Credit-card technology doesn't change often...

Credit-card technology doesn't change often...

Yet when it does, it's a huge transition.

The classic "swipe" cards were first introduced in the 1970s. They had magnetic tape on the back so that consumers' information could be easily transmitted when paying for something.

Decades later, chip-based credit cards came on the scene. These cards are more secure than swipe cards, as they generate unique codes for every transaction – making them much more difficult for thieves to counterfeit. They're so much more secure that merchants were required to start using them in 2015.

Today, we've entered the era of contactless payments. If you've gotten a new credit card recently, you may have noticed an added feature... While you can still swipe or insert your card, you can also just tap it over a reader.

Once again, credit cards have become even more secure. The technology in contactless cards is safer and more convenient. You don't have to let go of or insert the card at any point when paying. That makes it even less likely that someone could steal your data.

Contactless cards are still growing like crazy... And countries around the world are embracing this form of payment. The British government, for example, raised the contactless-spending limit to £100 in 2021.

And last year, the value of all contactless payments jumped by nearly 50%. That growth isn't slowing down anytime soon, either. The U.S. market for contactless payments is expected to grow 19% annually between 2022 and 2030.

Today, we'll look at one of the companies at the center of the contactless-card rollout. It's already making a lot of money by selling contactless-payment-capable credit cards. However, an important pattern means it might not be a good investment today.

This one company is behind most credit-card production...

This one company is behind most credit-card production...

Payment-solutions provider CPI Card (PMTS) has a near-monopoly on the U.S. credit-card market. It's the leading manufacturer of physical debit and credit cards.

CPI Card makes half of the credit cards in circulation here in the U.S. With roughly 600 million cards produced every year, that's about 300 million.

The company has a lot to gain from the ongoing rollout of contactless cards. It estimates that only about 40% of cards were contactless in 2021. And by 2025, it predicts contactless cards will make up 85% of the market.

That means banks and credit-card companies will need to issue brand-new cards to a lot of customers.

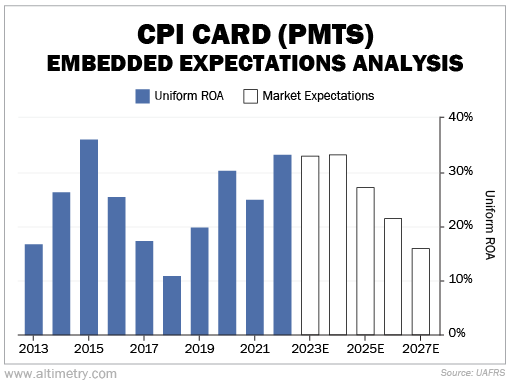

CPI Card's business lives and dies on these adoption cycles. The company performed well at the height of the chip-card rollout. Its Uniform return on assets ("ROA") more than doubled from 17% in 2013 to almost 36% in 2015... the year chip cards became mandatory.

In the following years, Uniform ROA steadily declined. It was down to 11% by 2018. However, since then, Uniform ROA has climbed back up as contactless cards have grown in popularity. Returns rose to 30% in 2020.

The market for contactless cards is set to expand for years...

The market for contactless cards is set to expand for years...

So you'd think investors would expect the same from CPI Card's Uniform ROA. As it turns out, that's not the case. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Investors expect CPI Card's Uniform returns to fall to 16% in 2027.

Take a look...

Investors believe CPI Card's Uniform ROA will fall right back down to 2017 levels. That's because they understand a key rule that's unique to cyclical businesses like this one...

The future returns of cyclical businesses tend to settle around past cycle averages.

CPI Card's average Uniform ROA is about 18%. That's about what we should expect from its business going forward... at least, until the next cycle takes hold. For once, the market actually has the right idea.

Don't expect a great deal of upside from CPI Card in the near term. However, that doesn't mean you should write it off completely. If the company can break out of these cycles to keep profits sustainable – or if the stock gets beaten up down the line – there might be an opportunity here.

Regards,

Joel Litman

March 28, 2023

Credit-card technology doesn't change often...

Credit-card technology doesn't change often...