Twitter (TWTR) is long past its days as the 'next big thing'...

Twitter (TWTR) is long past its days as the 'next big thing'...

That's a critical difference between the social media giant and the other companies that Tesla (TSLA) CEO Elon Musk has been a significant part of in the past.

As we highlighted yesterday, Musk's deal to take over Twitter (TWTR) seems to be under fire... and it should be.

Musk is currently looking for a way out of the deal, citing the number of bots on the platform. And while he believes he can unlock further value in the business, it still looks like he would be overpaying – especially since the market tanked after he made his offer.

But there's more to the story than price...

The returns Musk and his followers are after may simply be impossible to reach. This isn't anything against Twitter as a business. Rather, it has to do with the size of the company.

No matter the price Musk pays, Twitter is no Tesla...

No matter the price Musk pays, Twitter is no Tesla...

From PayPal (PYPL) in the early 2000s... to SpaceX, Starlink, and the Boring Company... Musk has been the main engine behind turning these companies into high-growth rocket ships. He invested a huge amount of his own initial capital in these businesses when they were new and tiny.

When each enterprise took off, Musk's wealth compounded to unimaginable levels. If you start with a big investment in a small company, you make a lot more money when it grows.

But large companies can only get so much larger. For example, Big Tech behemoth Apple (AAPL) sits at a market cap of more than $2 trillion. For its stock to rise 10%, Apple has to create the value equivalent of PepsiCo's (PEP) or Verizon's (VZ) entire market cap out of thin air.

This is what makes Twitter so different from Musk's other successful endeavors. In the past, he started from ground zero.

Let's zoom in on his most successful venture to date – Tesla.

In 2003, Musk became one of Tesla's earliest investors. He eventually gained control of the company, pouring in $70 million of his own money. As Tesla grew, Musk's investment compounded... making him wealthy even before the company's initial public offering.

When Tesla went public in 2010, it was a relatively tiny $1.6 billion stock. Yet Musk's investment in the firm had already ballooned from $70 million to $646 million.

Since then, the company's immense growth has sent its valuation soaring to more than $740 billion. And Musk has become the richest person in the world. He's now worth about $220 billion, mostly thanks to his stake in Tesla.

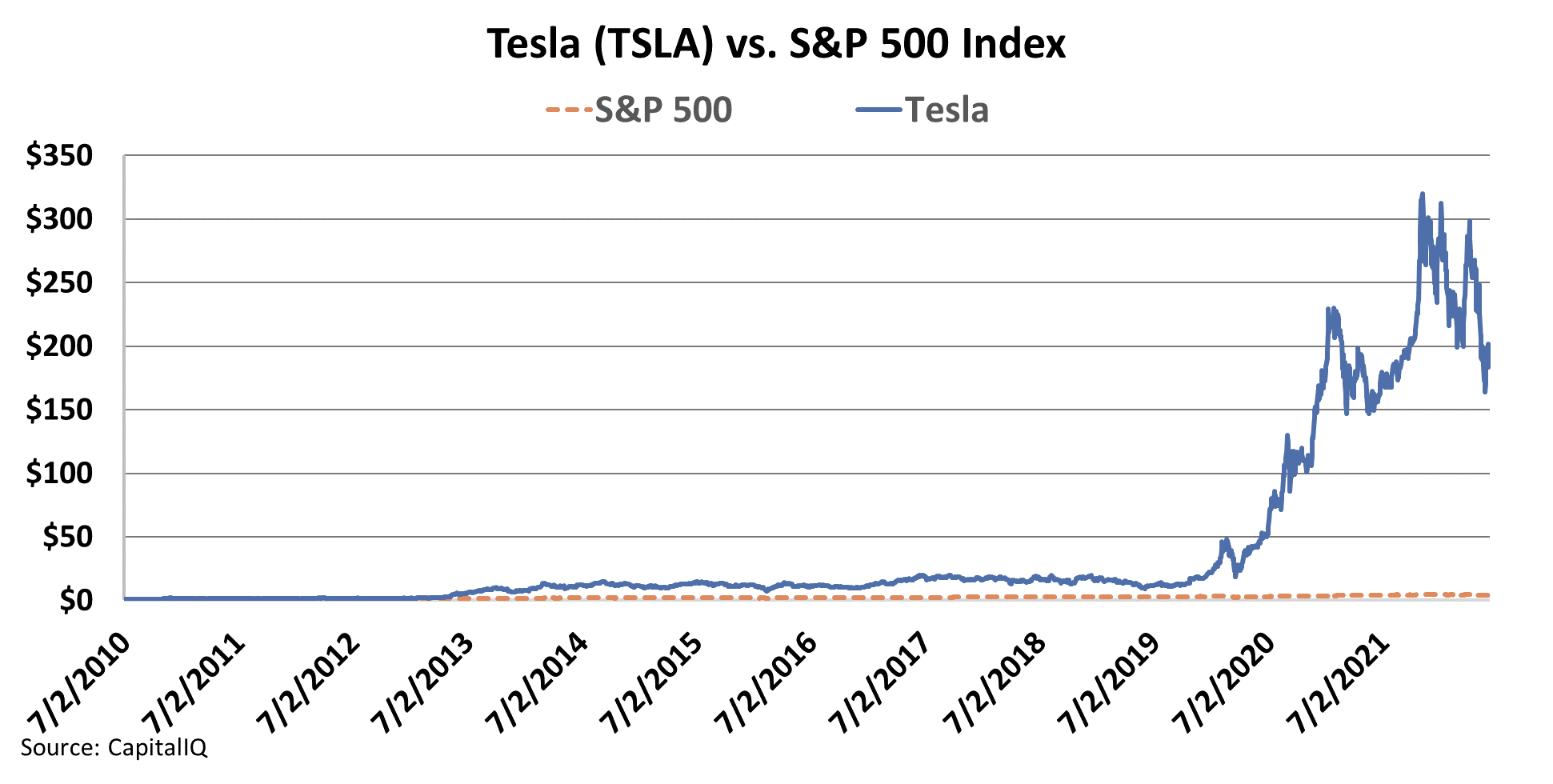

You can see this immense growth below. If you'd invested in the S&P 500 in 2010, you would have quadrupled your money. But if you'd invested in Tesla in the same time period, each dollar would have turned into more than $150. That's a whopping 14,900% return.

To create tremendous wealth, you have to start with tiny stocks...

To create tremendous wealth, you have to start with tiny stocks...

Twitter will never generate this type of return. For Twitter to climb 14,900%, its market cap would need to skyrocket to $4.5 trillion – three times as much as Google parent Alphabet (GOOGL).

For the potential to create life-changing wealth like a successful entrepreneur, you need to find tiny stocks that can compound over time.

It's next to impossible to bag a 10 times gain in a megacap company... let alone a 150 times gain. They're just too large. But for a company that's already tiny – say, below $1 billion or $500 million – those returns are much more attainable.

And that's why microcaps are our favorite area to invest in right now.

In short, true upside potential lies in turning a small company into a major one.

Tesla is an extremely successful example. But it's just one of the many cases where starting tiny is the right way to go.

In fact, I just released a special report discussing one of my favorite tiny companies that I think is primed to explode higher... as soon as this morning's open.

It's a misunderstood auto-parts manufacturer that has fallen off the market's radar. But one of the greatest investors of the past four decades is taking notice – and so are we.

If you want to learn more about this opportunity, including how you can set yourself up for potentially transformational gains, click here to get started.

Best,

Joel Litman,

June 8, 2022

Twitter (TWTR) is long past its days as the 'next big thing'...

Twitter (TWTR) is long past its days as the 'next big thing'...