Joel's note: The Altimetry offices are closed tomorrow for New Year's Day, so we'll be back in touch with the next Altimetry Daily Authority on Thursday, January 2. I hope everyone has a wonderful New Year!

Boeing (BA) just can't get out of its own way...

Boeing (BA) just can't get out of its own way...

In the December 20 Altimetry Daily Authority, we highlighted the plane maker's ongoing issues with its 737 MAX and the recent production suspension.

Since then, Boeing undertook a problematic spaceship launch, fired its CEO (after having already fired the head of the Commercial aviation division), and has gone on a mini-PR binge.

It has been a busy 11 days.

On the day that CEO Dennis Muilenburg was fired, Boeing's stock rallied. Investors appeared hopeful that a change at the top would put the company back on track. In reality, market expectations for Boeing are still high – even with the stock sitting near 52-week lows.

Boeing still trades at a Uniform price-to-earnings ("P/E") ratio of 22 even after the drop. The market is still pricing the company for returns to reach and maintain all-time highs.

Investors are acting as though the 737 MAX and other operational problems are just passing issues and won't disrupt long-term demand for Boeing products. With expectations still so positive in the midst of real operational risks, Boeing could be a portfolio "torpedo."

These are the kind of large-cap stocks that seem safe... but are hiding serious fundamental issues and can sink an investor's entire portfolio. By using our powerful Altimeter tool, we can identify these big companies before it's too late.

Boeing is one of five major businesses we've recently found that are lurking in many diversified portfolios, just waiting to blow up. Altimeter subscribers can get the full list right here.

To gain access to the Altimeter – and learn more about these potential portfolio torpedoes – click here.

Last month, we discussed a popular home appliance maker and how it benefits from the 'illusion of choice'...

Last month, we discussed a popular home appliance maker and how it benefits from the 'illusion of choice'...

That is the idea that consumers think they have the choice to buy products from several different brands, when in reality, these brands are often owned by the same companies.

We highlighted Whirlpool (WHR) and its nearly 30 major brands. We also mentioned beverage giant Anheuser-Busch InBev (BUD), which has expanded its illusion by fully acquiring Craft Brew Alliance. Craft Brew by itself already owns Kona Brewing, Redhook, and Cisco Brewers, among others.

The illusion of choice is a powerful tool regardless of the industry. It gives the appearance of perfect competition, but in reality, diverse competition does not exist.

Personally, there's one example of the illusion of choice that I notice more than any other. It also happens to be one of the most clear-cut examples of why the phenomenon is so powerful.

For context, I travel frequently. In an average 365-day year, I spend nearly 120 nights in a hotel room. That's about four months in various hotels every year... so lo and behold, I know my way around a travel website.

If you search Google for travel sites, you'll be bombarded with links to sites like Booking.com, Priceline, Expedia, and KAYAK. If you're searching for a more specific service, you might be directed to Cheapflights, Rentalcars.com, or Agoda.

Well, six of the seven sites I just listed are all owned by just one company.

Booking Holdings (BKNG) owns all of the above businesses except Expedia (EXPE), which in its own right controls some big players in the travel site game.

While it may not be obvious on the surface, if you take a closer look you'll find the following at the bottom of each of its websites: "This company is part of Booking Holdings, the world leader in online travel and related services."

Below that is an image of Booking Holdings' main websites: Priceline, Booking.com, KAYAK, Agoda, Rentalcars.com, and even OpenTable.

While the company was originally called Priceline.com, it pivoted to the Booking brand as it turned its focus internationally and began acquiring smaller sites.

You see, in the online travel game, the two most important factors are users and data. The more interfaces you have, the more users you can attract... and the more datapoints you can collect to refine your services across all websites.

That's why Booking Holdings has made upwards of 25 acquisitions in its 22-year history.

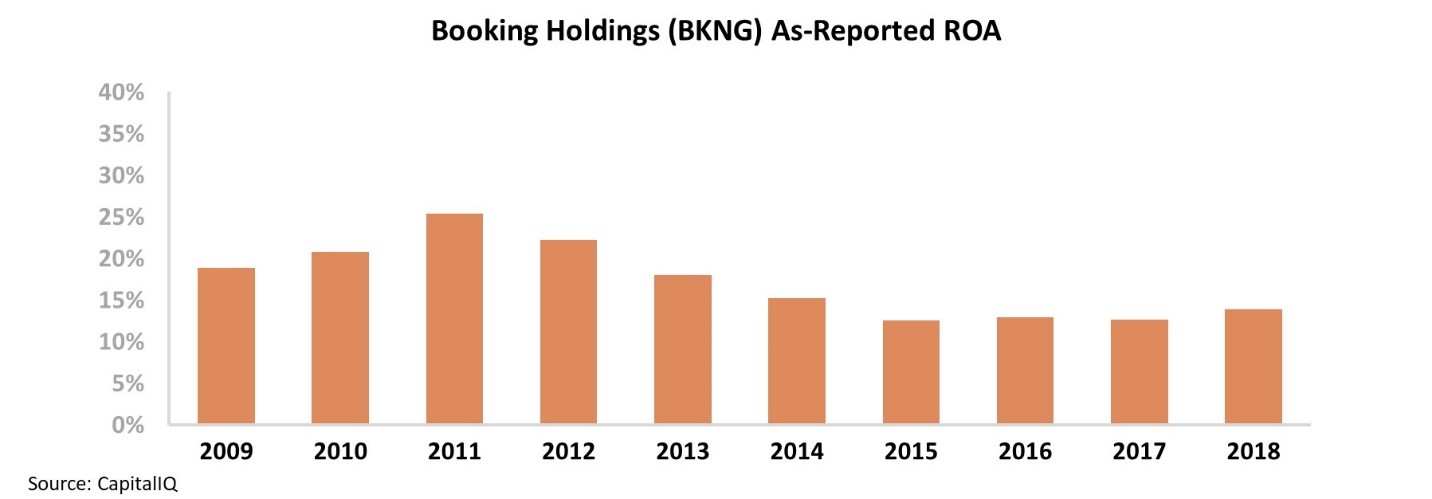

Looking at the company's returns, it appears its acquisitions have been worthwhile. On an as-reported basis, Booking Holdings' return on assets ("ROA") has been consistently strong – ranging between 13% and 25% over the last decade.

Any investor would be happy to see those numbers – with long-term corporate average ROA in the 6% range, Booking Holdings looks like a solid company. However, this fails to capture exactly how successful the company's illusion of choice has been...

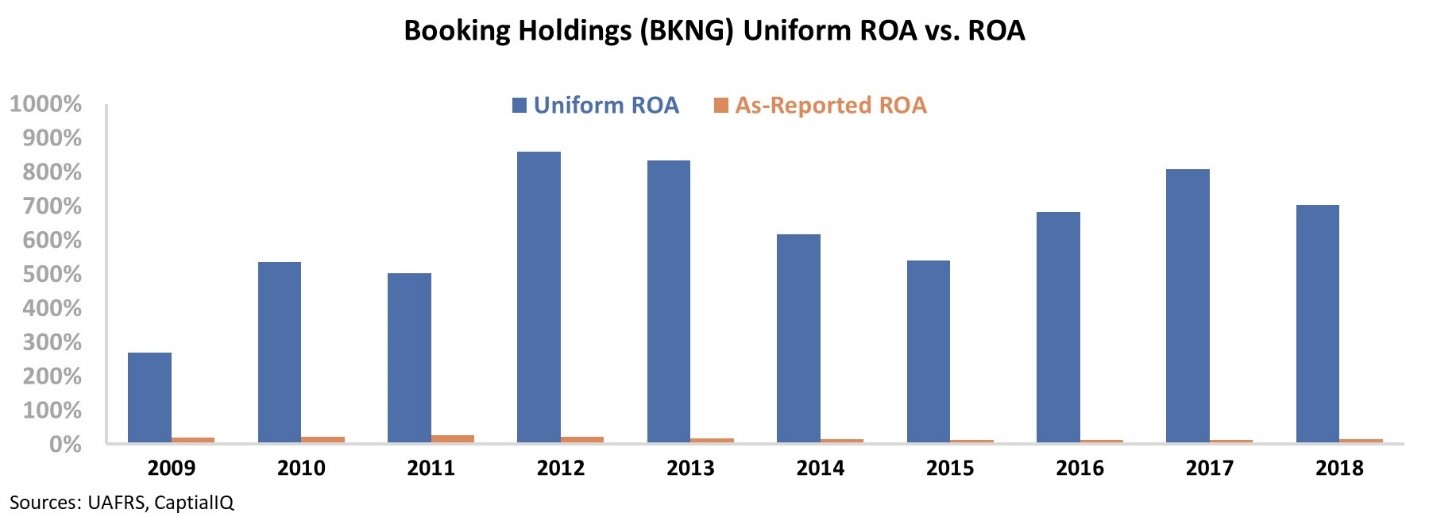

Once we apply our Uniform Accounting metrics, we can see the real value behind Booking Holdings' rampant acquisition strategy. Once we adjust for the misleading impact of several standard accounting procedures – such as the treatment of goodwill, excess cash, and the impact of non-cash stock option expenses – we can see the company's true profitability. As you can see in the chart below, the discrepancy is staggering...

Yes – those are the same orange bars from the first chart. Last year, Booking Holdings' Uniform ROA was a massive 704%... that's a factor of 50 times higher than traditional metrics would suggest. Not only that, but we can now see that the company's recent acquisitions have actually added value. Since 2015, Booking Holdings' ROA improved from a low of 540% as it has integrated OpenTable, Momondo, Cheapflights, and Mundi.

As the company continues attracting more users to its websites and continues gaining more data to improve its results and features, there's no reason its ROA couldn't stay as high as it is today.

While Booking Holdings might have looked good on an as-reported basis, that didn't even begin to tell the whole story. How can you trust numbers that are 50 times off from reality?

Regards,

Joel Litman

December 31, 2019

Boeing (BA) just can't get out of its own way...

Boeing (BA) just can't get out of its own way...