Meta is now getting other companies into trouble...

Meta is now getting other companies into trouble...

Meta Platforms (FB), formerly known as Facebook, has been slammed for making its products intentionally addictive and causing privacy concerns.

Addiction and privacy continue to be hot-button issues for Meta's products. Back in 2019, Facebook saw a whopping $5 billion fine for its breach of privacy.

And privacy concerns are extending to some of Meta's other platforms, like its popular messaging platform WhatsApp. Regulators get nervous when they see important deals or messages conducted behind closed doors on WhatsApp.

JPMorgan Chase (JPM) executives were tasked with ensuring their employees' communications were archived and submitted to the Federal Trade Commission ("FTC") to ensure no funny business was going on with the messaging platform. But instead, these executives were caught using WhatsApp themselves.

This led to JPMorgan paying a $200 million penalty to two U.S. banking regulators. Federal law requires financial firms to maintain archives of messages between brokers and clients. Policing unofficial channels has become more difficult amid the coronavirus pandemic with the influx of remote work.

And JPMorgan isn't the only firm to experience this type of infraction – the addictive use of third-party apps is pervasive at other firms too...

Addictive product design helped Meta build a sizable piggy bank...

Addictive product design helped Meta build a sizable piggy bank...

Meta's impressive platforms keep users coming back for more even when it's against their best financial interest.

This strong portfolio is why we liked the stock way back in 2013 and why we generated more than a 1,300% return for our institutional investors when we recommended it between May 2013 and October 2021.

We were quick to recommend Meta (then Facebook) to our Hidden Alpha subscribers in our January 2020 issue. And we told our Hidden Alpha readers in October to sell FB stock for a 69% profit.

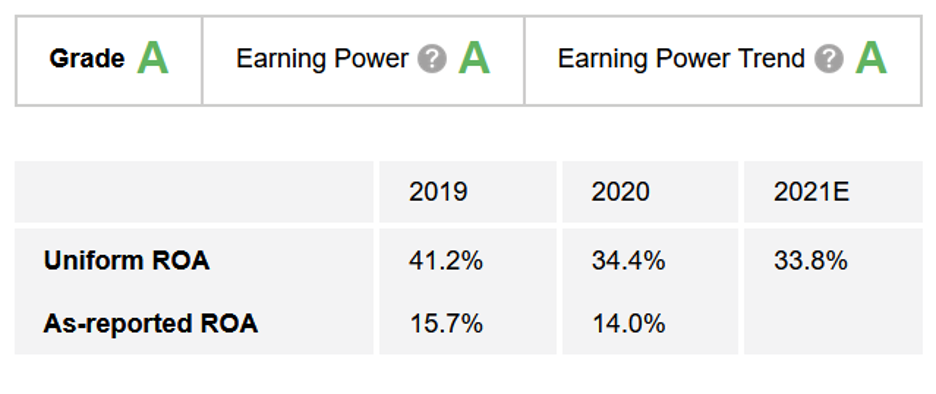

If you're looking at the as-reported numbers, the Big Tech company only appears to have an average return of around 15% for the past few years.

For a firm to dominate the technology space, pay $5 billion fines, and regularly be flirting with $1 trillion valuations, this defies belief. Any investor would assume that Meta's business must be more profitable than merely average.

The Altimeter, which shows users easily digestible grades to rank stocks on their real financials – suggests they would be right.

Despite the as-reported metrics showing passing profitability, Uniform Accounting underscores the reality that Meta is a great business generating enviable returns for investors.

The Altimeter shows how the company generated a strong Uniform return on assets ("ROA") of 34% last fiscal year and is forecast to sustain returns north of 33% this fiscal year.

These results earn Meta an "A" grade for overall performance, driven by robust profitability and a fundamental momentum.

You may be wondering why we are no longer recommending the name, considering its strong grade for performance...

The Altimeter once again has the answer...

The Altimeter once again has the answer...

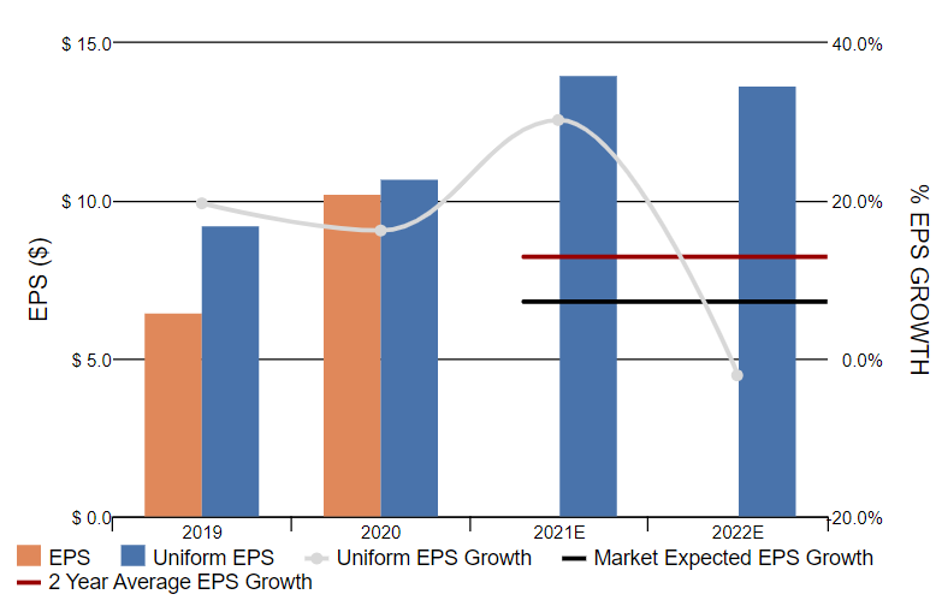

Along with showing return on assets, The Altimeter also breaks down earnings per share ("EPS"), a measure of how much of a company's bottom line every investor is entitled to.

In the chart below, which is also included in The Altimeter, the orange bars represent EPS while the blue bars represent Uniform EPS. Meanwhile, the grey line is EPS growth, the red bar represents the two-year average, and the black bar represents market expected EPS growth.

Looking at the chart, while EPS has continued to trend upward through 2021, we can see that it is forecast to flatten out as growth tapers through 2022.

Using The Altimeter, it becomes clear that Meta has sustained earnings growth for shareholders in the past. But regulatory overhangs and limited growth into the next decade mean the next few years will be tougher for the company.

Are you interested in seeing how your portfolio grades out in The Altimeter?

Are you interested in seeing how your portfolio grades out in The Altimeter?

Meta is just one of nearly 5,000 U.S.-listed companies researched and graded in The Altimeter. Our propriety database sifts through the as-reported data to uncover the true financial picture of a company and its outlook.

With the tool, you can look up a stock that you follow and see how it is graded – assessing whether it's a good fit for your stock portfolio.

Typically, a subscription to this powerful tool costs $1,200 per year. But for a limited-time offer, you can try out The Altimeter on a risk-free trial basis.

Get more details about this short-time offer by clicking here.

Regards,

Rob Spivey

January 6, 2022

Meta is now getting other companies into trouble...

Meta is now getting other companies into trouble...