It's your last chance to register for tonight's big event...

It's your last chance to register for tonight's big event...

Our friend Dr. Steve Sjuggerud over at Stansberry Research is hosting a free, can't-miss event tonight where he'll discuss the future of this historic bull market.

His "Melt Up" thesis has been spot-on as the market has grinded higher... and tonight, he's announcing an important update. Despite our different research approaches, his outlook consistently lines up with our own... so we're always interested in what he has to say when he makes a big call.

And during the event tonight, Steve isn't just going to be talking about his outlook for the market... He'll also give one of his favorite picks for 2020 – absolutely free – just for tuning in. It's a stock he thinks could rise as much as 500%.

It all starts at 8 p.m. Eastern time, and you can register right here. Don't miss it... I know we'll be dialing in.

It's another powerful example of the 'illusion of choice'...

It's another powerful example of the 'illusion of choice'...

This is far from our first time talking about this phenomenon... Whether it's home appliance maker Whirlpool (WHR) or travel site company Booking Holdings (BKNG), we've demonstrated that secretly dominating a market is a surefire strategy.

Building an "illusion of choice" has many advantages, but the two most powerful are creating economies of scale and having lower competition than people think.

"Economies of scale" is a popular business school term, but it basically means larger companies are able to cut down on costs by sharing overhead (back-office costs), buying and producing products in bulk, getting pricing power over customers, and having more resources overall.

A company like Booking Holdings makes its money with digital assets and benefits greatly from its scale. As a reminder, all of its touchpoints increase the amount of data it has access to, its massive footprint gives it pricing power over its suppliers, and it can run all of its travel sites from the same servers and with the same development teams. This massively cuts down on costs.

On the other hand, having multiple sites not competing for market share (they're under the same umbrella) boosts revenue because there isn't price-based competition. At the end of the day, many of the "competing" businesses are owned by the same holding company – meaning less pressure on price than you might originally think.

Similarly, Whirlpool – which owns popular brands like Maytag, KitchenAid, and Admiral – wins no matter which brand the consumers pick. The company has less pressure to lower prices because it offers the majority of the options.

Another company makes use of both of these phenomena... and its returns are staggering as a result.

Omnicom (OMC) is the second-largest advertising firm in the world. It employs more than 75,000 people, but you likely haven't heard of anybody using Omnicom for advertising needs...

This is because the company operates as more than 1,500 individual agencies spanning the globe under five brands: BBDO Worldwide, Diversified Agency Services ("DAS"), DDB Worldwide, Omnicom Media Group ("OMG"), and TBWA Worldwide.

Omnicom continuously buys smaller agencies to add to its portfolio. It's a common practice among the largest advertising firms... The agencies keep their individual skills and continue operating as they would have otherwise, but the parent company gains a huge edge from this strategy.

First, all of the agencies can use the same central organization for back-end support. This significantly cuts down on costs – rather than maintaining 1,500 servers, the combined company just needs one large server.

Additionally, all of the individual companies would be highly competitive on price. Since each agency is owned by the same conglomerate, they have less reason to lower their prices... as the money all goes to the same place.

Lastly, each of those individual agencies would be dwarfed in size by the main content businesses they'd want to place advertisements in. Those individual companies wouldn't have pricing power... But as a massive buyer of ad space, Omnicom does.

However, this strategy of mass acquisition doesn't seem to translate to better returns on an as-reported basis...

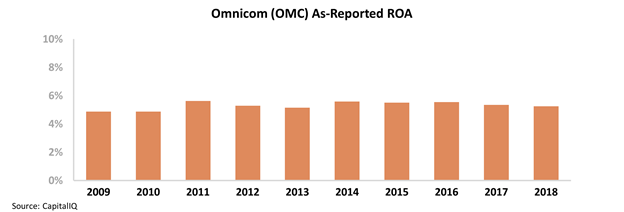

Over the past decade, Omnicom's return on assets ("ROA") has been stable but weak – hovering just below long-term corporate averages of 6%.

This makes it look like the company's acquisition strategy – and the illusion of choice – have no impact on improving returns.

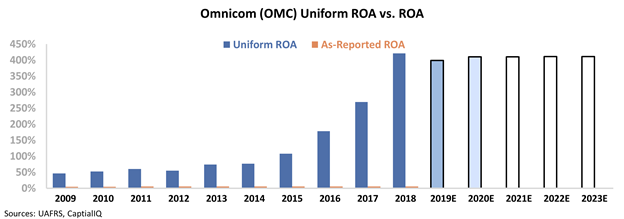

However, traditional as-reported metrics punish companies that make a lot of acquisitions by keeping large amounts of goodwill on the company's books. This makes companies like Omnicom look much more asset-intensive and much less efficient than they really are.

Once we make the proper adjustments to Omnicom's financials – including the impact of goodwill, non-cash stock option expense, and treatment of operating leases – we can see the illusion of choice in action...

The chart below highlights Omnicom's historical corporate performance levels in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do for full year 2019 and 2020 (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, Uniform metrics paint a completely different picture for Omnicom. Not only is the company's profitability much stronger – never falling below 46% in the last decade – but ROA has accelerated massively in recent years. In 2018, Omnicom's Uniform ROA was a whopping 421%. Take a look...

This is the illusion of choice in action. However, investors don't seem to understand this trend. Currently, the market expects Omnicom's ROA to completely flatline despite the massive acceleration we have seen over the past four years.

We've seen differences between as-reported and Uniform metrics time and time again. It's in large part because traditional accounting standards are meant to be useful for accountants, not for investors... and in the case of Omnicom, the accounting distortions are staggering.

Regards,

Joel Litman

February 12, 2020

It's your last chance to register for tonight's big event...

It's your last chance to register for tonight's big event...