... But the as-reported financial metrics paint a poor picture for the firm.

TechTarget operates in a huge area of investment for most companies... But the as-reported financial metrics paint a poor picture for the firm.

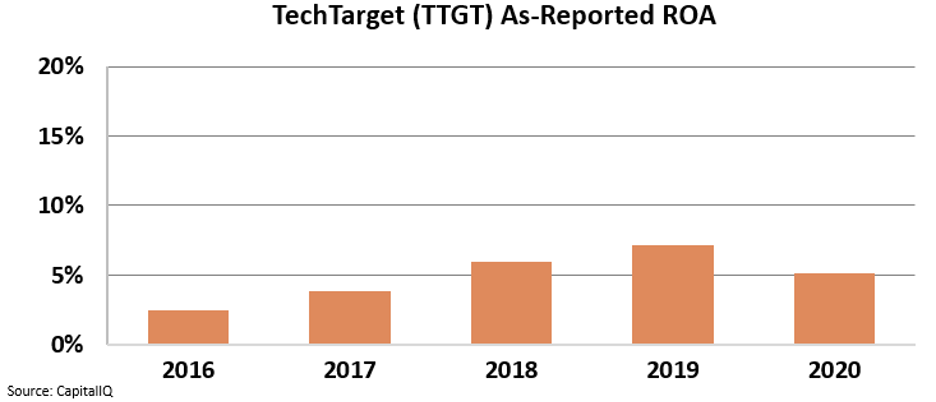

Specifically, after expanding from 2% in 2016, TechTarget's return on asset ("ROA") levels peaked at 7% in 2019. Last year, they fell to 5%.

Based on these numbers, the company's approach to create digital supply chains hasn't led to big profitability. And even at the peak, TechTarget's returns were well below the U.S. corporate average of 12%. Take a look...

In reality, it's not that TechTarget isn't offering value for those trying to figure out their IT supply chain...

In reality, it's not that TechTarget isn't offering value for those trying to figure out their IT supply chain...

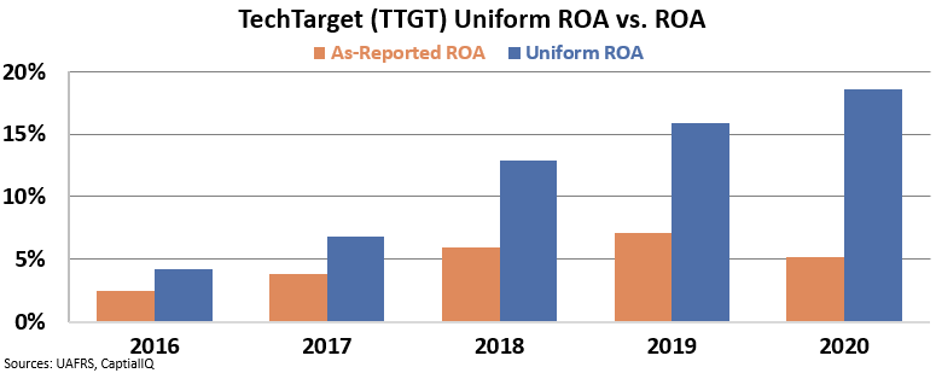

The issue is with the GAAP numbers. The as-reported financials don't give an accurate picture of TechTarget's real profitability levels.

Once we clean up the numbers with Uniform Accounting – which removes the distortions and discrepancies – we can see that TechTarget has generated strong returns that are well above the corporate average.

In fact, the company's ROA trend has been strongly positive since 2016 – rising from 4% that year to 19% in 2020.

As the marketplace is building great economies of scales, TechTarget's returns are only getting stronger.

TechTarget's true profitability shows the strength of helping people and companies better find solutions in their digital supply chains... And Uniform Accounting proves it.

But just because TechTarget generates big profitability doesn't mean its stock is a buy...

But just because TechTarget generates big profitability doesn't mean its stock is a buy...

If the company's strong fundamentals are already priced in, then investors who rush to buy TTGT shares now could be overpaying for the stock. If the market has high expectations, any misstep from TechTarget could send the stock tumbling.

Thanks to our Altimeter tool – which uses Uniform Accounting to generate grades for individual stocks – we can see TechTarget's true valuations. To learn more about The Altimeter – and gain access to the company's full grading – click here.

Regards,

Joel Litman

May 11, 2021

Supply chains should be a source of strength...

Supply chains should be a source of strength...