The future looks bright for nonchemotherapy cancer treatments...

The future looks bright for nonchemotherapy cancer treatments...

Cancer was the second leading cause of death in the U.S. in 2019, responsible for more than half a million deaths.

Typically, chemotherapy is the default treatment for patients with common forms of the disease like lung or breast cancer.

While it can be effective in slowing the growth of cancers or even pushing them into remission, chemotherapy can be incredibly damaging to the body.

Hair loss, constant fatigue, nausea, and even permanent damage to critical organs like the heart are all common side effects of what used to be the only option.

But now, things are beginning to change.

Advances in genetic testing now allow doctors to understand how a patient's body might respond to chemotherapy before treatment.

This foresight allows doctors to optimize treatment plans. If it's clear the tumor won't respond to chemotherapy, revolutionary immunotherapy drugs can be prescribed.

These treatments come in daily pills to help the immune system attack invasive cancer cells.

While some drugs are still in their early stages, the results look promising in helping cancer patients live longer lives without undergoing damaging chemotherapy treatments.

Immunotherapy is a moneymaker for big pharma companies...

Immunotherapy is a moneymaker for big pharma companies...

The most compelling benefit of immunotherapy innovation is that the drugs being developed can attack only cancer cells rather than every cell in the body.

These biologics, known as monoclonal antibodies, are changing the face of cancer treatment.

One of the biggest players in this emerging space is Celgene. Its Revlimid drug helps the immune system slow tumor growth in multiple myeloma – commonly known as cancer of the bone marrow.

Revlimid treatments allow doctors to target the exact tumor cells causing the problem and help the immune system fight the cancer better.

Revlimid's success in the market was a big reason why pharma giant Bristol Myers Squibb (BMY) acquired Celgene in 2019 for $74 billion.

Since the deal closed, Bristol Myers Squibb has also seen its own cancer medication – under the brand name OPDIVO (nivolumab) – perform well, helping treat several types of cancer.

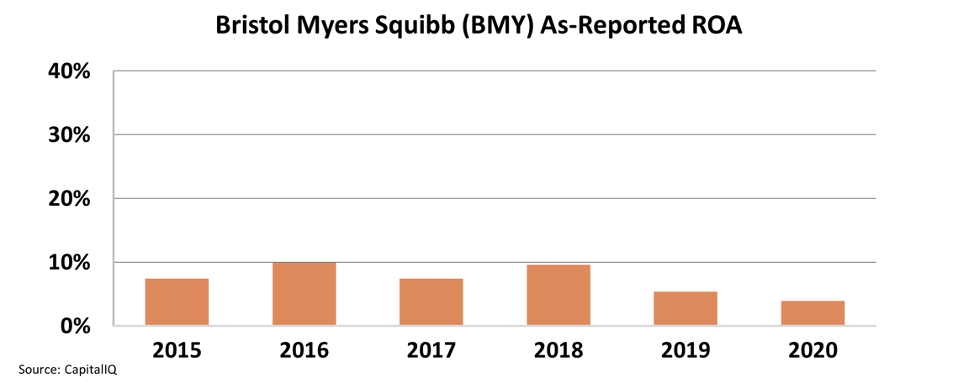

One would assume these positive tailwinds from the Celgene acquisition and OPDIVO success would lead to higher profitability. But as-reported metrics show that the return on assets ("ROA") for the company fell from 10% in 2018 to 4% in 2020.

This suggests the Celgene acquisition was a costly mistake for Bristol Myers Squibb, one that pushed the company to generate returns below cost-of-capital levels.

See for yourself below...

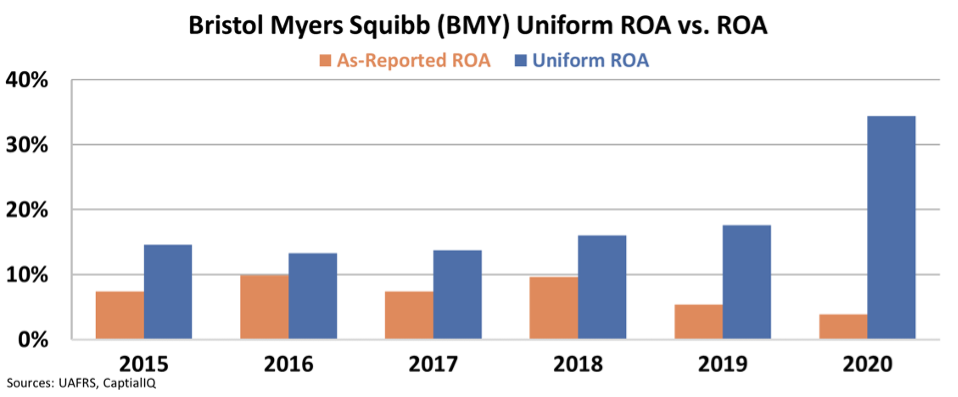

In reality, the as-reported metrics are distorted by convoluted acquisition accounting and arbitrary rules around research and development (R&D) spending.

Looking at the Uniform Accounting metrics, which clean these issues up, we see that the Celgene acquisition and strong uptake of OPDIVO massively boosted returns.

The tailwinds pushed Bristol Myers Squibb's Uniform ROA up from 16% in 2018 to 34% in 2020, showing how innovative cancer treatments can create tremendous value.

As cancer innovation continues to develop and reach new frontiers, pharmaceutical companies at the forefront of R&D stand to reap big rewards.

Bristol Myers Squibb isn't the only pharma company pouring money into cancer drugs...

Bristol Myers Squibb isn't the only pharma company pouring money into cancer drugs...

As subscribers to Altimetry's Hidden Alpha newsletter are aware, we just recommended one big pharma player in the cancer treatment innovation space... and we think this company stands to nearly double its stock price from where it trades today.

A subscription to Hidden Alpha not only includes instant access to this stock pick that we recommended earlier this week but complete access to the entire Hidden Alpha portfolio of large-cap stocks. The average return among Hidden Alpha's more than 25 open recommendations is 44%...

Plus, as a bonus, you'll also get complimentary access to our Timetable Investor. Our Timetable Investor readers receive first access to our thoughts on the markets and the economy as a whole. These are market ideas and insights you won't find anywhere else...

Learn how you can get a year of Hidden Alpha for 75% off the normal price – by clicking right here.

Regards,

Joel Litman

November 3, 2021

The future looks bright for nonchemotherapy cancer treatments...

The future looks bright for nonchemotherapy cancer treatments...