'Can you send shorts, too?'

'Can you send shorts, too?'

One of our readers, Leigh, wrote in and asked us if we could provide one good short idea for every two long ideas we provide in our Altimetry's High Alpha and Altimetry's Hidden Alpha newsletters.

He wasn't complaining... Leigh was kind enough to say that thanks to our powerful Uniform Accounting data, we've got the data to be able to do this.

You'll notice that we generally write about something macro-related each Monday here on Altimetry Daily Authority. We use it as an opportunity to highlight the overall trends we're seeing for the market and the economy.

Understanding the bigger picture is incredibly important for determining how to think about overall portfolio positioning. Right now, our macro work gives us a lot of reasons to stay bullish.

We've written about the real implications of an inverted yield curve, about how credit markets are flashing an "all clear" sign for the markets, about how Uniform Accounting signals the market is not expensive right now, and how debt maturities signal some runway for the market before any concerns in prior Daily Authority essays.

In a bull market, recommending shorts is often just recommending stocks that will lag the market. In a bear market, trying to be long anything is an effort in futility. Everything goes down... some stocks just go down less or more than others.

From time to time, when the macro themes also line up, we might talk about short ideas in our High Alpha, Hidden Alpha, and other future newsletters we produce.

But for now, with the macro signals we monitor and write about as positive as they are, we'll be focused on the companies that can make our readers money by outperforming the market. We think that is the best way for us to help our subscribers profit.

That being said, thanks for the vote of confidence, Leigh!

What are your thoughts? Do you think we should be recommending more shorts, or do agree with our focus on long ideas in High Alpha and Hidden Alpha? Let us know at [email protected].

Buyers prefer to have options...

Buyers prefer to have options...

Not all customers are created equal. Some consumers love Corona, others enjoy Budweiser. Some choose Oreos, and others pick Chips Ahoy. Those with more expensive tastes may debate between a Lamborghini and a Bugatti.

However, consumers often do not have as much choice as they believe when deciding on brand loyalty. The products we mentioned above in each category appear to compete with one another, but are actually owned by the same parent companies.

If you were to buy a chocolate bar, you could choose from over hundreds of brands... but you would really only be choosing between Mars, Nestlé, Hershey (HSY), or Mondelez (MDLZ). Budweiser, Stella Artois, Corona, and Modelo are all owned by Anheuser-Busch InBev (BUD) in different parts of the globe. Despite the plethora of car brands, the entire industry is owned by only 14 established companies, with Volkswagen owning both Lamborghini and Bugatti.

Another industry where choice is not as great as it first appears is home appliances. In the 20th century, household appliances were manufactured by a large number of independent manufacturing firms. But today, the industry is undergoing rapid consolidation. One of the most recent major movements was General Electric (GE) selling its appliance business to the Chinese home-appliance giant Haier in 2016.

A U.S. consumer might go to a chain store like Sears, Home Depot, or Lowe's and see options like Maytag, KitchenAid, Admiral, and Whirlpool. He may think he still has real options in who he's buying his products from, even if he doesn't choose from a big foreign manufacturer.

In reality, Whirlpool (WHR) is the last major manufacturer to produce home products in the United States. With nearly 30 major brands such as Maytag, KitchenAid, and Admiral, the company makes fridges, blenders, and a multitude of other household appliances.

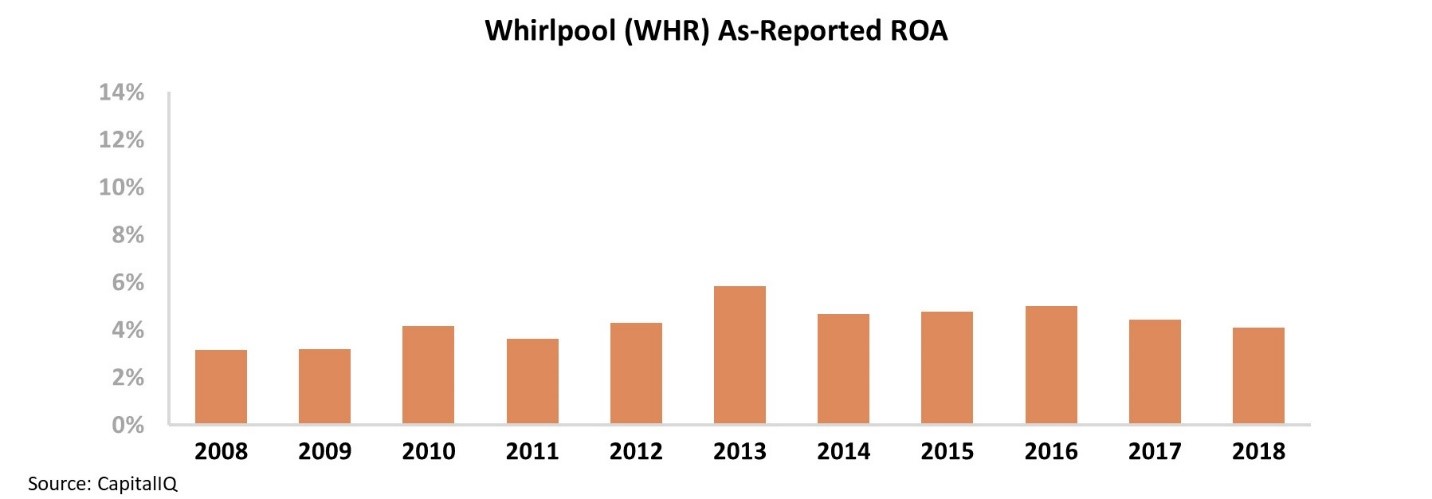

For investors, Whirlpool appears to be a poor company. Looking at its as-reported numbers, Whirlpool has maintained only 3% to 5% returns since the financial crisis. It would appear that Whirlpool is one of the many U.S. companies that have been hollowed out by Chinese competition and is feeling the pressure from foreign businesses, such as Haier. Take a look at Whirlpool's stagnant as-reported return on assets ("ROA") over the past decade...

With returns languishing near Whirlpool's cost of capital, it's no wonder that the stock price has failed to improve. While the market has been up significantly since before the 2016 election, Whirlpool's stock is basically flat. Shares traded for $162 in November 2016 and are now roughly $140.

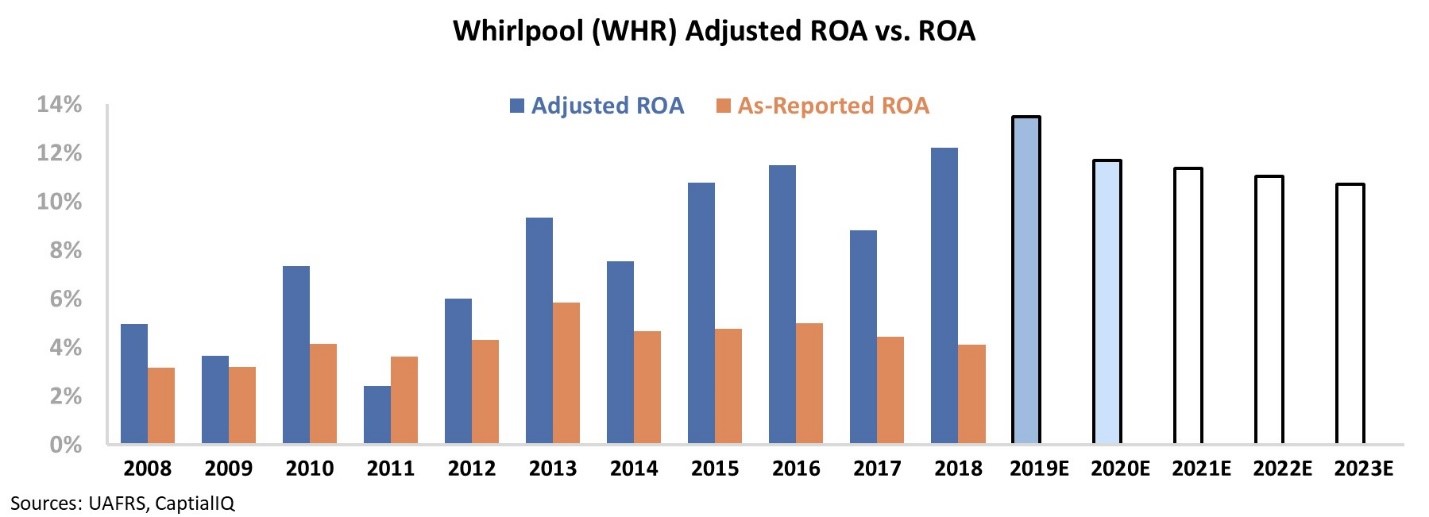

However, as you know, we specialize in Uniform Accounting, which removes the noise inherent in GAAP and IFRS reporting. While as-reported metrics have held near the cost of capital, by removing as-reported accounting distortions around goodwill, operating leases, and other items, we are able to see a much different picture.

The chart below explains Whirlpool's Uniform historical corporate performance levels in terms of ROA (dark blue bars), versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars). Take a look...

Once we have pulled the veil of GAAP from Whirlpool, we can see the company has returns that have improved significantly. Its Uniform ROA has, in fact, jumped from 5% in 2008 to 12% last year.

As the white bars show, the market expects the company to maintain much of its significant improvement in returns.

As you can see, as-reported metrics have missed the efficiencies that Whirlpool has built over the past 10 years through its acquisition strategy. By expanding and refining its portfolio of home appliances, Whirlpool has realized significant operational improvements.

On the other hand, the market realizes this... It caught on long before the as-reported metrics did. As Whirlpool has kept on doing what the market expected – maintaining strong returns thanks to its competitive moat – the stock has stayed sideways.

But if Whirlpool can keep on improving returns as it has for the past 10 years, there could be more upside left in the company.

Best,

Rob Spivey

November 20, 2019

'Can you send shorts, too?'

'Can you send shorts, too?'