Two years ago, President Joe Biden pledged to fix up U.S. infrastructure...

Two years ago, President Joe Biden pledged to fix up U.S. infrastructure...

The Inflation Reduction Act and the CHIPS and Science Act offered more than $400 billion in funding, tax credits, and incentives to infrastructure and manufacturing projects.

They covered everything from clean energy to semiconductors, supply chains, and domestic manufacturing.

At first, this funding seemed like a nice head start. Companies committed around $228 billion for 114 large projects worth more than $100 million each.

Unfortunately, the timing wasn't in the U.S.'s favor. According to the Financial Times, less than $10 billion worth of projects have been completed and classified as operational since then. And $84 billion worth have either been delayed or paused.

As we'll explain today, things are expected to turn a corner soon... and it could lead to key tailwinds in the industrial sector.

Back in August 2022, inflation was at decade-high levels around 8%...

Back in August 2022, inflation was at decade-high levels around 8%...

The Federal Reserve was in the thick of a huge rate-hike cycle. It was much harder for companies to fund these projects than many folks realized.

These days, uncertainty surrounding the upcoming election isn't helping. On top of that overproduction in China – especially in clean technologies such as solar panels and batteries – has further discouraged companies from investing in these areas.

However, the election will wrap up in November... and the Fed is expected to start cutting rates this week.

Lower interest rates should help companies get easier access to financing. And with less uncertainty, they'll be more willing to invest in big infrastructure projects.

More than $100 billion worth of projects tied to the Inflation Reduction Act and the CHIPS Act are still underway... and expected to be completed roughly on schedule.

In addition, $70 billion of the previously mentioned delayed projects are only halted due to funding conditions and economic uncertainty.

That means most of these projects aren't doomed. They're just on hold until financing becomes easier to access.

In short, U.S. industrials are about to get a lot more profitable...

In short, U.S. industrials are about to get a lot more profitable...

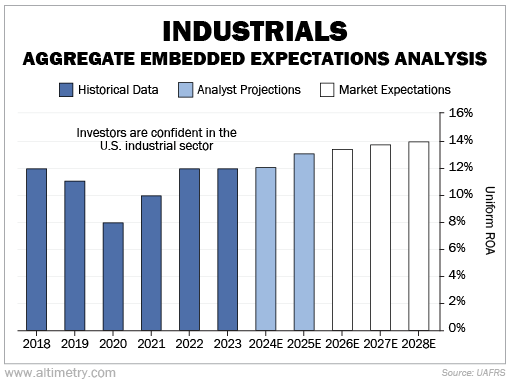

And the market knows it, too. We can see this through our aggregate Embedded Expectations Analysis ("EEA") framework.

We start with the average stock price of all U.S. industrial companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well U.S. industrials have to perform in the future to be worth what the market is paying for them today.

This industry has averaged a Uniform return on assets ("ROA") of roughly 11% over the past five years. It has been 12% in the past two years, right in line with the U.S. corporate average.

Analysts realize the macro setup is about to improve, though. They expect the industry's Uniform ROA to reach 13% by 2025... and 14% by 2028.

Take a look...

It seems investors are already in the know about industrials. They're pricing in the potential benefit of these huge investment projects in a lower-rate environment.

And yet, even though the market is already bracing for improvement, there's still plenty of upside in this sector...

And yet, even though the market is already bracing for improvement, there's still plenty of upside in this sector...

As the Fed's rate-cut cycle gets underway, we expect pressures on delayed projects to ease considerably.

Most folks expect the first cuts at the central bank's meeting this week. That could be the catalyst for more funding as borrowing gets easier.

Of course, we're not saying industrials will take off like a shot tomorrow. Keep an eye out for opportunities, though.

The biggest companies in this sector have a lot to gain from government incentives... and plenty of upcoming projects to boost their profitability.

Regards,

Joel Litman

September 17, 2024

Two years ago, President Joe Biden pledged to fix up U.S. infrastructure...

Two years ago, President Joe Biden pledged to fix up U.S. infrastructure...