Cutting inflation from 9% to 4% was the easy part...

Cutting inflation from 9% to 4% was the easy part...

If you just looked at inflation as a straight line, things look pretty good.

Here in the U.S., inflation has been below 4% for three straight months. Considering the Fed's target is 2%, that sounds pretty good.

However, the Fed thinks the easy part is behind us.

Earlier this week, Fed Chairman Jerome Powell announced the federal-funds rate would stay put between 5.25% and 5.5%, which is a 22-year high.

The Fed wants to reach target inflation of 2% by 2026, and it's not going to lower rates until it sees "convincing evidence" that things are improving.

Powell even hinted that one more rate hike could be on the docket this year.

As we'll talk about today, this news is going to hurt the stock market... The only question is when.

Stocks measure the value of a company's future cash flows.

Stocks measure the value of a company's future cash flows.

Sometimes you'll hear Wall Street analysts talk about "discounted cash-flow models." All they're doing is predicting how much money a company will make in the future and "discounting" those cash flows based on how risky or expensive it will be to generate capital.

Remember, when interest rates rise, companies' costs go up with them. That in turn makes future cash flows less valuable.

The other way to think about valuation is how much you're willing to pay for a company's earnings. This is all a price-to-earnings (P/E) multiple represents.

Again, if a company's future earnings are more valuable, then investors should be willing to pay more for them. That's why low-inflation, low-tax environments produce the strongest stock markets.

Before 2022, we had the best possible combination of factors to drive the stock market higher.

Inflation and interest rates were low. That meant companies had lower costs, and their future cash flows were expected to have more value.

Plus, investors' tax rates are low. Long-term capital gains taxes are still capped at 20%, which is far lower than they were decades ago.

So companies were earning more cash flows (thanks to lower costs), and investors kept more of their investment money as gains.

Today's higher inflation and interest rates are going to hurt valuations.

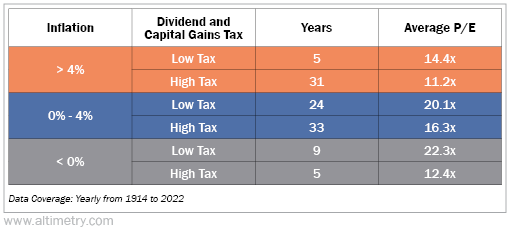

We've kept track of more than 100 years of the relationship between inflation, taxes, and P/E multiples.

As you can see below, valuations are highest when inflation is low, or even negative, and taxes are low too. Take a look at the blue segment. Before inflation took off last year, we were in the low tax bracket that yielded an average P/E multiple of 20.1.

Investors have gotten used to that environment. It's basically what we've had since the Great Recession ended.

However, the Fed is clear. Inflation isn't going back to 2% overnight. Last month, it rose from 3.2% to 3.7%.

That means the market shouldn't be valued at 20 times... Rather, it ought to fall closer to 14 times.

And yet, with this year's market rally, the stock market is valued at about 25 times earnings. That's higher than it should be in any market environment.

This is a damning signal for stock investors. As the market finally realizes that inflation and interest rates are going to stick around for a while, valuations are bound to drop.

Investors need to be tactical... and get out of a 'stocks only' mindset.

Investors need to be tactical... and get out of a 'stocks only' mindset.

Not every stock is doomed. In the long term, the stock market is still the best place for investors to put their money.

However, over the next several months, we expect investors to wake up to the looming risk. That's going to lead to huge sell-offs in the stock market.

That's why we believe that investors should be cautious about new stock investments over the next few months... If you're going to put new money to work in the market, look for the highest-quality stocks with rock-solid fundamentals. Avoid highfliers with bloated valuations. And consider alternative investments that are likely to be more stable than stocks over the coming months.

Regards,

Joel Litman

September 22, 2023

P.S. The outlook for stocks looks more concerning than it has in years... and investors can't afford not to widen their investment scope. That's why I'm officially "sounding the alarm" on every warning sign I'm seeing – and what you need to do to avoid financial disaster.

On Wednesday, September 27, at 8 p.m. Eastern time, I'll lay out exactly what I'm seeing in the market... why it has me so worried... and the steps every investor must take as soon as possible. Plus, I'll be joined by a special guest with more than a decade of experience in the No. 1 strategy that could save your money today.

This event is absolutely free to attend. All we ask is that you reserve your spot in advance right here.

Cutting inflation from 9% to 4% was the easy part...

Cutting inflation from 9% to 4% was the easy part...