America is preparing for a new kind of rearmament...

America is preparing for a new kind of rearmament...

This industrial push isn't focused on tanks or jets – it's centered on ships. The U.S. is trying to close a decadeslong gap in maritime capacity.

The trigger was an executive order from the Trump administration. It aims to restore domestic shipbuilding on a scale not seen since World War II.

China now commands a fleet of more than 5,500 ocean-going commercial vessels. The U.S. has just 185. That imbalance is becoming a bigger threat by the day.

In times of war or supply-chain disruption, America relies on commercial vessels to move fuel, food, and military gear. Without them, both our economy and our defense posture are vulnerable.

The administration's plan includes subsidies and training grants. The president wants to levy new port tariffs on Chinese ships. And he's pushing for direct investment in maritime infrastructure.

Today, we'll explore how this shift could fuel a long-term tailwind for U.S.-based shipbuilders – and the defense giant that could win big as it plays out.

A national security mission meets commercial opportunity...

A national security mission meets commercial opportunity...

The new executive order marks a sharp departure from Reagan-era policy, which prioritized military readiness far more than commercial maritime spending.

Unlike Reagan, Trump's White House is now taking a unified approach. He wants to treat shipbuilding as critical infrastructure, much like semiconductors during the pandemic.

The plan calls for expanding America's commercial fleet while modernizing its military logistics capabilities.

That shift opens the door for private-sector investment alongside public support. Tax credits, training incentives, and trade protections are just the start.

And the rare companies that can serve both sides of this strategy will come out on top... like General Dynamics (GD).

Through its National Steel and Shipbuilding ("NASSCO") division, General Dynamics builds commercial ships including tankers and container carriers.

It's one of the few U.S. players with modern shipyard capacity, a trained workforce... and experience in building massive ships.

General Dynamics' expertise already gives it an industry advantage. That leg up could become even more critical as the government pushes to rebuild U.S. maritime capabilities.

Better yet, NASSCO already operates facilities in San Diego and Norfolk – two of the most strategically important naval ports in the country.

The market is totally missing out on General Dynamics' top-tier position...

The market is totally missing out on General Dynamics' top-tier position...

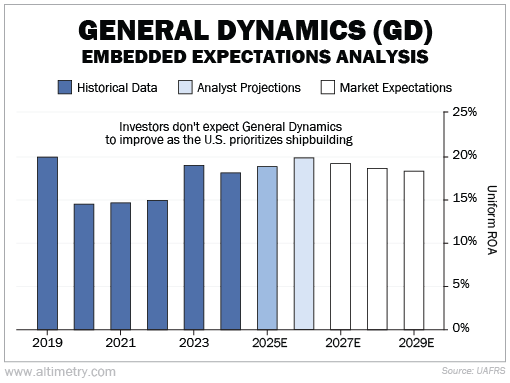

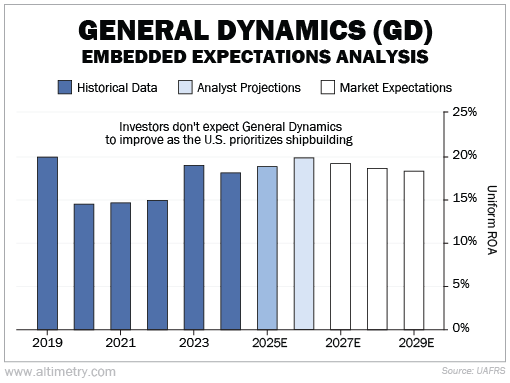

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet... We use General Dynamics' current share price to calculate what investors expect from future performance and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

Longtime Altimetry subscribers know we also pay attention to near-term Wall Street analyst estimates. These folks tend to have a good grasp of where a company is headed over the next two years or so.

Uniform return on assets ("ROA") has ranged between 14% and 20% for the past six years. It has hovered closer to the high end of the range since 2023.

Analysts expect returns to improve slightly, reaching 20% by next year. But the market thinks profitability will stay flat through 2029.

Take a look...

Investors have no clue what the shipbuilding boom could mean for NASSCO. And that's creating an opportunity...

Shipbuilding has been treated as a stagnant sector for decades...

Shipbuilding has been treated as a stagnant sector for decades...

And there's some merit to that view. It's not usually a big industry in the U.S... as evidenced by the way China's commercial ships far outpace our own fleet.

But Trump's new policy marks a lasting structural change for shipbuilding. If the U.S. follows through, maritime manufacturing could become the next leg of industrial policy.

General Dynamics won't turn into a "pure play" shipbuilder. But NASSCO gives it a powerful head start.

Investors looking for exposure to defense, infrastructure, and long-cycle manufacturing should take note of shipbuilders like this one.

Regards,

Joel Litman

May 13, 2025

America is preparing for a new kind of rearmament...

America is preparing for a new kind of rearmament...