The past six years haven't been kind to aircraft maker Boeing (BA)...

The past six years haven't been kind to aircraft maker Boeing (BA)...

After two high-profile crashes in 2018 and 2019, the company was forced to halt production and ground its fleet of 737 Max jets.

Just as it seemed to be moving on, an Alaska Air (ALK) flight had to make an emergency landing earlier this year... when a piece of a Max 9 fuselage fell off midflight. The Federal Aviation Administration ("FAA") grounded all Max 9 jets with similar parts while it investigated.

In February, a former employee who blew the whistle on alleged production issues was found dead right as he was wrapping up depositions.

And the FAA's investigation uncovered multiple instances of failure to comply with quality control standards.

In March, CEO Dave Calhoun announced he's resigning at the end of 2024... while Board Chair Larry Kellner won't vie for reelection... and Boeing Commercial Airplanes CEO Stan Deal stepped down, effective immediately.

Congress has spent the past month examining allegations of major safety failures within the company's operations and culture. An expert panel as well as a Boeing engineer raised concerns at the session.

All of those are Boeing-specific problems. We haven't even gotten to high interest rates and a potential travel slowdown as the global economy stumbles. Demand might weaken even further for Boeing's commercial airline business.

It doesn't seem like anyone can save Boeing from itself. But it just so happens that one investing legend specializes in downtrodden companies that nobody else will go near...

Warren Buffett is sitting on a large pile of cash... $189 billion, to be exact.

Warren Buffett is sitting on a large pile of cash... $189 billion, to be exact.

And that pile of savings got folks talking at Berkshire Hathaway's (BRK-B) annual shareholder meeting.

Buffett made it clear it would take a while to invest all that cash... and that investors shouldn't expect outstanding returns.

But his remarks didn't stop people from speculating about where Buffett and Berkshire might park all that cash next.

Earlier this month, Bloomberg opinion columnist Thomas Black suggested Buffett could use the money to save Boeing.

Now, Black understands this is unlikely. He laid out all the reasons it probably won't happen alongside the reasons it could.

But it got us thinking, too.

In some ways, Buffett and Boeing could be the perfect match...

In some ways, Buffett and Boeing could be the perfect match...

This wouldn't be the first time Buffett has used his name and his nearly bottomless wallet to bail out struggling companies.

He did so with megabanks Goldman Sachs (GS) and Bank of America (BAC) during the Great Recession, extending each of them $5 billion in preferred stock.

Both banks had taken on far too much risk betting on mortgages. But Buffett knew they could become great businesses again... with a little help.

Boeing isn't so different in theory. It's one of only two major aircraft makers in the world. It has a $448 billion backlog to produce more than 5,600 commercial aircraft.

Shares are also down nearly 60% in the past five years. The company is worth just $154 billion. Buffett has the cash to buy it outright if he wants.

While it's a fun idea, Buffett likely won't take the risk...

While it's a fun idea, Buffett likely won't take the risk...

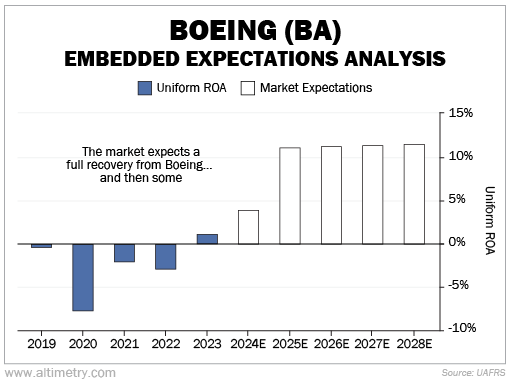

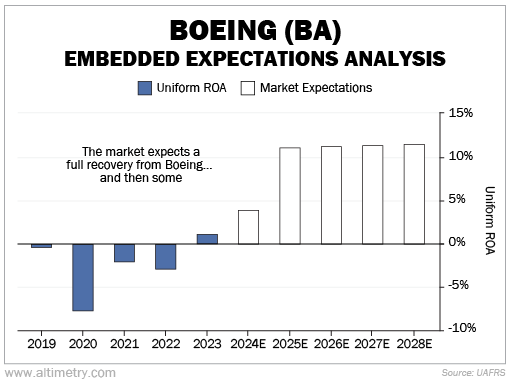

Despite its massive drop, Boeing's stock is still far from cheap. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Boeing's Uniform return on assets ("ROA") was negative for years before it barely flipped positive in 2023. The market now expects returns to reach 4% in 2024... and as high as 12% in the following years.

Take a look...

Keep in mind, Boeing's Uniform ROA averaged about 10% from 2008 to 2016. So investors are already pricing in a full recovery... even at today's depressed prices.

Boeing had to take on a lot of debt to deal with production issues...

Boeing had to take on a lot of debt to deal with production issues...

That's part of the reason it's not so cheap after all. The company's debt soared from $8.5 billion back in 2018 to more than $45 billion today.

Sure, Buffett has the cash to step in and help fix Boeing. But that huge chunk of debt would make his job much harder.

And investors expect a full recovery as it is. Even with the stock down 60% from its all-time high, Buffett probably wouldn't be able to get enough upside from a turnaround.

Boeing isn't worth Buffett's time... and as investors, it's not worth our time, either.

Regards,

Rob Spivey

May 21, 2024

The past six years haven't been kind to aircraft maker Boeing (BA)...

The past six years haven't been kind to aircraft maker Boeing (BA)...