It's out with the old and in with the new for tobacco giant Altria (MO)...

It's out with the old and in with the new for tobacco giant Altria (MO)...

Altria is the parent company of Philip Morris (PM), which produces the top brand in cigarettes – Marlboro. It's a leader in traditional tobacco products. And it's trying to dominate the next generation, too.

Back in 2018, the company made a $13 billion investment in vape company Juul. It was betting on the future of vaping, which younger consumers were adopting in droves.

Then Juul started fighting with regulators like the U.S. Food and Drug Administration ("FDA") about marketing to teenagers. The FDA banned Juuls in the U.S. last June. (The ban has since been put on hold and remains in limbo.)

The value of Altria's investment had sunk to around $250 million by the end of 2022.

Altria decided enough was enough. It's exchanging its ownership stake for intellectual-property rights. That will help protect it from any further legal troubles.

And the company isn't done with e-cigarettes... Altria announced in March that it's buying vape startup NJOY for $2.8 billion.

It might sound like Altria is making the same mistake twice. But as we'll explain today, one key distinction could make all the difference.

NJOY is already miles ahead of Juul where it counts the most...

NJOY is already miles ahead of Juul where it counts the most...

Along with most other vape companies, Juul is vying for FDA approval to market its products. But NJOY is there already. It was the first vape company to receive FDA approval to market two of its offerings.

In other words, Altria got its hands on the first vapes that don't have future regulatory risk. NJOY's products can be sold and marketed legally.

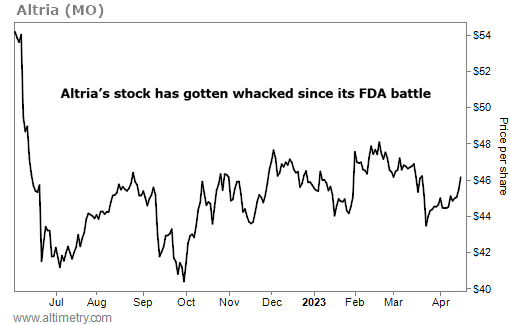

Investors haven't noticed. They're still hyper-focused on the Juul ban. Altria's stock is down 15% from its June peak since rumors of the ban started swirling. Take a look...

Investors panicked about how the Juul ban could hamper Altria's growth going forward. Since the drop, nothing has been able to change their tune.

Investors still anticipate bad news from Altria...

Investors still anticipate bad news from Altria...

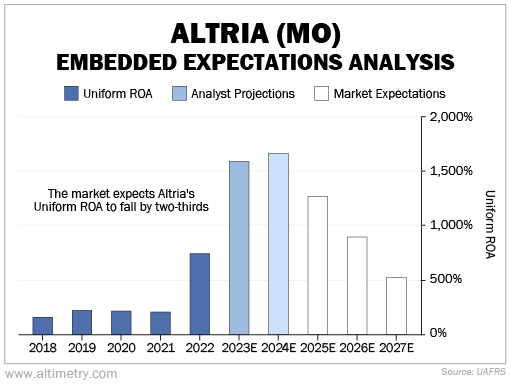

We can get an idea of their expectations for the business through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Wall Street analysts are wising up to Altria's smart new purchase. They expect the company's Uniform return on assets ("ROA") to rise from 745% last year to almost 1,600% this year... and even higher in 2024.

Suffice it to say, that's much higher than the 12% corporate average. For once, the pros have the right idea. They realize that Altria's strong brand and sleepy business model mint money.

But investors haven't caught on yet. They expect Altria's ROA to drop to 500% by 2027. That's a two-thirds drop from the 2023 forecast.

Take a look...

At the same time, the company is trading at a five-year-low valuation. Its Uniform price-to-earnings (P/E) ratio is just 7 times... far lower than the 20 times corporate average.

Altria's NJOY acquisition could help it dominate the vape market...

Altria's NJOY acquisition could help it dominate the vape market...

But the market is distracted by the Juul debacle. It's not paying attention to the value of this latest purchase. If Altria has the right vape business, it could supercharge returns and growth.

This company is well positioned to be a leader in the next generation of smoking products. "Vice" products like cigarettes are proven winners even when times are tough. So Altria should certainly be able to weather macroeconomic headwinds.

Altria also isn't blindly betting on FDA approval this time. NJOY already has authorization for two products, and it could get more in the future. That could help Altria claw back last year's losses.

Regards,

Rob Spivey

April 20, 2023

It's out with the old and in with the new for tobacco giant Altria (MO)...

It's out with the old and in with the new for tobacco giant Altria (MO)...