Feeling the pain at the pump, investors debate oil's potential...

Feeling the pain at the pump, investors debate oil's potential...

In the past year, inflation has filled the headlines.

Inflation appears practically everywhere, but it's most noticeable at the gas pump for many. As gas prices go up, inflation repeatedly stares people in the face when they fill up their tanks.

For the past half of a decade, oil has been relatively inexpensive. In 2014, the price of oil dropped below $100 per barrel and remained there for many years. But that price is once again flirting with the $100 line, offering a blunt reminder of inflation.

There are several reasons why this is happening.

Russia supplies more than 5% of the world's oil. Geopolitical uncertainty in Ukraine means OPEC is refraining from adding capacity until they are sure the world's economy is on firmer footing. On the other hand, optimism about a recovery in air travel, a huge consumer of oil, along with a broad economic recovery, mean demand for the commodity is rising.

With such strong tailwinds for the oil industry, one of the questions that our institutional clients often ask is whether we're getting more bullish on oil companies and if there are any that look interesting.

There's plenty of debate about the long-term investment potential of being long on oil. The market is split on when electric vehicles will dominate the world of land transportation, what is in store for synthetic plastics that don't need oil to produce them, and how alternative energy and heating sources emerge.

When the market isn't sure about something yet, there is money to be made.

But there's an easy place to go to understand whether any of these names are interesting now... and the cash flows these companies are likely to generate.

Let's take a closer look at a few oil companies...

Let's take a closer look at a few oil companies...

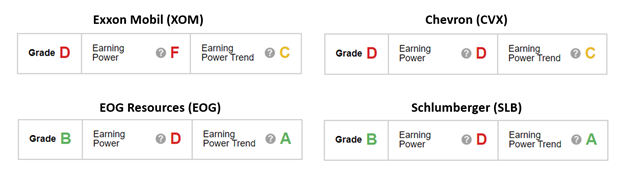

Let's look at The Altimeter grades of four large oil companies: Exxon Mobil (XOM), Chevron (CVX), EOG Resources (EOG), and Schlumberger (SLB).

While all of these are oil companies, they each do something a little different.

Exxon Mobil and Chevron are integrated oil companies, owning both the upstream portion of the process that involves the wells, along with the downstream refining, storage, and marketing aspects of oil and gas.

EOG is an exploration and production (E&P) company, which means the company only does the drilling to get oil and gas out of the ground.

Schlumberger is an equipment and services company, so it doesn't technically have exposure to the commodity itself. Instead, it deals with drilling wells and ramping up production. That's tied to the price of the commodity, but it worries more about the activity as opposed to having direct exposure to oil.

To get a better look at the performance of these four, we can look at The Altimeter, which shows users easily digestible grades to rank stocks on their real financials.

All these names have poor Earnings Power grades. Even though oil prices are rising, return on assets ("ROA") is still low across the board. Because of that, each company only earned a "D" or an "F."

However, it is surprising to see how much stronger the grades are for Earning Power Trend among the pure-play oil companies.

The Earnings Power Trend tells us the ability of a company to grow its Uniform adjusted earnings year over year. EOG and Schlumberger earn an "A" for Earnings Power Trend and a "B" for overall Performance.

Meanwhile, Exxon Mobil and Chevron didn't look nearly as good based on Earnings Power Trend, both earning just a "C" and overall Performance grades of a "D."

So what oil companies are worth investing in now?

So what oil companies are worth investing in now?

Perhaps this can shine a light on how working on just the oil patch and trying to speed up the drilling process is a smarter place to focus than those companies trying to do it all.

Companies like Exxon Mobil and Chevron have many more assets and cash flows tied up in parts of the business that aren't going to benefit as much from current market environments. Furthermore, these oil majors have bigger issues down the line as the world continues to work on decarbonization.

Altimeter subscribers can click here to see how these four oil companies are valued based on Uniform Accounting and if this story is being priced in by the market. Using The Altimeter, you can see how they stack up with other oil and gas companies, as well as nearly 5,500 other U.S.-listed companies.

Regards,

Rob Spivey

February 24, 2022

P.S. Yesterday, we discussed launching a potential credit-based newsletter and have already seen dozens of responses.

We would love to continue the dialogue with our readers around bonds and the state of credit markets. If you have any questions about bonds or want to discover the names of the three AAA-equivalent companies, send us an e-mail at [email protected].

Feeling the pain at the pump, investors debate oil's potential...

Feeling the pain at the pump, investors debate oil's potential...