Most folks know the slogan 'America runs on Dunkin'...

Most folks know the slogan 'America runs on Dunkin'...

But if you really want to be accurate, it should actually say, "America runs on credit."

We don't just buy things with our savings. People need credit to buy houses and cars and refrigerators. And companies need credit to develop products and build new factories.

Most people have no idea what happens when credit dries up. But I'll give you a hint...

You've seen it before... in 2008.

It wasn't pretty back then. And the next time it happens – and I believe it will happen again soon – it won't be any prettier.

What you need to understand as an investor is that credit has incredible predictive power. Trouble in the credit market forecasts pain for the stock market.

It's the same with individual companies. Credit is at least half the picture when it comes to understanding a company's health and where it's headed.

And yet, almost no one looks at it.

Today, I'll detail two concerning signs unfolding in the credit market... and what it could mean for investors.

Think of it this way... The credit market is the economy's most important vital sign.

Think of it this way... The credit market is the economy's most important vital sign.

It's just like your pulse at the doctor. When we check on the health of the credit market, we're checking the economy's blood pressure... or maybe even its bloodwork.

And right now, this vital sign says the economy is about to have a heart attack.

Both companies and individuals are sitting on more borrowed money than pretty much any time in history.

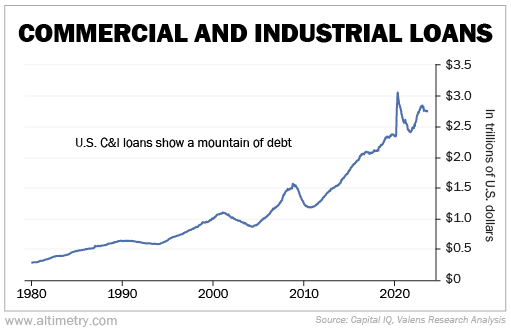

We can see this through commercial and industrial (C&I) loan growth.

Companies use C&I loans to fund capital projects instead of relying on cash flows. So C&I loan growth can tell us a lot about corporate investment and the corporate outlook.

Today, C&I loan trends are showing two worrying signs...

They're near all-time highs, signaling a ton of debt piled up on the U.S. economy. And in recent months, they've started shrinking.

Take a look...

This is a sign that high interest rates are starting to do what the Federal Reserve hoped... economic growth should start slowing down soon.

Put simply, it has been easy to borrow money for a long time. You could do it for next to nothing.

We became addicted to "easy credit." Everybody assumed it would stay easy forever.

But now, we've just been through the fastest increase in those rates on record... easy credit is drying up.

Banks don't make money lending in these conditions. So they don't lend. It's like when you hear a record scratch and the music just stops.

Without this flow of credit, companies can't grow. They can't add products... hire workers... or build factories.

And it's the same for individuals...

And it's the same for individuals...

Mortgage rates have more than doubled, to above 7%. Credit-card interest rates are up from 14% to 21%. And rates on car loans have doubled as well, with the biggest spike in just the past year.

Of course, the cumulative balance of all these debts has skyrocketed to record highs at the same time.

If you've relied on debt in any way... life is about to get much harder and more expensive.

Add it all up. Companies don't have the money to grow. Consumers don't have the money to spend.

And what people don't realize is... it's setting up a massive storm in the debt markets. The credit market is already struggling, and the storm hasn't even hit yet.

But that's not even the biggest problem.

Remember, we're already sitting on record debt from when money was easy.

And it's all coming due. We're staring down a tidal wave of debt that companies can't afford to pay and can't refinance.

During the pandemic, there was a huge surge in borrowing at near-zero rates. It was an even bigger surge than you'd usually expect, because we wanted to keep companies in business.

Now, that money is running out.

Worse, companies can't do what they've always done in the past... which is refinance for next to nothing. Interest rates are sky-high and banks don't want to lend.

They're going to default on their debts. Many will go bankrupt.

A huge number of those that do survive will see their profits wiped out by interest expenses. Their stocks will crater.

Folks, there's no way around it...

There's going to be carnage in the corporate credit market...

There's going to be carnage in the corporate credit market...

Many companies will default and go bankrupt.

And it's going to happen nearly all at once, setting off a 2008-like panic – mark my words.

But that panic is also going to create an opportunity... It will lead to an absolute fire sale in one specific market.

The credit crisis is arriving right now, as we speak. This is the critical moment to understand what's coming... and to look into strategies outside the stock market.

People who do will be in a position to make better returns than in equities... do it more safely... and do it over and over again.

Regards,

Joel Litman

September 25, 2023

P.S. Investors have good reason to feel uncertain about the stock market today...because every warning sign on Wall Street is flashing red. But that doesn't mean you should throw your hands up and abandon investing entirely...

My team and I are seeing the perfect setup for an entirely different strategy – one completely outside of the stock market.

Billionaires and Wall Street hedge funds have already caught on. They're pouring billions of dollars into this approach... because they know it's the one investment everyone should take seriously when the next crisis hits.

I'll explain everything in my brand-new presentation on Wednesday, September 27, at 8 p.m. Eastern time. This event is completely free to attend. Learn more and RSVP right here.

Most folks know the slogan 'America runs on Dunkin'...

Most folks know the slogan 'America runs on Dunkin'...