From late 2016 to early 2018, the S&P 500 did something it had never done before...

From late 2016 to early 2018, the S&P 500 did something it had never done before...

It rose for 15 straight months.

The index booked a total return of 21.7% in 2017, including dividends. Earnings were growing steadily. And corporate tax reform was on the horizon.

But despite all the green flags, few investors felt like they were living through a healthy bull market. In fact, folks spent most of the year warning that the market was too expensive.

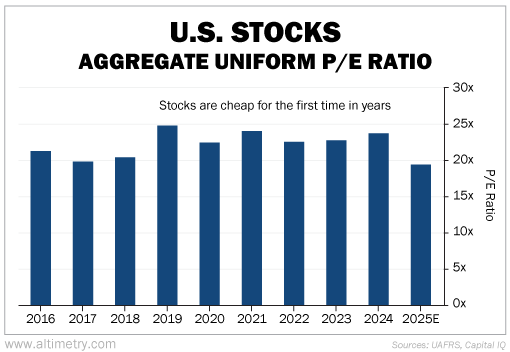

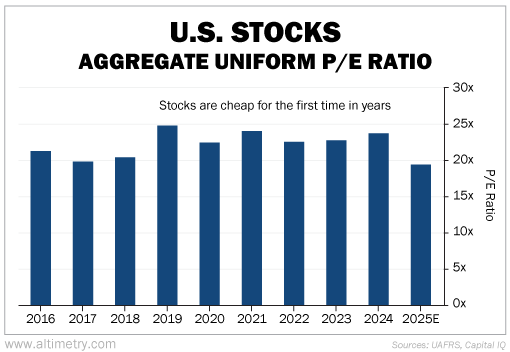

Valuations were already stretched at the end of 2016. By mid-2017 – only halfway through the eventual run – the S&P 500 was trading at 24 times Uniform earnings... a premium by almost any standard.

The market average, given our current tax and inflation environment, should be closer to 20 times.

As that was happening, the Federal Reserve was raising interest rates to cool off a piping-hot economy. Analysts warned that growth was peaking. And fund managers were overweight stocks.

All those factors had Wall Street analysts and financial journalists calling for a pullback. But they were dead wrong.

That July, Goldman Sachs warned there was a 99% chance of the stock market underperforming over the next decade...

That July, Goldman Sachs warned there was a 99% chance of the stock market underperforming over the next decade...

By October, the investment bank announced stocks had rarely been more expensive.

And yet... the market kept rising for another half a year. It didn't stop until the Fed hiked interest rates enough to cool off the economy.

Folks, valuations or sentiment alone cannot stop a bull market. They can't stop a sell-off, either.

They can slow down how quickly the rally or sell-off moves. Valuations can act as a governor of animal spirits. But they won't stop momentum in its tracks.

The market has been moving fast. U.S. stocks have sold off en masse since President Donald Trump's "Liberation Day" tariff announcement.

And for the first time since late 2022... the market isn't expensive. It's trading at just a 19.4 times Uniform price-to-earnings (P/E) ratio, slightly below average.

Take a look...

Investor sentiment has shifted from reliably bullish to slightly bearish...

Investor sentiment has shifted from reliably bullish to slightly bearish...

That may be enough to slow down, or even stop, the sell-off.

But as we know from 2017, valuations and sentiment alone aren't an all-out buy signal.

Once the market starts to believe that earnings or credit are improving, this will prove a great buying opportunity.

Until then, don't expect most stocks to rocket higher. But volatility may be lower in the near term.

Regards,

Rob Spivey

May 6, 2025

From late 2016 to early 2018, the S&P 500 did something it had never done before...

From late 2016 to early 2018, the S&P 500 did something it had never done before...