I teach a course called 'Return-Driven Strategy'...

I teach a course called 'Return-Driven Strategy'...

It's a fun, interesting program to teach. And we've been running it two to three times per year at various universities.

Specifically, we look at a large survey of companies, both good and bad. And we examine the perspectives of the greatest investors in the world (many of whom are our clients).

Central to the course is Driven. It's a textbook that I wrote with Mark Frigo, a professor and the director of the Center of Strategy, Execution, and Valuation at DePaul University's Driehaus College of Business.

The operative term of the course and the subject of Driven is "return on investments." We dive into proven strategies to drive strong returns by great management teams.

The word "returns" can refer to the stock returns that great companies achieve for their investors.

It may also refer to the internal returns on invested capital that great companies measure and use to manage their businesses. In either case, the investment must come first. The returns come later.

It would be nice if companies could just open their doors for business and suddenly generate cash flow... But that's simply not the case.

This idea of generating a "return" carries great weight with investors and smart management teams. And it should be considered even when you think about your career.

A phrase that captures this: "You give before you get."

In the 1930s, Napoleon Hill wrote a phenomenal book on success called Think and Grow Rich. In it, he explained:

You take your God-given gifts, and then you give, and in return you get what you want out of life.

The idea of giving first – of investing for future returns – does not just apply to monetary investments. Great firms provide value to customers, show the value they can create, and then generate cash flows from that value shown.

In the world of venture capital and successful startups, you often hear the phrase, "Give it away and get rich."

Great entrepreneurs, companies, and high-performance people always find creative ways to demonstrate value upfront. We give... and then we enjoy the return.

This 'give before you get' strategy is behind one of the most common ways companies get new clients...

This 'give before you get' strategy is behind one of the most common ways companies get new clients...

One of the most basic ways companies push the "give it away and get paid" business model is by giving free trials to potential customers.

In today's environment, we see more and more companies using this model to enhance customer engagement and attract new customers.

Netflix (NFLX) is a unique example of this idea. The streaming giant not only gives free trials but also allows customers to share their accounts.

Theoretically and legally, the company could be far more restrictive in sharing its services. And that would force more customers to subscribe (even in the same household).

But Netflix's strategy has garnered more than 207 million subscribers around the globe, with roughly 75 million subscribers located in the U.S. and Canada.

That means 1 in 5 individuals in the U.S. and Canada subscribes to Netflix.

The company allows users to view its lineup of shows and movies for free during a 30-day trial version. Once people become loyal Netflix viewers and the trial ends, they have no choice but to pay up.

Netflix's lax legacy policy on account sharing and its free trial guarantee the company an even wider universe of customers. Subscribers are hooked before looking into clamping on shared accounts. (Although Netflix might change its account-sharing policies in the future.)

The "give it away and get paid" business model works for Netflix and makes it a dominant video-streaming player.

It has also allowed the company to generate impressive profitability.

To see how impressive, let's turn to our Altimeter tool…

To see how impressive, let's turn to our Altimeter tool…

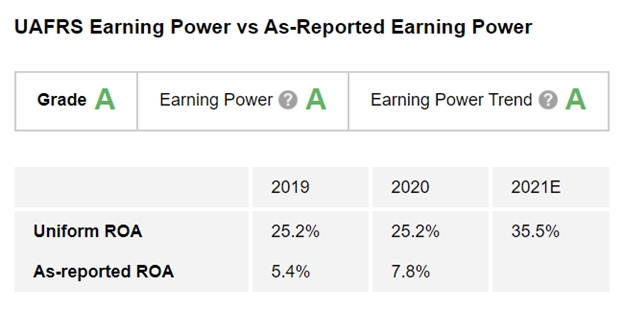

Using the power of Uniform Accounting, which removes the distortions in as-reported financial metrics, The Altimeter grades stocks based on their real financials.

After cleaning up the GAAP numbers, we can see that Netflix is currently minting money, with its return on assets ("ROA") at robust levels.

On a Uniform basis, Netflix's ROA has remained steady at 25% levels. And ROA is expected to expand to around 36% by the end of this year.

Due to this strong profitability and solid trend in ROA, Netflix earns an "A" grade across the board for Performance. Take a look...

But high returns alone don't mean the stock is a screaming buy...

But high returns alone don't mean the stock is a screaming buy...

Before buying the stock, we need to understand Netflix's valuations. And once again, The Altimeter cuts through the accounting "noise" to show the real story of whether NFLX shares are cheap or expensive.

Altimeter subscribers can click here to see how Netflix is valued – and graded – based on Uniform Accounting. The Uniform valuations show whether the market already understands the strength of the company's returns.

If you aren't an Altimeter subscriber yet, click here to find out how to gain immediate access to the rest of the Uniform data for Netflix... as well as thousands of other U.S.-listed companies. Don't let the distorted, as-reported numbers lead you into making the wrong investments.

Regards,

Joel Litman

June 18, 2021

I teach a course called 'Return-Driven Strategy'...

I teach a course called 'Return-Driven Strategy'...