Payment processor Stripe was a venture capital ('VC') darling during the pandemic...

Payment processor Stripe was a venture capital ('VC') darling during the pandemic...

Stripe specializes in online payments. It makes it easier for businesses to sell online. That meant a huge boost in business when consumers were stuck at home, buying all manner of items online.

However, the company recently shared some bad news... It announced in January that it raised $1 billion in new funding from Thrive Capital.

Now, raising more money isn't bad by itself. The company raised $600 million back in March 2021. It became the most valuable VC-backed company in history.

The problem is Stripe's new implied valuation.

The last time Stripe raised a lot of cash, its valuation was $95 billion. This new fundraising round values Stripe between $55 billion and $60 billion. That's about a 40% drop.

Today, we'll cover what Stripe's "down" round means for the private markets... and what that could mean for the next few months in the public markets, too.

VC companies are leading the market's march lower – and investors don't realize it...

VC companies are leading the market's march lower – and investors don't realize it...

Regular readers might recall that last October, we debunked a common misconception about private equity. A lot of folks assume private investments are doing way better than public investments.

Unlike public assets, private equity (like VC) doesn't have to report price changes every day. Said another way, private assets aren't actually less volatile than public companies. They just hide it better.

That's exactly what happened with Stripe. Since the company didn't raise money between March 2021 and January 2023, its valuation seemed to hold strong at $95 billion. So investors were shocked to hear how low its valuation had sunk.

In reality, this dip in valuations wasn't out of the blue. Stripe was struggling with the same issues as its publicly traded peers this entire time.

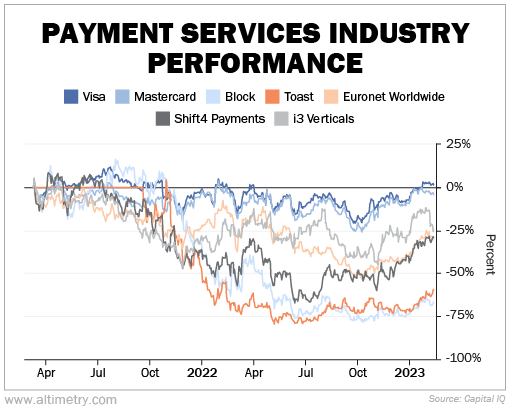

The VC-backed payment processors have been in a downtrend since Stripe's last funding round. Payment-processing giants Visa (V) and Mastercard (MA) are basically flat since March 2021. Some smaller players, including Euronet Worldwide (EEFT), Shift4 Payments (FOUR), and i3 Verticals (IIIV) are down between 30% and 40% each.

Only two payment processors have fared worse than Stripe... and they both happen to be former VC darlings. Block (SQ) and Toast (TOST) are down 70% and 69%, respectively. (Toast wasn't publicly traded until September 2021.)

Take a look...

Block and Toast were both in the VC pipeline before going public. So like Stripe, soaring VC funding rounds pumped their valuations higher and higher before they went public.

This can help us understand what's going on with Stripe and other payment processors. VC valuations are coming back down to Earth.

Stripe isn't all that different from its peers...

Stripe isn't all that different from its peers...

That's why the latest news shouldn't be a huge surprise.

We've been saying for months that VC- and private-equity-sponsored companies aren't immune to rising interest rates and economic headwinds. It's just that they don't have to "mark" their prices daily.

Expect more "down" funding rounds and falling valuations in the coming months. That doesn't mean it's time to panic.

In this case, private valuations are a lagging indicator to the public market. They'll likely reflect the stock market's performance from the past few years. That doesn't necessarily translate to more pain ahead for public assets.

And if you're a private-equity investor, look to the recent performances of similar stocks. They're a sign of what's to come in private assets.

Regards,

Joel Litman

February 22, 2023

Payment processor Stripe was a venture capital ('VC') darling during the pandemic...

Payment processor Stripe was a venture capital ('VC') darling during the pandemic...