Everyone loves an underdog...

Everyone loves an underdog...

For most of the past few decades, you would never have heard a president celebrating the unionization of a retail store. And you would certainly never have heard the words "large companies" and "unions" in the same sentence.

Big corporations provide jobs, stimulate the economy, and often lead the way in their own industries. But public sentiment is shifting. These days, it seems folks are rooting for the little guy. And politicians don't intend to be left in the dust.

The latest headlines come from an Apple (AAPL) store outside of Baltimore. A few weeks ago, workers voted to unionize. This is the first U.S. Apple store to do so.

Employees wanted better workplace conditions and protections against growing inflation and employee shortages. Their decision represents a larger movement within the U.S retail, tech, and service labor force.

President Joe Biden recognizes these sentiments. The winds of public approval have shifted against these big companies. Voters increasingly view corporations as the "enemy of the people."

By railing against these companies, Biden can score some easy political points...

By railing against these companies, Biden can score some easy political points...

That's no small feat, considering the hit his popularity has taken in the face of inflation and rising gas prices.

Apple's reputation as a luxury retailer makes it an easy target. It's known for its expensive tech – shelling out $1,000 dollars to text your friends on a chunk of metal seems ludicrous. But we keep doing it.

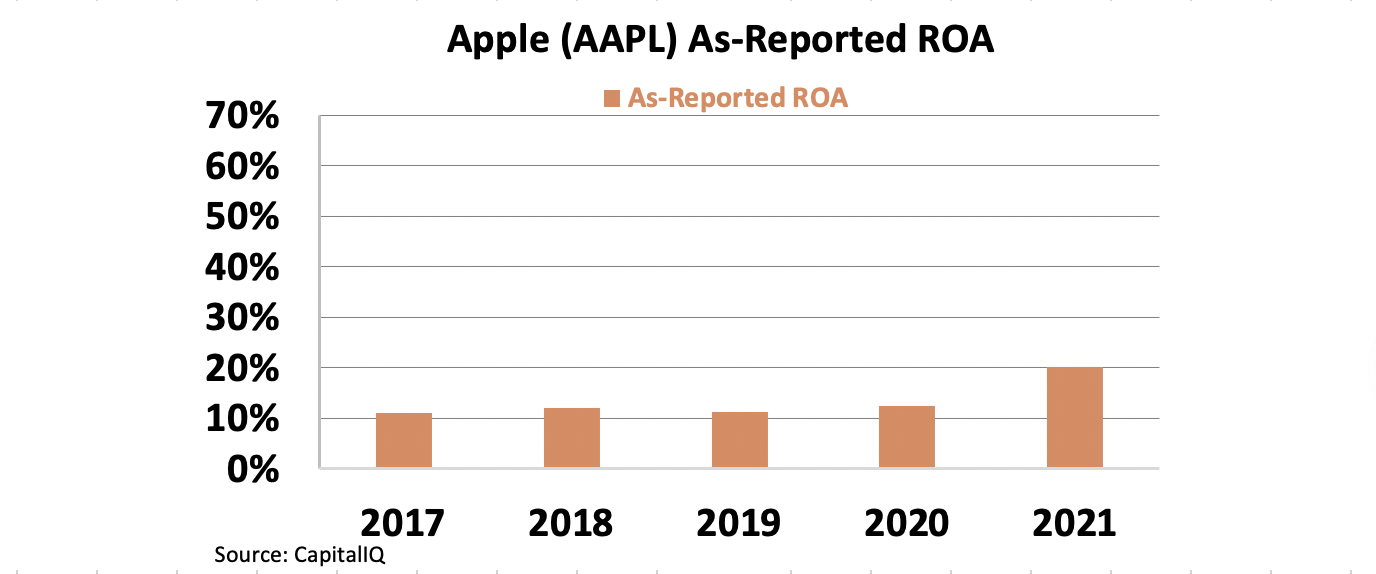

Since Apple's products are so expensive, it should have massive returns. You would expect its margins to reflect its prices. And its as-reported metrics seem to back that up...

Apple appears to have almost doubled its profitability in the past year. In 2020, its as-reported return on assets ("ROA") was 13%. In 2021, that number reached 20%.

We wouldn't be surprised if Biden took a shot at how much Apple charges its customers next. It seems like the company isn't playing fair with employees or consumers.

But Apple's returns aren't what they seem at first glance...

But Apple's returns aren't what they seem at first glance...

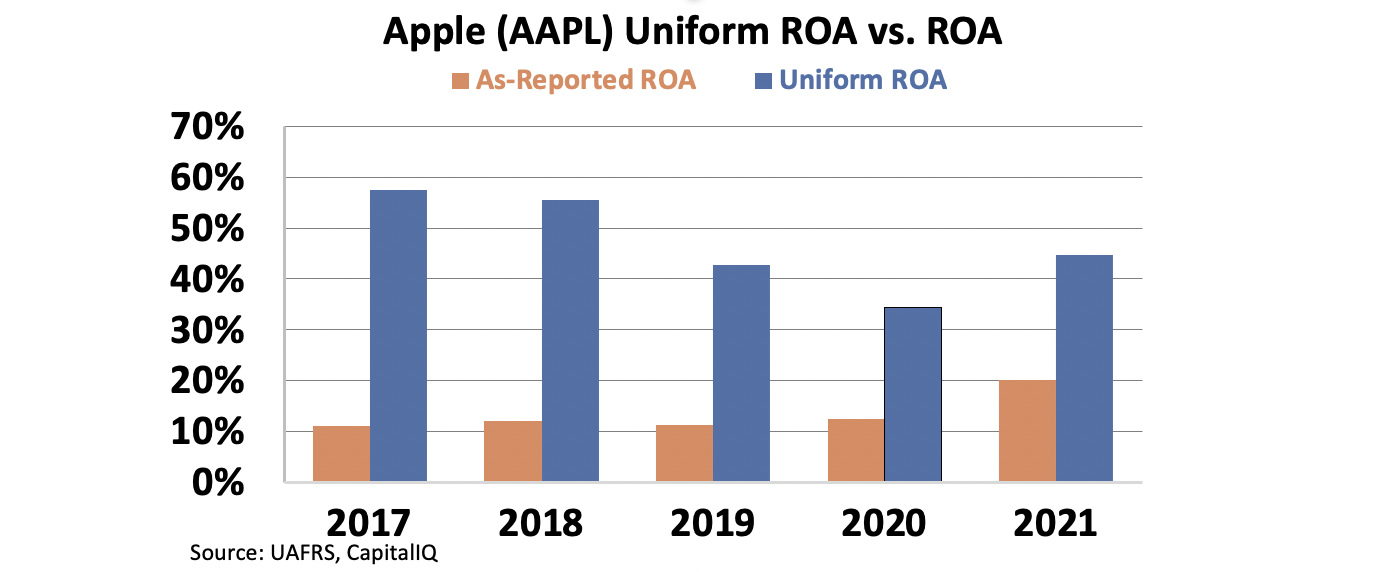

Uniform metrics tell a different story.

Yes, Apple has historically enjoyed extraordinarily high returns. Its Uniform ROA was 45% in 2021 – more than double what as-reported metrics show.

But Uniform metrics also show a surprising conclusion... Apple's returns are falling. Its Uniform ROA was 58% in 2017. ROA has largely been in a downtrend for five years. The only recent rally was in 2021.

Over the past 10 years, Apple's employee count has more than doubled, from about 73,000 to 154,000. As Apple has invested in labor and employment, its returns have fallen significantly. And while the company charges a premium for its products, only some of that revenue is going back into paying its larger workforce.

Over the past decade, Apple has grown into the largest publicly traded company in the world. To keep its spot at the top, it will have to learn to balance the needs of its large workforce with satisfying shareholders.

Regards,

Rob Spivey

July 12, 2022