China is steadily expanding its presence in the Americas...

China is steadily expanding its presence in the Americas...

It has already surpassed the U.S. as South America's largest trading partner. And now, China is poised to strengthen its foothold with a massive new port in Peru.

The $1.3 billion Chancay Port is funded under China's ambitious Belt and Road Initiative ("BRI").

BRI aims to build trade routes and strengthen economic ties by funding transportation, energy, and communication-infrastructure projects.

So far, 22 countries in South America and the Caribbean have participated in BRI projects, including Argentina, Costa Rica, and Barbados. Chinese President Xi Jinping is working to recruit even more countries.

While the Chancay Port promises to boost commerce, it has also raised concerns among U.S. officials...

They fear China wants to use the port for another, more troubling purpose – to prop up the Chinese navy in the Americas... and flex its muscle toward America.

Today we'll talk about how the U.S. might respond to this potential threat... and how one domestic shipbuilder could benefit most from this development.

The Chancay Port is much more than an economic catalyst...

The Chancay Port is much more than an economic catalyst...

Its deepwater design and strategic location – at the U.S.'s doorstep – suggest full military-base capabilities.

That means it could easily accommodate Chinese warships.

And it's being built by China Cosco Shipping (1919.HK) – a state-owned marine transportation conglomerate. This company is also slated to be the port's exclusive operator.

If the Chancay Port doubles as a military base, China would pose an even bigger threat to the U.S. and change the balance of power in the Pacific.

We recently spoke with Jonathan Shaffner, a decorated retired colonel and longtime friend of ours, about what a situation like this would lead to. He highlighted that maintaining a strong U.S. Navy would become an even higher priority.

And the new Trump administration would invest heavily in fleet modernization and advanced military equipment.

The last time Trump was in office, the defense budget swelled from $592 billion (in 2017) to $716 billion (in 2019).

We're likely to see a repeat of that in the next four years.

That's where companies like Huntington Ingalls Industries (HII) would come into play...

That's where companies like Huntington Ingalls Industries (HII) would come into play...

Huntington is one of the largest military shipbuilders in the U.S. It specializes in designing, developing, and maintaining naval vessels for the U.S. Navy and Coast Guard.

It could see a surge in demand as the U.S. strengthens its naval force... in response to various marine threats, including China's role in the Chancay Port.

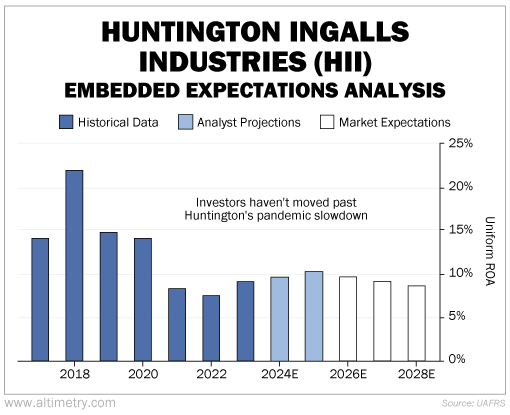

Yet, investors aren't too excited about the company. We can see this through our Embedded Expectations Analysis ("EEA") framework...

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

When business was good, Huntington saw double-digit Uniform returns for four consecutive years... peaking at 22% in 2018. However, the COVID-19 pandemic slowed demand for the company’s state-of-the-art military ships. And it hasn’t fully rebounded.

In the past three years, its return on assets ("ROA") has fallen to 8%, on average. The market expects Uniform ROA to stay at 10% or lower moving forward. Take a look...

With ongoing tensions between the U.S. and China, investors are underestimating the company's true potential.

We think Huntington can get back to its pre-2021 levels. That's because...

America is rarely complacent when it comes to safeguarding its global power...

America is rarely complacent when it comes to safeguarding its global power...

And right now, it can't afford to cut costs in the defense space.

As China ramps up support for BRI projects, the U.S. will have to keep a close eye on the Chancay Port in Peru.

If it winds up becoming a full-blown military base, we'll see a surge in U.S. Navy spending.

We already know the Trump administration will make defense a priority. And these factors could boost companies like Huntington...

Despite investors' hesitation, Huntington seems positioned to return to its pre-pandemic levels. And this could set up the shipbuilder for a rebound the market doesn't expect.

Regards,

Joel Litman

November 26, 2024

China is steadily expanding its presence in the Americas...

China is steadily expanding its presence in the Americas...