Somewhere along the way, General Electric (GE) lost its identity...

Somewhere along the way, General Electric (GE) lost its identity...

Since Thomas Edison co-founded the company in 1892, it was practically synonymous with innovation. From Edison's invention of the lightbulb to breakthroughs like the X-ray machine and home television, GE led American industry with its progressive spirit.

The company has made almost every household appliance imaginable. It was the poster child of the industrial conglomerate for nearly a century.

But 50 years after Edison's death, things changed...

In 1981, "Neutron Jack" Welch was appointed CEO. Shortly after taking over, he started altering GE's culture and mission. Under Welch's leadership, GE built businesses across all kinds of industries, including aircraft engines and financial services. It even bought media titan NBCUniversal.

GE became one of the biggest companies in the world. Over time, it grew so large and so varied that its huge scale became a burden... not a help.

The company's market cap peaked in 2000. Welch retired a year later. New management realized the error of Welch's ways not long after he rode off into the sunset. It has spent years unraveling the pieces of the complex web that Welch built.

In 2021, GE announced it was splitting into three public businesses... health care, aviation, and renewable energy. The split will allow these businesses to focus on what they do best without weighing one another down.

Today, we'll explain why this shift is coming at the perfect time for one business in particular... and why the market still hasn't caught on. As you'll see, now is a great time to double down before investors realize what they're missing.

GE suffered from the 'conglomerate discount'...

GE suffered from the 'conglomerate discount'...

Put simply, the value of its overall business was less than the value of each individual business combined.

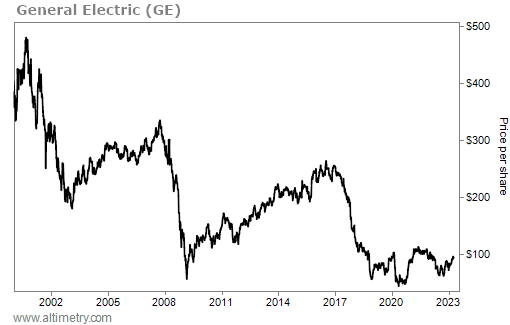

GE's stock price has fallen by more than 60% since Welch retired. The market realized GE's existing business model was too complex... essentially acting as a tax on performance.

Take a look...

The various businesses just didn't mesh well together. It looks like that has finally become clear to management. GE started unpicking the mess by spinning off its health care segment. It's in the process of spinning off energy, too.

That leaves legacy GE with its largest segment by revenue...

That leaves legacy GE with its largest segment by revenue...

Aviation.

Demand for aviation services is the highest it has been in years. This is clear in both the defense and travel sectors.

The U.S. government is ramping up defense spending as tensions with China rise... Our defense budget is projected to be more than $100 billion more in 2024 than it was in 2022.

And U.S. allies are looking to finally start to invest in defense with Russia and China threatening. In 2022 alone, our NATO allies grew defense spending by $350 billion.

As the Pentagon and allies demand new planes, GE stands to benefit. It sells the engines that go in those planes.

Plus, travel is surging as the world moves on from COVID-19. That means plane makers like Boeing (BA) and Airbus (EADSY) are producing as many planes as possible.

Both of these companies are customers of GE's aviation business. No wonder management expects aviation revenue to grow double digits annually for the next few years.

But investors still anticipate more of the same from GE...

But investors still anticipate more of the same from GE...

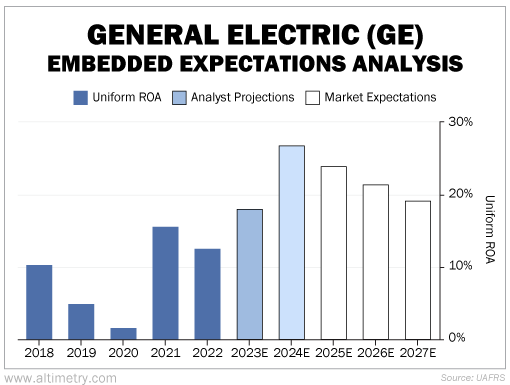

We can get an idea of their expectations for the revised business through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

GE's Uniform return on assets ("ROA") was 13% last year. Wall Street analysts expect that number to rise to 18% in 2023... and 27% next year. That's more than double the 12% corporate average.

But investors haven't caught on yet. The market expects GE's Uniform ROA to steadily decrease, falling to 19% by 2027.

Take a look...

The market views GE as a cog in the economic machine. That hasn't changed... even though the business has. GE's new focus on aviation means it will benefit from booming demand.

And when the market takes notice of those stronger-than-expected returns, savvy investors will profit.

Now is a great time for GE to invest in its aviation business. And it's an even better time for investors to put their money in GE.

Regards,

Rob Spivey

April 13, 2023

Somewhere along the way, General Electric (GE) lost its identity...

Somewhere along the way, General Electric (GE) lost its identity...