The concept of credit is nothing new...

The concept of credit is nothing new...

In fact, it dates back at least 5,000 years.

Of course, civilizations past didn't have small plastic credit cards like we do today. But they did have a means of recording "buy now, pay later" transactions. Archaeologists have unearthed tablets from ancient Mesopotamian merchants recording future agreements to pay for goods.

These ancient folks had the right idea. Borrowing continued to evolve over time... until a businessman named Frank McNamara changed the game with the first modern credit card in 1950.

McNamara came up with the idea after forgetting his wallet at a restaurant one too many times. Embarrassed when his wife had to come pay the bill, he created a cardboard card called the "Diners Club Card."

Card users could charge their restaurant meals to the card instead of paying right away. The restaurants would bill Diners Club, which would take a small commission. And the restaurant patrons would pay Diners Club the balance they owed at the end of the month.

This first version of the credit card was wildly popular. Membership surpassed 40,000 people within a year. Consumer credit cards surged over the next two decades.

These days, credit and interest can help economies grow at a faster rate. Buying goods with credit gives consumers financial flexibility. Folks can manage their income statements without having to manage their cash balances perfectly every day. Most modern credit cards even offer additional membership rewards.

In short, credit cards are great – if you use them responsibly. But not everyone does...

If used incorrectly, credit cards can burden consumers with carrying balances and mounting interest expenses. Once you fall into a credit-card debt hole, it can be very difficult to dig yourself back out.

That's why economists are increasingly worried about U.S. consumer credit health...

That's why economists are increasingly worried about U.S. consumer credit health...

Online credit-card marketplace CreditCards.com recently reported that 60% of card debtors have carried their balances for more than a year. That's up from 50% last year.

Consumer credit health is an important indicator for the strength of the economy. If credit health declines, it could be a big problem for the U.S.

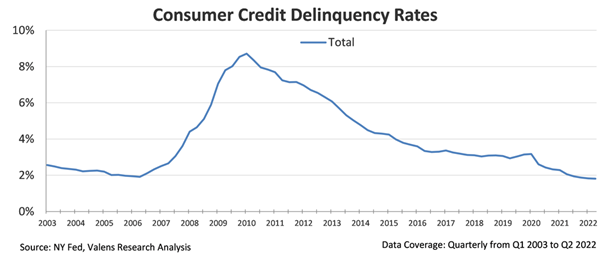

The best way to see if consumers are getting in trouble with credit is to look at delinquency rates. This number rises when consumers fail to pay off their balances and the amount of past-due debt increases.

The following chart shows that delinquency rates peaked in 2010 as consumers dealt with the hardships of the Great Recession. Since then, they have been falling.

Take a look...

As you can see, delinquency rates rose to threatening levels above 8% in 2010. But they've since dropped below 2%. That's the lowest level since before the 2008 financial crisis.

And this decline wasn't driven by a dip in one sector either...

And this decline wasn't driven by a dip in one sector either...

In fact, rates have been declining across the board... in everything from auto and credit cards to home-equity lines of credit and student loans.

Credit-card delinquencies in particular have also declined steeply since 2020. That further drives home the fact that consumers are acting responsibly for the most part.

Every company has some form of debt on its balance sheet. It makes sense that individual consumers do, too.

Consumer credit health is actually very strong, even though many consumers are choosing to keep debt on their balance sheets. We don't think there's any reason to worry about consumer credit today. And we certainly don't believe we're on the cusp of a massive wave of defaults.

Regards,

Joel Litman

October 3, 2022

The concept of credit is nothing new...

The concept of credit is nothing new...