Barbra Streisand would be the first to tell you things don't always go as planned...

Barbra Streisand would be the first to tell you things don't always go as planned...

Streisand is a talented performer, famous worldwide for her fantastic multidecade singing and acting career. She is one of only 17 EGOT winners – people who have been awarded an Emmy, a Grammy, an Oscar, and a Tony.

And yet, one of her most notable contributions to our culture was off the stage. It's the so-called "Streisand effect."

In 2003, a photographer took a picture of Streisand's mansion in Malibu, California, and posted it online. Streisand heard about the photo and didn't like it being out there.

She didn't want everyone to know where she lived and what her house looked like. So she sued the photographer and the website for $50 million for violating her privacy.

It only made matters worse.

The lawsuit became an even bigger story than the pictures. Now everyone wanted to know what Streisand was hiding... and they wanted to see where her house was.

More than 400,000 people visited the website that hosted the picture in the following month. Instead of the lawsuit suppressing this information, it had the exact opposite effect.

This story demonstrates the "law of unintended consequences." If we do something with one outcome in mind, we might be just as likely to get another outcome... even the exact opposite outcome, if we're not careful.

Today, we'll talk about how this theory relates to investors. And we'll share how you can apply this knowledge to get ahead of the curve in the market.

The law of unintended consequences plays a huge role in business...

The law of unintended consequences plays a huge role in business...

A great example of this comes from tech company IBM (IBM) in the mid-1990s.

IBM's board decided to change management's compensation plan. The board wanted management to increase its earnings per share ("EPS"). It believed that was the one metric that most directly impacted shareholders and could send the stock higher.

That change to the compensation framework destroyed a lot of value for shareholders.

On its surface, the best way to improve EPS is by growing earnings. That usually entails growing the business and improving margins.

However, savvy investors might recall what actually happened...

From 1995 through 2019, IBM enacted one of the biggest share-buyback programs in history. It bought back more than $200 billion worth of IBM shares.

That's about $80 billion more than its current market cap.

The board thought management would grow earnings by investing cash in the business. But management took another approach.

Finding new growth engines to push earnings higher is hard. Using all that cash flow to buy back shares and reduce the share count? That's much easier.

Management wasted money shrinking IBM's share count. It bought back shares instead of spending money on innovation, research and development, and other ways to drive growth.

In a technical sense, it achieved the board's intended effect... IBM's EPS did actually increase.

It just wasn't the kind of increase that creates value for shareholders.

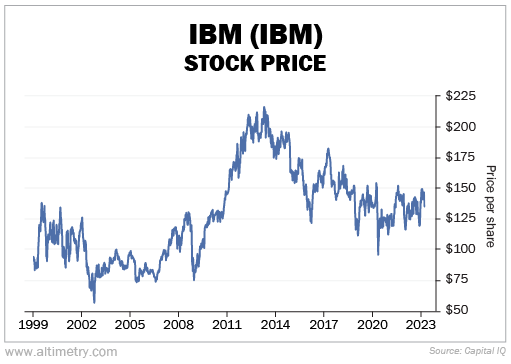

The buyback program really took off around 1999. Since then, IBM's stock is only up about 53%. The S&P 500 is up 235% in the same time frame.

Take a look...

The IBM story goes to show that you don't always end up with the most obvious or basic outcome... especially in the markets.

To protect your money as an investor, you have to consider the daisy chain of possible effects from your actions.

The law of unintended consequences is impacting investors right now...

The law of unintended consequences is impacting investors right now...

Regular readers are likely well versed in the supply-chain supercycle by now. If you need a refresher, it refers to a huge wave of spending on things like construction, factories, and infrastructure in the U.S.

The supply-chain difficulties of the past two years have pushed inflation higher, created shortages for all sorts of goods, and caused a mismatch between supply and demand.

That's driving more companies to build their supply chains closer to home.

Like the Streisand effect, the supply-chain supercycle is having some unintended consequences. Fortunately, they might actually be beneficial...

The return of industry and supply chains to the U.S. has meant soaring demand for blue-collar workers. Jobs in areas like construction, transportation, and warehouses are finally coming back. They'll be important for the U.S. economy going forward.

Once you know about the law of unintended consequences, you'll start to see it in all corners of the market.

A similar domino effect is taking place in Japan, as we talked about on Tuesday. The Japanese government is focused on decreasing rates... which may be artificially boosting the market.

The fundamentals don't seem to explain the recent rally. Stocks may just be rising because of a wash of cash flowing into the market from the Bank of Japan. It's yet another example of actions in one part of the market changing things in another.

In your own investing, exercise caution... and think creatively about unintended consequences.

In your own investing, exercise caution... and think creatively about unintended consequences.

The most straightforward way of thinking about an investment might not be the most accurate way to analyze it – or the most profitable.

To make the most of your investments, you must look beyond the surface. The best way to do this is by performing what's called a pre-op.

That means stopping before you make an investment decision to ensure that you think everything through. Ask yourself questions like...

What could go wrong?

What are the potential problems with this investment?

What biases might be distorting my analysis?

By asking these questions (and others), you'll discover possible unintended consequences. And you'll be able to make a more informed investment decision.

You'll also protect yourself from being blindsided in unfamiliar scenarios. Better yet, it can help you identify ideas that separate you from the pack.

Regards,

Rob Spivey

February 3, 2023

Barbra Streisand would be the first to tell you things don't always go as planned...

Barbra Streisand would be the first to tell you things don't always go as planned...