Russia's invasion of Ukraine hasn't gone according to plan...

Russia's invasion of Ukraine hasn't gone according to plan...

Russia's full-scale invasion of Ukraine came after years of rising tensions between the two countries.

The world was surprised by the speed with which the invasion began. Even more surprising is how Russia appears to be stunned by the firm resistance Ukraine forces have shown.

No matter what eventually plays out on the ground in Ukraine, one thing remains clear, Russia misplayed its hand with the invasion.

With historic divisions throughout Europe, Russia had initially hoped it would strike a decisive blow, with little international pushback.

Russia thought concerns about energy prices in Germany along with friendly autocrats in countries like Hungary would inhibit alliances. And it also hoped that the members of the North Atlantic Treaty Organization ("NATO") and the rest of the world would be unable (or unwilling) to mount a firm resistance as tanks rolled into Ukraine.

A unified stance against Russia...

A unified stance against Russia...

But Russia's hopes were dashed quickly when its offensive movement came to a halt without achieving any major objectives in the first two and a half weeks.

A weak international condemnation quickly became a united stand against Russian aggression.

Fears of further Russian aggression in Ukraine and beyond have caused even neutral countries, such as Sweden and Finland, to drift toward NATO.

After decades of shirking its NATO commitment, even Germany has committed to ramping defense spending to above its 2% NATO target.

Now, NATO is looking to fund Ukraine's war effort against the Russians.

Poland has proposed providing Soviet-era MiG-29 jets to Ukraine. This would be the quickest way to give Ukraine an edge in the skies.

If this deal goes through, the countries that provide older jets could then see their hangars refilled with more modern Western jets like the F-16 from the U.S.

Even as Russia believed it had the upper hand in technology, imports of cutting-edge, antitank Javelin missiles to Ukraine have left its tanks vulnerable to small, two-person rocket teams.

It has been a startling transformation that Russia wasn't expecting.

And Russia has nobody to thank for it more than itself.

NATO spending record amounts of money will be a tailwind for defense stocks...

NATO spending record amounts of money will be a tailwind for defense stocks...

The defense industry stands to benefit from this change, as Western democracies are taking their defense seriously after years of neglect.

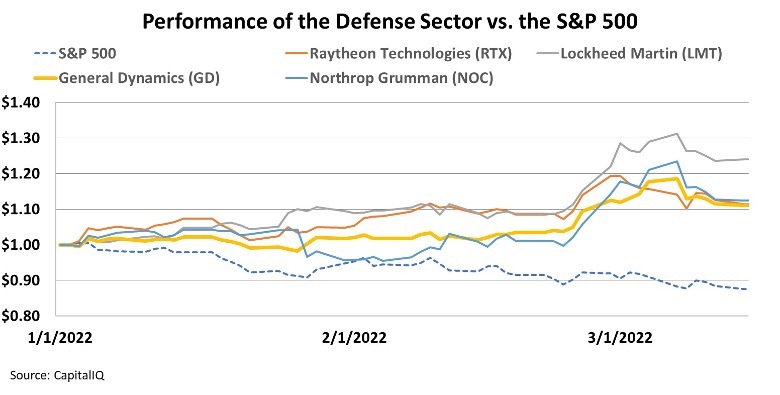

Already since the outbreak of fighting began a couple of weeks ago, many of the companies in the sector have seen their stocks see impressive rallies.

As you can see, General Dynamics (GD) provides a great example of the tailwinds this NATO spending wave creates.

GD should see a surge in demand, as it makes the popular F-16 fighter, a mainstay of the U.S. Air Force.

The F-16 could be the plan that replaces the jet fleets for Eastern European countries.

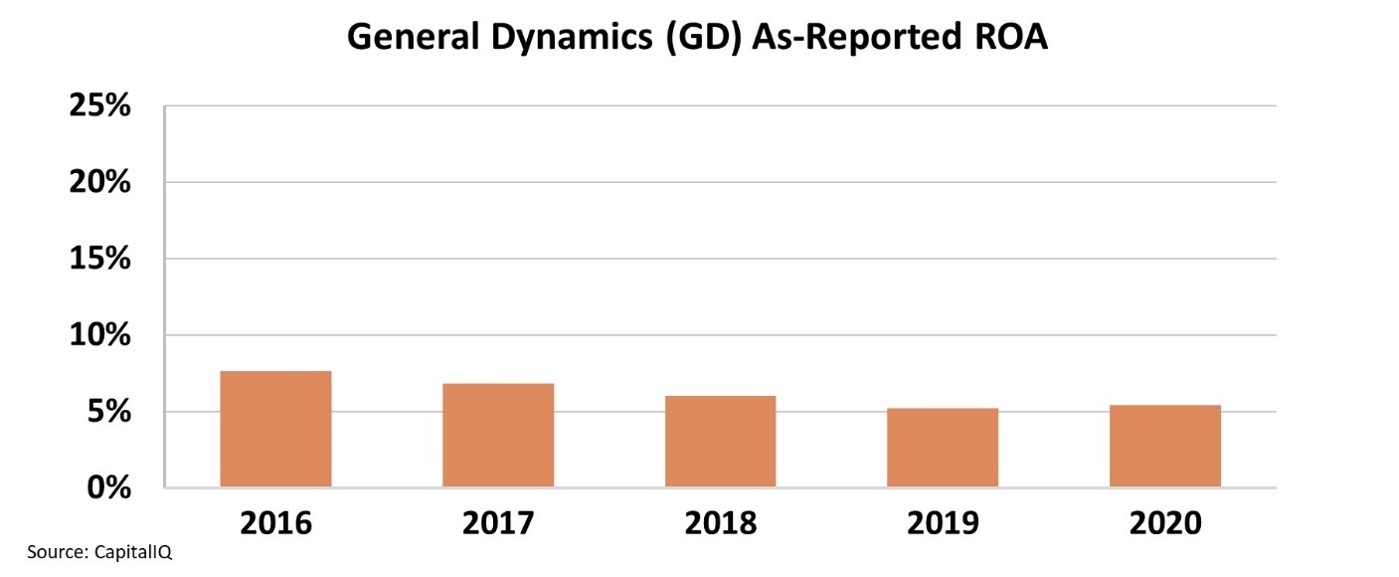

With such a pivotal role in keeping countries safe, you would assume it's a highly profitable company.

But when we look at as-reported metrics for the past five years, the company's returns have been declining and are consistently in the single-digits.

After all, growth for a company only returning the cost-of-capital doesn't create value for investors.

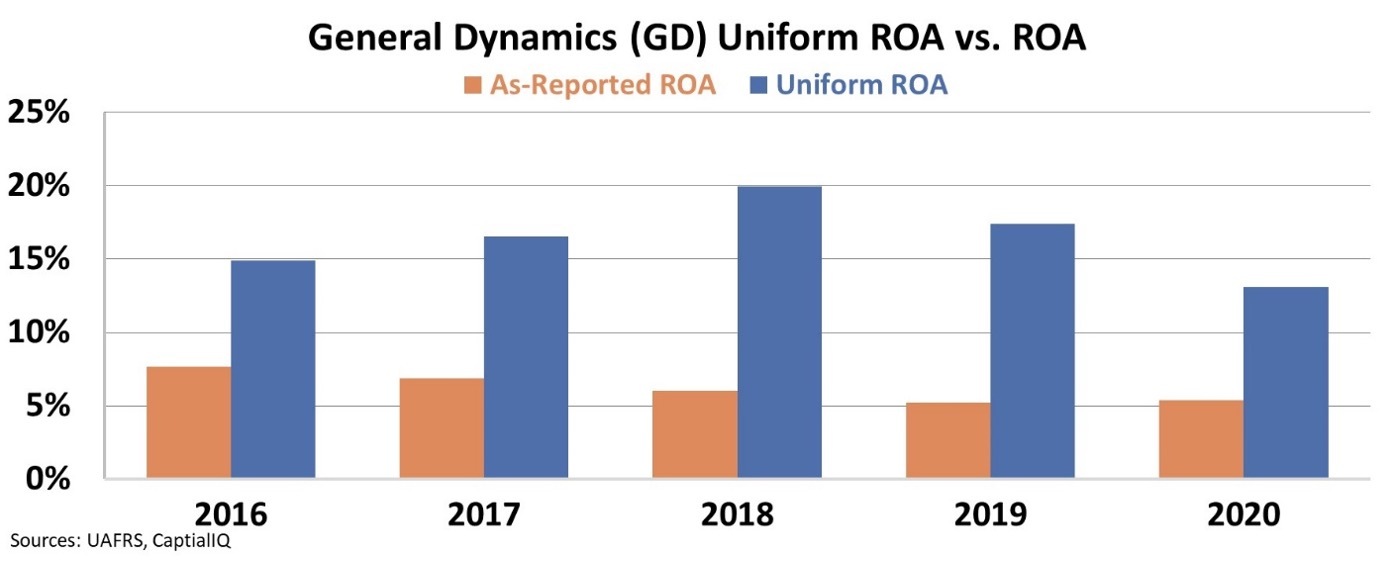

Here at Altimetry, however, we use our Uniform Accounting framework to account for GAAP-based distortions in financials.

With this Uniform Accounting data, we see a company with a strong return on assets ("ROA"), above the capital cost. Its ROA has consistently remained in the mid-teens, and before the pandemic was at 17%.

While we see a company whose as-reported numbers may appear to dissuade investors, the Uniform data shows a company that has delivered consistently strong returns.

If these new demand tailwinds mean strong growth in key areas like its aircraft division, General Dynamics could be seeing a catalyst for strong ROA upside and continued equity tailwinds.

Regards,

Joel Litman

March 15, 2022

P.S. A few weeks ago, I was summoned to speak at the Pentagon. The top military brasses wanted my forensic accounting insights on the stock market. And of course, I talked to them about the recent market declines. But what I didn't tell them was that I've found a little-known group of companies on the verge of a massive investing breakthrough.

In my recent presentation, I reveal my No. 1 stock to buy to take advantage of this coming megatrend – ticker symbol included – no e-mail address or credit card required. You can watch my full presentation right here.

Russia's invasion of Ukraine hasn't gone according to plan...

Russia's invasion of Ukraine hasn't gone according to plan...