Aircraft leasing companies are benefiting from this troubled plane maker...

Aircraft leasing companies are benefiting from this troubled plane maker...

In September, we wrote about how Boeing's (BA) 737 MAX issues have been a boon to the aircraft leasing business.

On Monday, Boeing announced that it wasn't just further delaying how long it will be until the 737 MAX can re-enter service... but it's also suspending production of the plane starting in January. It looks like Boeing has longer to go before it will be able to put its problems in the rear-view mirror.

The impacts of these issues on Boeing's stock in the months ahead aren't news to subscribers of our Altimeter tool. We've highlighted these problems a few times in our Altimeter Weekly... including in an issue just published last week on the dangers of some popular stocks that have the potential to blow up an investor's portfolio.

Right now, we've identified another four companies that can sink an entire portfolio – Altimeter subscribers can get the full list right here.

If you're interested in signing up for access to our Altimeter tool and finding out more about these potential portfolio "torpedoes," click here to learn more.

A strong brand is the loftiest goal of any rising company...

A strong brand is the loftiest goal of any rising company...

Coca-Cola (KO) is a marketing machine as much as a beverage company.

Coffee shop chain Starbucks (SBUX) has more than 15 million members in its rewards program.

Through memorable marketing campaigns, Apple (AAPL) has created a tech empire worth more than $1 trillion.

However, Apple's ubiquity worked against it over a now common term, the "app" – short for application software. The "App Store" was what Apple called its platform for downloading programs on its new iPhone, and applied for a trademark on the term in 2008.

However, Apple was so ahead of the curve that app and App Store entered the public lexicon. Instead of being trademarked products, a user can now just download an app on any phone from Google's or Amazon's online store.

Over the past century, many companies lost the trademark to their branding because their products became so successful. Linoleum was a brand of floor covering invented in the mid-19th century but was ruled as a generic term in 1878 because its use had become so widespread.

The same thing has happened with videotape, escalator, and cellophane – all originated as valuable brands names. But as these products entered the public lexicon, companies saw the brand value they worked hard for erased overnight.

A term some experts think might lose its trademark is Jet Ski, which is currently owned by Japanese vehicle maker Kawasaki.

For competing companies like Polaris (PII), they had to advertise their personal watercraft without using the term "jet ski." However, this isn't the only way that Polaris has been impacted negatively by branding...

Since its humble beginnings in the late 1950s making snowmobiles, today Polaris manufactures other types of recreational vehicles as well – including motorcycles, boats, and ATVs.

Due to a long history of competition with other snowmobiles such as Ski-Doo, the name "Polaris" never quite became synonymous with "snowmobile." However, this is also because Polaris has focused on expanding into aqua sports and ATVs.

This reputation as a recreational-vehicle manufacturer has investors pegging the company as at risk of being impacted by a potential recession.

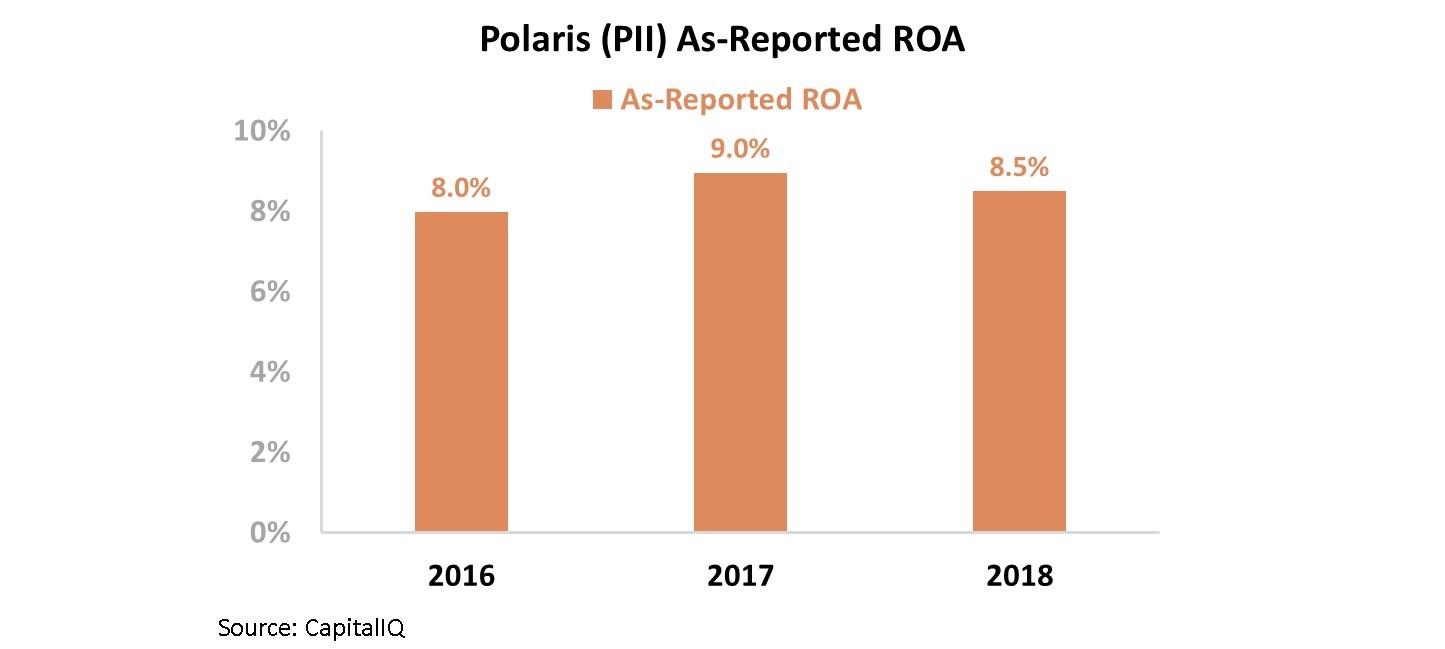

In a bull market, investors would like to see a cyclical company such as Polaris improve its returns. However, over the past three years, Polaris has reported a stagnant as-reported return on assets ("ROA") of 8% to 9%.

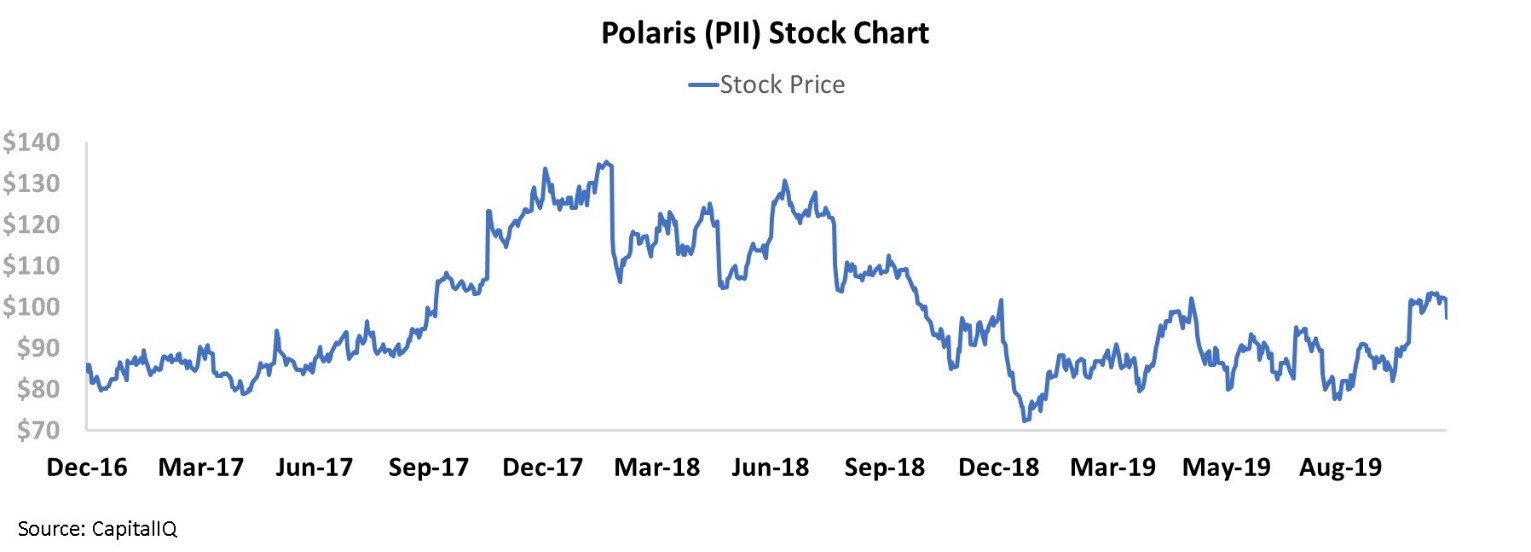

With a reputation as a cyclical business and with failure to improve its profitability during a period of market expansion, it's no wonder Polaris has been trading sideways since 2016. Take a look...

However, the fog of as-reported returns has fooled the market into believing this one-dimensional story for Polaris. While the company makes a majority of its revenue from recreational vehicles, it has begun to expand out of this market...

In 2016, Polaris entered a $2.5 million contract with the U.S. Marine Corps to produce a light vehicle to supply ground units across difficult terrain. And the company also sells a wide range of commercial vehicles for use in warehouse or industrial settings.

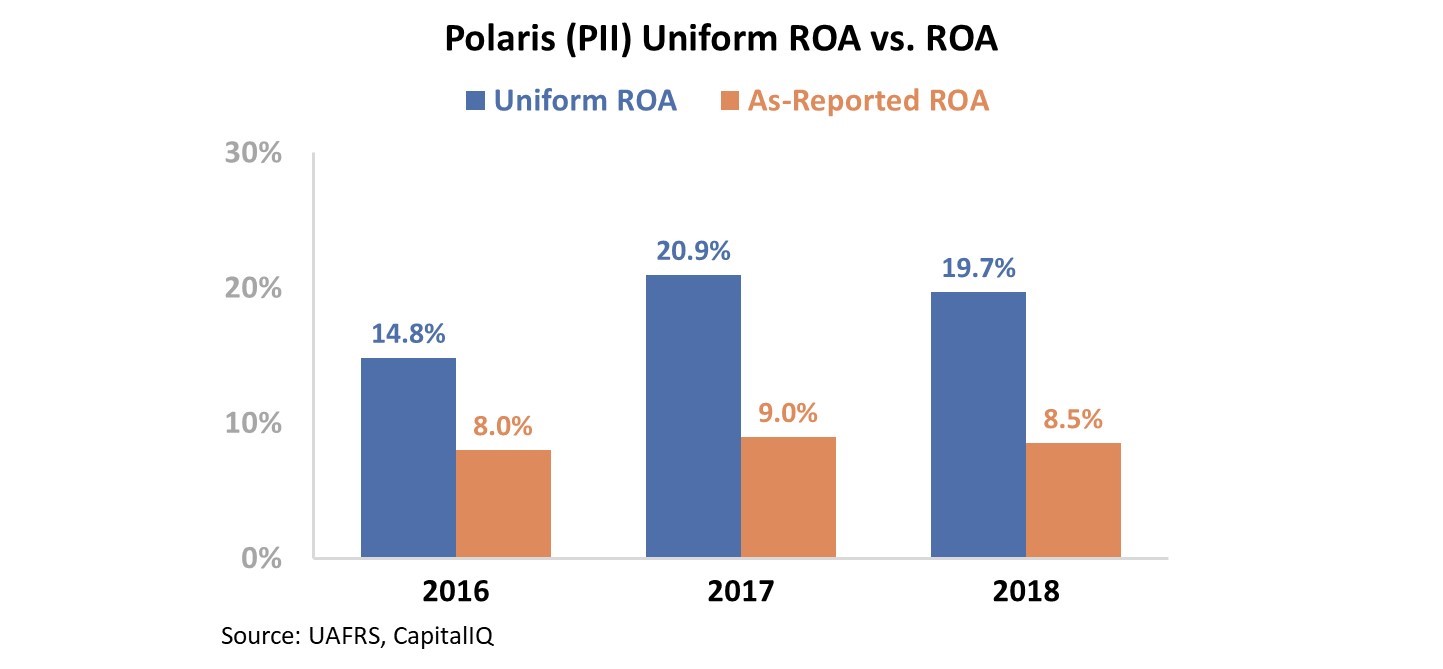

After making several adjustments to Polaris' financial statements – accounting for mistreatment of items like goodwill, research and development, and stock option expense – we can see the company's true profitability and profitability trend.

As you can see in the chart below, Polaris has seen its profitability step up significantly over the past three years. Rather than wasting shareholder capital on dead-end investments, Polaris has leveraged its diversification efforts into improving profitability. The company's ROA was more than double the as-reported figures in 2018 and 2017...

Once the market understands there's more to Polaris' brand than just recreational vehicles, investors may wise up to the trend going on under their noses that Uniform Accounting analysis already reflects.

Regards,

Rob Spivey

December 20, 2019

Aircraft leasing companies are benefiting from this troubled plane maker...

Aircraft leasing companies are benefiting from this troubled plane maker...